Choose the topic of your interest

Toggle

I understand why this question comes to everyone’s mind. Is Finvasia trustworthy? Which is Better Finvasia or Zerodha? Don’t worry I’ve been through the same when I was really skeptical about their “zero brokerage” model.

I thought that there might be something hidden. How will a zero brokerage model survive in the market? But, I have seen good reviews about Finvasia trading brokers.

Let’s discuss in detail Is Finvasia trustworthy? Which is Better Finvasia or Zerodha? We have compared Finvasia and Zerodha on different parameters such as account opening charges, brokerage charges, features, customer care, and customer reviews.

Key Highlights

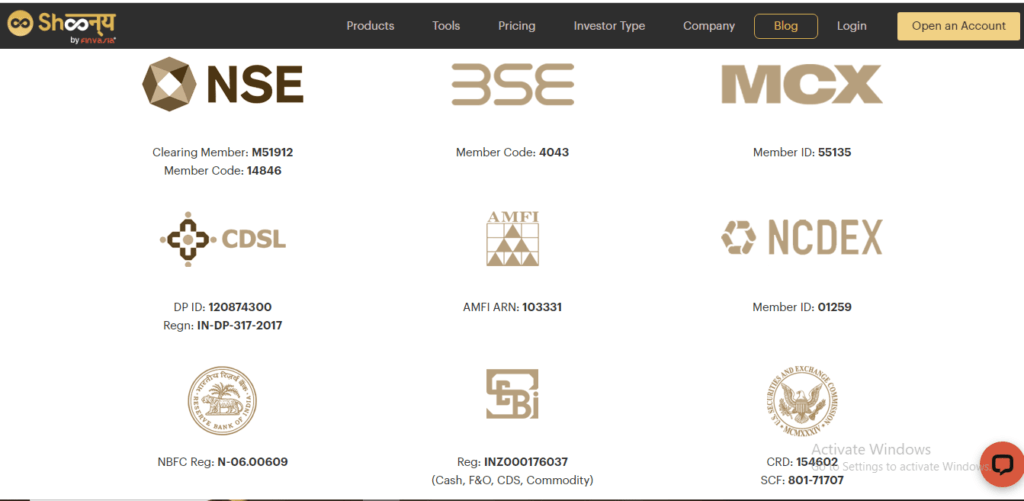

- Registered with SEBI: Finvasia is registered with the Securities and Exchange Board of India (SEBI), the regulatory body for the Indian securities market.

- Zero Brokerage Model: Finvasia offers a unique selling point – zero brokerage on all segments, including intraday, delivery, F&O, commodities, and mutual funds. This makes Finvaisa an affordable stock broker.

- Positive Reviews: Finvasia generally receives positive reviews from users, highlighting its reliable customer support and user-friendly platforms.

- Relative Newcomer: Compared to Zerodha, Finvasia is a relatively new player.

Is Finvasia trustworthy?

Finvasia Shoonya is considered a trustworthy share broker as the company is registered with SEBI. The company allows you to diversify your investments across stocks, futures and options, commodities & mutual funds. Finvasia does not charge brokerage on any segment, be it intraday, delivery, or F&O.

Is Finvasia The Right Choice For Intraday Traders?

Finvasia is a perfect choice for intraday trading. As you know other brokers charge intraday charges, which means you need to pay brokerage charges for both sides (buy and sell) every time you trade in a single day. In such cases, Finvasia is a saver; it offers complete zero brokerage trading. But, Is Finvasia Trustworthy? Keep reading !!

What Is The Difference Between Zerodha And Shoonya?

Zerodha was founded by Nithin Kamath in 2010 and its headquarters is in Bangalore, India. Finvasia was founded by Tajinder Pal Singh and Sarvjeet Singh in 2013 and its headquarters is at Chandigarh. Zerodha and Finvasia are both Discount brokers.

Is Finvasia Trustworthy? Which is Better Finvasia or Zerodha in 2024? The major difference between Zerodha and Shoonya that is making Shoonya attractive is their “Zero brokerage model.” Shoonya offers zero brokerage on all intraday & delivery trades on NSE, BSE, MCX, and NCDEX.

Also Check, if you want to open Free Trading and Demat Account: Is Dhan Trading App Safe? Dhan App Review 2024

Highlights of Shoonya

Brokerage Fee – Zero brokerage on all intraday & delivery trades on NSE, BSE, MCX and NCDEX

Account Set Up Fees – Zero trading & demat account opening and AMC charges

Call & Trade Fees – Zero charges when you call them to place any trade.

Clearing Fees – Zero Clearing fees for trading on NSE & BSE, irrespective of the volume you trade.

Is Finvasia Trusted or Not? | Shoonya Finvasia Charges 2024

Which is better Finvasia or Zerodha?

As we have compared Fivasia and Zerodha we found Zerodha a more stable and suitable trading broker due to its strong brand name. No doubt, Finvasia is growing rapidly due to its differentiation quality of offering zero brokerage on all segments. However, if you want to start with zero brokerage accounts, you can go with Finvasia and give it a try as the broker account opening charges are also NIL.

Further, Other facilities like call and trade, auto square-off, clearing service, account opening, account maintenance, and trading platforms, are all available free of cost. Here, Finvasia is definitely a winner. And if you want to do Algo trading, they provide a third-party platform FoxTrader, so Algo trading is also possible with Finvasia.

Their support team is also responsible and helpful. We have also checked reviews for Finvasia and found it a reliable broker. Is Finvasia Trustworthy? Which is Better Finvasia or Zerodha in 2024?

Compare Zerodha with other Brokers

Zerodha vs Shoonya Finvasia Comparison

Let’s compare Zerodha and Shoonya of different parameters to understand the difference between Zerodha and Shoonya.

| Overview | Zerodha | Finvasia |

| Broker Type | Discount Broker | Discount Broker |

| Headquarter | Bangalore, India | Mohali, Chandigarh |

| Founders | Nithin Kamath | Tajinder Pal Singh and Sarvjeet Singh |

| Foundation Year | 2010 | 2013 |

| Supported Exchanges | NSE, BSE, MCX and NCDEX | BSE, NSE, MCX, and NCDEX |

| Total branches | 22 | 1 |

Zerodha and Finvasia Trading Account Opening and Demat Charges

Account opening charges – Finvasia offers Free account opening where Zerodha charges Rs 200 (Equity +Currency) and Rs 300 (Equity + Currency + Commodity) for account opening.

Demat AMC charges – Finvasia offers Free AMC for Demat account where Zerodha charges Rs 300 per annum AMC for Demat account.

| Account Opening and Demat Charges | Zerodha | Finvasia |

| Trading Account Opening Charges | Rs 200 (Equity +Currency) and Rs 300 (Equity + Currency + Commodity) | Zero |

| Demat AMC (Annual Maintenance Charges) | Rs.300 per Annum | Zero |

| Trading AMC (Annual Maintenance Charges) | Free | Free |

| Margin Money | Zero | Zero |

Zerodha vs Finvasia Equity Brokerage Charges

| Equity Brokerage Charges | Zerodha | Finvasia |

| Equity Delivery Brokerage | Zero Brokerage | 0.00% |

| Equity Intraday Brokerage | 0.03% or Rs. 20/executed order whichever is lower | 0.00% |

| Equity Futures Brokerage | 0.03% or Rs. 20/executed order whichever is lower | 0.00% |

| Equity Options Brokerage | Flat Rs. 20 per executed order | 0.05% |

| Currency Futures Brokerage | Rs.20 Per Order | 0.00% |

| Currency Options Brokerage | Rs.20 Per Order | 0.04% |

Zerodha vs Finvasia – Other Brokerage Charges

| Other Brokerage Charges | Zerodha | Finvasia |

| Transaction Brokerage Charges | 0.00325% of Total Turnover | 0.00325% of Total Turnover |

| SEBI Turnover Charges | 0.0002% of Total Turnover | 0.00015% of Total Turnover |

| Stamp Duty Charges | Varies based on the state (Use Zerodha Brokerage Calculator to see stamp duty charges) | Varies based on the state (Use Finvasia Brokerage Calculator to see stamp duty charges) |

| GST Charges | 18% of (Brokerage + Transaction Charges) | 18% of (Brokerage + Transaction Charges) |

| STT Charges | 0.0126% of Total Turnover | 0.025% of selling value |

| Other Brokerage Charges | Physical contact notes: Rs 20, Trade SMS Alerts: Rs 1 per SMS | Bracket Orders in NEST: Rs 99 per month |

| Call and Trade Charges | Rs 50 per executed order | Rs 0 |

Zerodha vs Finvasia Equity Exposure/Leverage

| Equity Leverage | Zerodha | Finvasia |

| Equity Delivery | Upto 20x | NA |

| Equity Intraday | Upto 28x | Upto 10 times |

| Equity Futures | Upto 15x | Upto 2 times |

| Equity Options | Upto 8x | NA |

Zerodha vs Finvasia Other Charges

| Account Features Compare | Finvasia | Zerodha |

| 3 in 1 Account | No | Yes |

| Charting | Yes | Yes |

| Algo Trading | Yes | Yes |

| SMS Alerts | No | No |

| Online Demo | Yes | Yes |

| Online Portfolio | Yes | Yes |

| Margin Trading Funding Available | No | No |

| Intraday Square-off Time | 3:15 PM | 3:10 PM |

Customer Support – Finvasia vs Zerodha

| Customer Service | Finvasia | Zerodha |

| 24/7 Customer Service | No | No |

| Email Support | Yes | Yes |

| Online Live Chat | Yes | No |

| Phone Support | Yes | Yes |

| Toll Free Number | No | No |

| Through Branches | No | Yes |

| Customer Care Number | Support: +91 9779 097 777/Sales: +91 9098 001 001 | “+ 91 80 4040 2020” |

| Account Opening Process | Online/Offline | Online/Paperless |

| Customer Support Email | contactus@finvasia.com/clientsupport@finvasia.in | support@zerodha.com |

| Knowledge Center/Education | https://finvasia.com/announcements | https://zerodha.com/varsity/ |

| Head Office Address | Finvasia Securities Pvt Ltd Plot #10, Netsmatrz House (Level 3), Rajiv Gandhi Chd. Tech Park, Chandigarh -160101 | Zerodha Headquater #153/154 4th Cross Dollars Colony, Opp. Clarence Public School, J.P Nagar 4th Phase, Bangalore – 560078 |

| Website | https://www.finvasia.com/ | https://zerodha.com/ |

Finvasia vs Zerodha Brokerage Calculator

What are the disadvantages of Finvasia?

Talking about the disadvantages of Finvasia, while comparing it with Zerodha, here are our views Is Finvasia Trustworthy? Which is Better Finvasia or Zerodha in 2024?

We haven’t found any such drawbacks or disadvantages of Finvasia. But, yes, there are a few things on which they can improve if we comment upon Which is Better Finvasia or Zerodha, like

- Adding more time frames in charts of their trading app/web platform,

- Opening more branches for offline assistance for growing trust, etc.

- Otherwise, I think they are doing quite well in the market.

Disclaimer: The information provided on this website is for general informational purposes only and should not be construed as financial advice, investment recommendations, or guarantees of any kind. This information is not intended as a substitute for professional financial advice. You should always seek the advice of a qualified financial advisor before making any investment or financial decisions.