Choose the topic of your interest

ToggleLong Build Up Meaning In Stock Market: The concept of Long Build Up is mainly used in the stock market technical analysis and in analysing options contracts.

Key Highlights:

Long Buildup:

- Simultaneous increase in stock price and open interest of futures/options contracts.

- Indicates bullish sentiment and potential uptrend.

- Analyze open interest changes (rising, falling, flat) for further insights.

Long Positions:

- Buying a stock or call option expecting a price increase.

- Basic investment strategy.

- It can involve direct shares, call options, or spread strategies.

Long Stock Value:

- Current market price x number of owned shares.

- Different from total investment value (includes dividends and gains/losses).

Long Position in the Stock Market:

- Owning anything that benefits from a price increase (shares, call options, etc.).

- Opposite of a short position.

Long Unwinding:

- Closing out long positions (selling stocks/options) for profit-taking, risk management, sentiment shifts, or hedging.

Stock Market Up:

- Overall, the value of publicly traded companies increases.

- Measured by major indices like S&P 500 or Dow Jones.

- Reasons include a strong economy, low-interest rates, etc.

Stock Buildup:

- Increase in shareholding within a company when existing shareholders buy more shares

- Short-term increase in trading volume due to news events and specific trading strategies.

Let’s read in detail Long Build Up Meaning In the Stock Market and various other related terms such as Long unwinding, Long position in the stock market, and Stock buildup.

Long Build Up Meaning In Stock Market

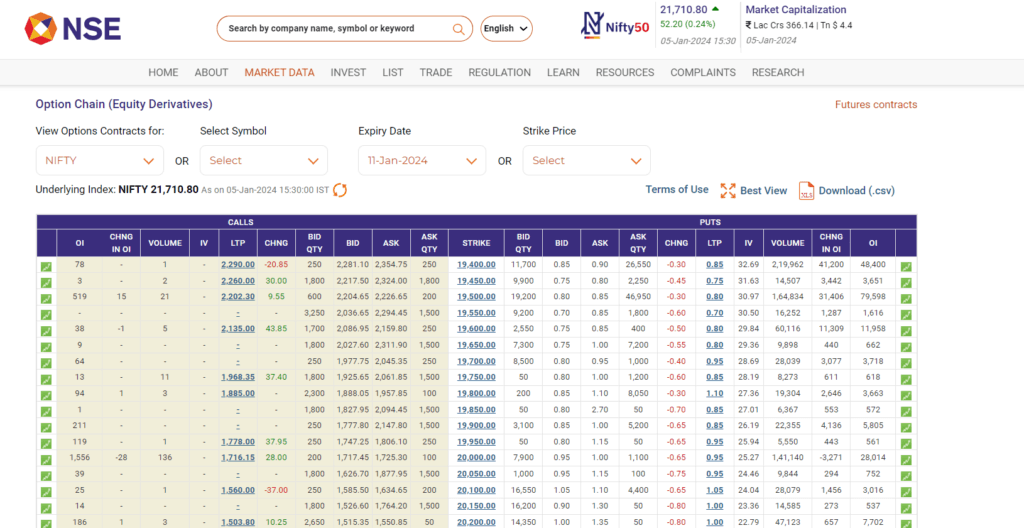

A long buildup in the stock market is a situation where there is a simultaneous increase in both the price of a stock and the open interest of its futures and options contracts. It indicates that the stock market traders are taking long positions on the stock, which means that the traders believe its price will go up in the future.

Here’s the meaning of the key terms:

- Open interest: The total number of outstanding futures and options contracts that haven’t been settled yet.

Analyze Open Interest Changes:

- Rising open interest: Generally, a rising open interest alongside a rising price indicates stronger buying pressure and a potential continuation of the uptrend.

- Falling open interest: Declining open interest with a rising price may signal profit-taking by early entrants or reduced interest in the contract.

- Flat open interest: If open interest remains flat while the price changes, it suggests limited engagement from new market participants, possibly indicating uncertainty or a temporary price fluctuation.

Here you can analyze the Open Interest Chart here.

- Long position: When an investor buys a stock or a call option. It means the investor is expecting that the price of stock or index will increase.

- Futures and options contracts: Derivatives that give the holder the right to buy or sell a specific stock at a set price by a certain date.

A long buildup can be a signal of bullish sentiment in the market. However, it’s important to note that long buildup doesn’t guarantee an increase in future price increases. You should also consider other factors, such as the company’s fundamentals and other market conditions, to understand or expect further market moves.

Also Read: What is CE and PE in Option Trading 2023? Practical Examples

What Does It Mean To Long A Stock?

Longing a stock means buying it with the expectation that its price will go up, so that you can sell it later and book a profit. This is the most basic investment strategy in the stock market.

There are several ways to long a stock:

Buying direct shares of companies: This gives you direct ownership of the company and voting rights at shareholder meetings. Read more How Do I Choose Which Stocks To Buy.

Buying call options: This gives you the right, but not the obligation, to buy the stock at a certain price by a certain date.

What Is Long Stock Value?

The long stock value is calculated by multiplying the current market price of the stock by the number of shares you own. For example, if you have 100 shares of Tata Power stock and its current market price is Rs. 350 per share, your long stock value would be $35,000.

Note: This is different from the total value of your investment, which would also include any dividends you have received and any gains or losses you have realized on your investment.

What Is Long Position In Stock Market?

A long position is any situation where you buy or hold shares or a derivative with the expectation of increasing its price and future, and you will book a profit from this long position in the stock market. This includes:

- Owning shares of the stock outright

- Holding a long call option

- Having a spread or other options strategy that profits from a rising stock price

The opposite of a long position is a short position, where you will profit if the stock price goes down. Read about Short Build Up Meaning In Stock Market | Caution or Reward?

Also Check: What are CNC and MIS in Zerodha Kite? Meaning with Example

What is Long Unwinding?

“Long unwinding” is the process of closing out long (buy) positions held by investors or traders in a stock or an option contract. This means they are selling the stocks or option contracts and booking profits.

Reasons for Long Unwinding:

1. Profit-taking: When a stock price reaches its target, investors book their profits and sell the stocks.

2. Risk management: When market conditions become volatile or uncertain, investors might reduce their overall exposure by exiting long positions, even if they haven’t made a profit yet, to minimize potential losses.

3. Changing sentiment: If investor sentiment towards the security shifts from bullish to neutral or bearish, they might unwind their long positions due to concerns about a potential price decline.

4. Hedging: Sometimes, investors may unwind their long positions as part of a hedging strategy to offset risks associated with other investments.

What Does It Mean When The Stock Market Is Up

When the stock market is up, it means that the overall value of all publicly traded companies is increasing. This is typically measured by the performance of major stock market indices, such as the Nifty50, Sensex, S&P 500 or the Dow Jones Industrial Average.

There are many reasons why the stock market might go up, including:

- Strong economic growth

- Low interest rates

- Increasing corporate profits

- Positive investor sentiment

A rising stock market can be a good thing for investors, as it means that their investments are increasing in value. However, it’s important to remember that the stock market is cyclical, and there will always be periods of decline as well.

What is Stock Build Up?

There are two different meanings of stock build up in two different contexts:

1. Increase in shareholding within a company:

This refers to existing shareholders acquiring more shares of the company, either through direct purchases or through share buybacks or stock splits. This can happen for several reasons, such as:

Belief in the company’s future potential: Shareholders might be confident in the company’s growth prospects and see increased ownership as a valuable investment.

Increased ownership by management or insiders: The company’s management or board members might buy additional shares to ensure the investors their commitment to the company and they have full faith in the company’s growth.

2. Short-term increase in trading volume:

In a more technical context, “stock buildup” also means a temporary surge in trading volume for a specific stock over a short period. This could be due to:

News events or announcements: Sudden positive news regarding the company, like successful product launches or partnerships, can trigger a burst of buying activity, leading to a temporary “buildup” in trading volume.

Technical trading strategies: Certain technical trading strategies might involve entering or exiting positions in rapid succession, causing short-term spikes in volume for targeted stocks.

Conclusion – Long Build Up Meaning In Stock Market

In conclusion, a Long Buildup in the stock market is a valuable indicator that indicates potential bullish sentiment and future price hikes. By analyzing the simultaneous rise in stock price and open interest of futures/options contracts, you can gain insights into investor confidence and identify possible uptrends.

Frequently Asked Questions

Bullish! It indicates rising prices and increasing investor interest in a stock. When both price and open interest of futures/options rise, signalling investor optimism and potential uptrend. It can refer to two things: 1) an increase in shareholding within a company and 2) a Short-term surge in trading volume for a specific stock. Analyze context and other indicators first. Consider buying the stock/call options or using bull call spreads, but use risk management strategies like stop-loss orders. भारतीय शेयर बाजार में, "लॉन्ग बिल्डअप" का मतलब है जब किसी स्टॉक की कीमत बढ़ रही होती है साथ ही साथ उसके फ्यूचर्स और ऑप्शन कॉन्ट्रैक्ट्स की ओपन इंटरेस्ट भी बढ़ रही होती है. ये आमतौर पर इस बात का संकेत देता है कि ज्यादा से ज्यादा निवेशक उस स्टॉक पर "लॉन्ग पोजीशन" ले रहे हैं, ये मानते हुए कि इसकी कीमत भविष्य में बढ़ेगी. इसे शेयर के प्रति बुलिश भावना का संकेत माना जाता है.Is long build up bullish or bearish?

What does long buildup in stocks mean?

What is a build up in the stock market?

How do you trade with long build up?

Long Build Up Meaning In Stock Market in Hindi