Choose the topic of your interest

ToggleIn this guide, we will compare Motilal Oswal vs Zerodha share brokers in India. This article will help you clarify which stock broker is good for you.

Key highlights of Zerodha vs Motilal Oswal

Type of broker:

- Motilal Oswal: Full-service broker offering research, advisory, and personalized service.

- Zerodha: Discount broker offering low-cost trading with a focus on technology and self-directed investing.

Brokerage charges:

- Motilal Oswal: Higher brokerage charges, ranging from 0.02% to 0.20% for equity delivery and Rs 20 per order for intraday and F&O.

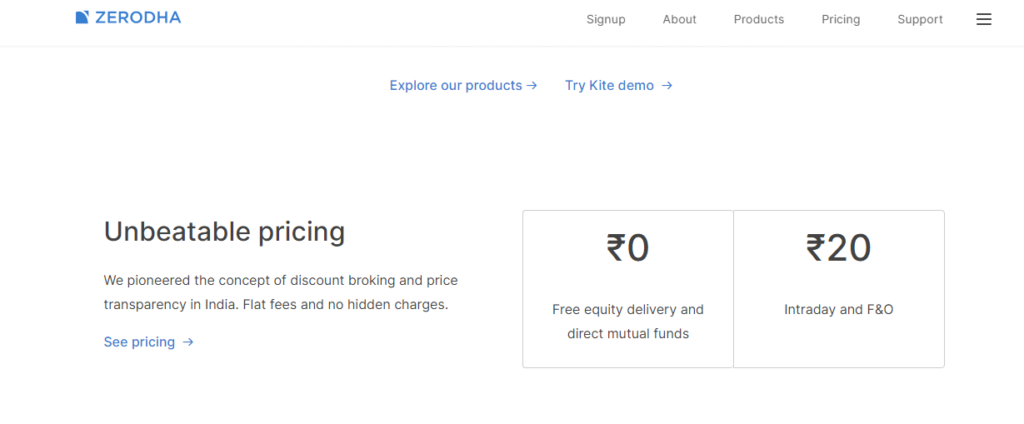

- Zerodha: Flat fee of Rs 20 per trade for all segments and exchanges, except free equity delivery and direct mutual funds on Coin.

Account opening and maintenance charges:

- Motilal Oswal: Free account opening and Demat AMC charges for the first year.

- Zerodha: Rs 200 for account opening and Rs 300 annual Demat AMC charges.

Other features:

- Motilal Oswal: Offers research reports, trading recommendations, and margin funding.

- Zerodha: Offers advanced order types, free UPI fund transfer, and a user-friendly trading platform.

Pros and cons:

Motilal Oswal:

- Pros: Personalized service, research reports, margin funding.

- Cons: High brokerage charges, no 3-in-1 account, high charges for additional services.

Zerodha:

- Pros: Low brokerage charges, user-friendly platform, free equity delivery and direct mutual funds.

- Cons: No research reports or personalized service, limited order types.

Overall:

- Motilal Oswal: Suitable for investors who need guidance and research support and are willing to pay higher brokerage charges.

- Zerodha: Suitable for cost-conscious investors who are comfortable with self-directed trading and don’t need research reports or personalized service.

In case you are in hurry and want a quick comparison of Motilal Oswal vs Zerodha, here it is:

When comparing Zerodha vs Motilal Oswal, both are well-known names in the Indian brokerage industry. Motilal Oswal’s comprehensive research, analysis tools and personalized investment advice make it an attractive choice for investors. (Major Cons – High Brokerage Fee).

On the other hand, Zerodha has gained popularity due to its user-friendly platform and low brokerage fees. (Major Cons – No research reports or trade calls).

Motilal Oswal vs Zerodha Overview

About Motilal Oswal

Motilal Oswal, established in 1987, is one of the oldest and most trustworthy full-service brokers in India. It offers trading at BSE, NSE, and MCX. It has 305 branches across India. The company offers various financial services, including equity trading, commodities trading, currency trading, mutual funds, initial public offerings (IPOs), and more.

Motilal Oswal trading account opening charges are Rs 0 (Free) and Motilal Oswal Demat Account AMC Charges are Rs 400 (Free for 1st year)

About Zerodha

Zerodha, founded in 2010, is a technology-driven discount broker. The company gained popularity due to its innovative approach. The company’s disruptive pricing models attracted a large user base and made it the no. 1 discount stock broker in India. It offers trading at NSE, BSE, MCX and NCDEX. It has 22 branches across India. Zerodha offers various financial services, including equity trading, derivatives trading, commodity trading, mutual funds, and more.

Zerodha account opening charges are Rs 200 and Zerodha Demat Account AMC Charges are Rs 300 annually.

Let’s read in detail about Zerodha vs Motilal Oswal

Motilal Oswal Vs Zerodha Basic Information

| Particulars | Motilal Oswal | Zerodha |

| Founders | Ramdeo Agarwall | Nithin Kamath |

| Year of Incorporation | 1987 | 2010 |

| Type of Broker | Full Service Broker | Discount Broker |

| Exchange Membership | BSE, NSE, MCX | NSE, BSE, MCX and NCDEX |

| Number of Branches | 305 | 22 |

| Headquarter | Mumbai, India | Bangalore, India |

Zerodha vs Motilal Oswal Trading & Demat Account Opening Charges

What is Demat Account?

A Demat account is used for holding securities/shares in electronic form, and the securities are deposited through National Securities Depository Limited (NSDL) or Central Depository Services Limited (CDSL).

Motilal Oswal offers Free account opening where Zerodha charges Online Rs 200 (Equity +Currency) and Rs 300 (Equity +Currency +Commodities) for account opening.

What is Demat AMC Charges?

When you open a Demat account with a Depository Participant (DP) or a stockbroker, you are required to pay an annual fee for the maintenance of your Demat account. This fee is known as the Demat AMC charge.

Motilal Oswal charges Rs 400 per annum (Free for 1st year) AMC for Demat account, whereas Zerodha charges Rs 300 per annum AMC for Demat account.

| Particulars | Motilal Oswal | Zerodha |

| Trading Account Opening fee | Rs 0 (Free) | Online Rs 200 (Equity +Currency), Rs 300 (Equity +Currency +Commodities) |

| Trading Account AMC Charges | Rs 0 (Free) | Rs 0 (Free) |

| Demat Account Opening Charges | Rs 0 (Free) | Rs 0 (Free) |

| Demat Account AMC Charges | Rs 400 per annum (Free for 1st Year) | Rs 300 per annum |

Motilal Oswal Vs Zerodha Brokerage charges

| Account Type | Motilal Oswal Brokerage Charges | Zerodha Brokerage Charges |

| Equity Delivery | 0.20% | Rs 0 (Free) |

| Equity Intraday | 0.02% | Rs 20 per executed order or 0.03% whichever is lower |

| Equity Futures | 0.02% | Rs 20 per executed order or 0.03% whichever is lower |

| Equity Options | Rs 20 per lot | Rs 20 per executed order |

| Currency Futures | Rs 20 per lot | Rs 20 per executed order or 0.03% whichever is lower |

| Currency Options | Rs 20 per lot | Rs 20 per executed order |

| Commodity Futures | 0.02% | Rs 20 per executed order or 0.03% whichever is lower |

| Commodity Options | Rs 200 Per Lot | Rs 20 per executed order |

Motilal Oswal Vs Zerodha Other Charges

| Other Brokerage Charges | Motilal Oswal | Zerodha |

| Minimum Brokerage Charges | 0.05% | Zero |

| SEBI Turnover Charges | 0.0002% of Total Turnover | 0.0002% of Total Turnover |

| GST Charges | 18% of (Brokerage + Transaction Charges) | 18% of (Brokerage + Transaction Charges) |

| STT Charges | 0.0126% of Total Turnover | 0.0126% of Total Turnover |

Motilal Oswal Vs Zerodha Transaction Charges

| Type | Motilal Oswal | Zerodha |

| Equity Delivery | NSE Rs 335 per Cr (0.00335%) | BSE Rs 1000 per Cr (0.01%) (each side) | NSE Rs 325 per Cr (0.00325%) | BSE Rs 375 per Cr (0.00375%) (each side) |

| Equity Intraday | NSE Rs 325 per Cr (0.00325%) | BSE Rs 200 per Cr (0.002%) (each side) | NSE Rs 325 per Cr (0.00325%) | BSE Rs 375 per Cr (0.00375%) (sell side) |

| Equity Futures | Rs 200 per Cr (0.002%) | NSE Rs 190 per Cr (0.0019%) |

| Equity Options | NSE Rs 5110 per Cr (0.0511%) | BSE Rs 200 per Cr (0.002%) (on premium) | NSE Rs 6250 per Cr (0.0625%) (on premium) |

| Currency Futures | Rs 125 per Cr (0.00125%) | NSE Rs 90 per Cr (0.0009%) | BSE Rs 25 per Cr (0.00025%) |

| Currency Options | Rs 4200 per Cr (0.042%)(on premium) | NSE Rs 3500 per Cr (0.035%) | BSE Rs 100 per Cr (0.001%) (on premium) |

| Commodity | MCX: Rs 250 per Cr (0.0025%) | Group A – Rs 260 per Cr (0.0026%) |

Motilal Oswal Vs Zerodha Leverage (Margin)/Equity Exposure

| Type | Motilal Oswal | Zerodha |

| Equity Delivery | 100% of trade value (1x leverage) | 100% of trade value (1x leverage) |

| Equity Intraday | Up to 20% margin of trade value (5 times leverage) | Up to 20% margin of trade value (5 times leverage) |

| F&O (Eq, Curr, Comm) | 100% of NRML margin (Span + Exposure) (1x leverage) | 100% of NRML margin (Span + Exposure) (1x leverage) |

Compare Motilal Oswal and Zerodha Features

| Features | Motilal Oswal | Zerodha |

| 3 in 1 Account | No | Yes |

| Charting | Yes | Yes |

| Automated Trading | Yes | Yes |

| Algo Trading | No | Yes |

| SMS Alerts | Yes | No |

| Online Demo | Yes | Yes |

| Online Portfolio | Yes | No |

| Margin Trading Funding | Yes | No |

| Margin Against Shares (Equity Cash) | Yes | Yes |

| Margin Against Shares (Equity F&O) | Yes | Yes |

| NRI Trading | Yes | Yes |

| Trading Platform | MO Investor App, MO Trader App, MO Trader Web, MO Trader EXE | Kite Web, Kite Mobile for Android/iOS and Coin |

| Intraday Square-off Time | Equity Cash: 3:10 PM | Equity Cash: 3:15 PM |

Customer Support – Compare Zerodha with Motilal Oswal

| Customer Service Options | Motilal Oswal | Zerodha |

| 24/7 Customer Service | No | No |

| Email Support | Yes | Yes |

| Onine Live Chat | No | No |

| Phone Support | Yes | Yes |

| Toll Free Number | No | No |

| Through Branches | Yes | Yes |

| Customer Care Number | 022 40548000/022 67490600 | “+ 91 80 4040 2020” |

| Customer Support Email | query@motilaloswal.com | support@zerodha.com |

| Head Office Address | Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai-400025 | Zerodha Headquater #153/154 4th Cross Dollars Colony, Opp. Clarence Public School, J.P Nagar 4th Phase, Bangalore – 560078 |

| Website | https://www.motilaloswal.com/ | https://zerodha.com/ |

| Broker Enquiry | Request a call back | Request a call back |

Motilal Oswal Vs Zerodha Research Report

Motilal Oswal provides

- Daily Market Report

- Free Tips

- Quarterly Result Analysis

- News Alerts

Whereas Zerodha doesn’t provide any research report.

Motilal Oswal Vs Zerodha – Pros and Cons

| Motilal Oswal | Zerodha | |

| Pros | Free Personal Advisor, Research reports, calls & trade recommendations. Free Demat and trading account opening Zero AMC for 1st year. Free Dedicated Customer Service. | You can open a 3-in-1 account, Demat + Trading + Bank A/c. Flat fee of Rs. 20 per trade across segments and exchanges (BSE, NSE, MCX). Free equity delivery trades. No brokerage charges for Cash-N-Carry orders. Zero brokerage and direct investment in direct mutual funds on Coin. Superfast and feature-rich web and app trading platform Kite. Free UPI-based hassle-free fund transfer process. Advanced order placement facility, such as bracket order (BO), cover order (CO), and after-market order (AMO). NRI Trading account is available. |

| Cons | Very high brokerage charges across all trading segments. No flat discount brokerage plan. You cannot open a 3-in-1 account, Demat + Trading + Bank A/c. | No stock tips, research, and recommendations. High Call & Trade is charged an extra Rs 50 per order. High Auto Square off is charged at an extra Rs 50 per order. No margin funding. |

Also Compare other Brokers with Zerodha

Zerodha vs Upstox ↗

Compare Zerodha vs Upstox share brokers

Finvaisa vs Zerodha ↗

Compare Finvasia vs Zerodha share brokers

Groww vs Zerodha ↗

Compare Zerodha vs Groww share brokers

Zerodha Vs Angel Broking ↗

Compare Zerodha Vs Angel Broking share brokers

ICICIDirect vs Zerodha ↗

Compare ICICIdirect vs Zerodha share brokers

Zerodha, Upstox, and Groww ↗

Compare Upstox vs Groww vs Zerodha share brokers

Frequently Asked Questions

Motilal Oswal Annual Fee for Demat Account is INR 400. However, it is free for first year. Other annual fee are as follows: Trading Account Opening fee - Rs 0 (Free) Zerodha is a great choice for beginners due to its low brokerage charges, user-friendly interface, powerful charting tools, and seamless order placement. Additionally, it has a large and active online support community. Motilal Oswal is popular stock broker in India due to its comprehensive research and advisory services. It provides in-depth analysis and research reports for trades and investment. Zerodha is a good brokerage platform trusted by many traders and investors in India due to its technology innovation and low cost advantage among the beginners. It has more than 1 Crore clients and contributes to over 15% of daily retail trading volumes across NSE, BSE, MCX. 1. Additional fee for Call and Trade Charges1. What is motilal oswal annual fee?

Trading Account AMC Charges - Rs 0 (Free)

Demat Account Opening Charges - Rs 0 (Free)

Demat Account AMC Charges - Rs 400 per annum (Free for 1st Year)2. Why do people prefer Zerodha?

3. Why Motilal Oswal is Best?

4. Is Zerodha Good or Bad?

5. What are the disadvantages of trading in Zerodha?

2. Limitations on margin funding for intraday trading

3. Occasional technical glitches and disruptions in service.