Choose the topic of your interest

ToggleIn this guide, we will compare Zerodha vs Groww share brokers in India. This article will help you clarify which stock broker is good for you.

Key Highlights

- Target audience: Groww is a good choice for beginner and casual investors for its simple platform and low fees, while Zerodha is a great option for more active traders who require advanced features and research tools.

- Trading and investment options: Groww offers a limited range of options compared to Zerodha. Zerodha covers equities, derivatives, commodities, currency, IPOs, and more.

- Fees and charges: Groww generally has lower account opening and maintenance charges, but its flat fee per trade might not be the most cost-effective option for high-frequency traders. Zerodha offers free equity delivery trades and has more flexible pricing based on volume.

- Customer support: Zerodha seems to have more comprehensive customer support options, including phone and branch support, while Groww offers email and chat support.

In case you are in hurry and want a quick comparison of Zerodha vs Groww, here it is:

When comparing Zerodha vs Groww, both are well-known names in the Indian brokerage industry. Groww follows a commission-free model for mutual fund investments and charges a flat fee for intraday trading and delivery-based equity trades.

On the other hand, Zerodha is known for its low-cost brokerage model. It offers zero brokerage charges for equity delivery trades. For intraday trading, it charges a flat fee or a percentage-based fee, depending on the trading segment.Is Zerodha Better Than Grow?

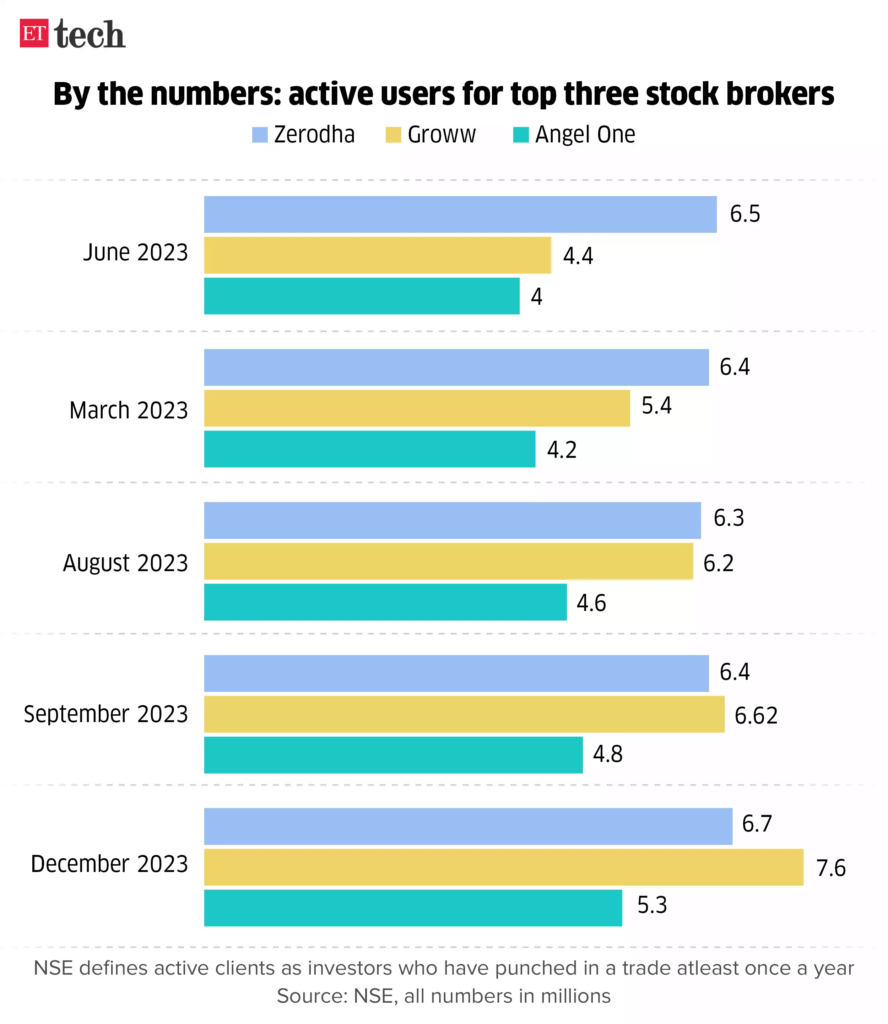

As of September 2023, Groww reported 6.63 million active investors, while Zerodha reported 6.48 million investors.

Groww’s rise in popularity due to no account opening and and annual maintenance charges.

Groww positioned itself as a platform with a primary focus on attracting new customers.

Zerodha vs Groww – Revenue Comparison

During FY23, Zerodha reported a 39 per cent growth in revenue at Rs 6,875 crore compared with the previous financial year, whereas Groww’s parent company, Nextbillion Technology Private Limited, recorded a revenue of Rs 1,294 crore in FY23. Despite the growth in number of users, Zerodha’s revenue is five times that of Groww.

Zerodha’s revenue is higher than Groww due to the dominance in the Futures and Options (F&O) trading. The F&O segment has been highly profitable for Zerodha.

Source: Groww vs Zerodha

Zerodha vs Groww Overview

About Groww

Groww is a Discount Broker incorporated in 2016. It offers trading at NSE and BSE. It has 0 branches across India. Groww started as a mutual fund investment platform and has expanded its offerings to include stocks, digital gold, and other investment options. It allows users to invest in direct mutual funds, stocks, IPOs, and exchange-traded funds (ETFs).

Grow trading account opening charges are Rs 0 (Free) and Grow Account AMC Charges are also Rs 0 (Free).About Zerodha

Zerodha is a Discount Broker incorporated in 2010. It offers trading at NSE, BSE, MCX and NCDEX. It has 22 branches across India. Zerodha is primarily a discount brokerage firm that offers a wide range of investment services. It provides trading and investment options in stocks, mutual funds, commodities, currency derivatives, bonds, and more.

Zerodha account opening charges are Rs 200 and Zerodha Demat Account AMC Charges are Rs 300 annually.Would you like to know my honest review on Zerodha Stock Broker? Zerodha Reviews 2023: Is Zerodha Good For Beginners In India? Honest Review

Let’s read in detail about Zerodha vs Groww

Zerodha vs Groww Basic Information

| Particulars | Groww | Zerodha |

| Founders | Lalit Keshre | Nithin Kamath |

| Year of Incorporation | 2016 | 2010 |

| Type of Broker | Discount Broker | Discount Broker |

| Exchange Membership | NSE and BSE | NSE, BSE, MCX and NCDEX |

| Number of Branches | 0 | 22 |

| Headquarter | Bangalore, India | Bangalore, India |

Point of View: Groww primarily operates as an online investment platform, so it doesn’t have physical branches like other traditional stock brokers, whereas Zerodha has several physical branches and partner offices across India to provide customer support and assistance.

Zerodha vs Groww Trading & Demat Account Opening Charges

What is Demat Account?

A Demat account is used for holding securities/shares in electronic form, and the securities are deposited through National Securities Depository Limited (NSDL) or Central Depository Services Limited (CDSL).

Groww offers Free (Zero) account opening where Zerodha charges Online Rs 200 (Equity +Currency) and Rs 300 (Equity +Currency +Commodities) for account opening.What is Demat AMC Charges?

When you open a Demat account with a Depository Participant (DP) or a stockbroker, you are required to pay an annual fee for the maintenance of your Demat account. This fee is known as the Demat AMC charge.

Groww Demat Account AMC Charges is Rs 0, whereas Zerodha charges Rs 300 per annum AMC for Demat account.| Particulars | Groww | Zerodha |

| Trading Account Opening fee | Rs 0 (Free) | Online Rs 200 (Equity +Currency), Rs 300 (Equity +Currency +Commodities) |

| Trading Account AMC Charges | Rs 0 (Free) | Rs 0 (Free) |

| Demat Account Opening Charges | Rs 0 (Free) | Rs 0 (Free) |

| Demat Account AMC Charges | Rs 0 (Free) | Rs 300 per annum |

Point of View: Groww focused on making investing accessible to newcomers and eliminating the fees associated with account opening and annual maintenance, which attracted many investors, where Zerodha trading broker introduced the concept of a discount brokerage, offering lower brokerage fees

Zerodha vs Groww Brokerage Charges

| Account Type | Groww Brokerage Charges | Zerodha Brokerage Charge |

| Equity Delivery | Rs 20 per executed order or 0.05% whichever is lower | Rs 0 (Free) |

| Equity Intraday | Rs 20 per executed order or 0.05% whichever is lower | Rs 20 per executed order or .03% whichever is lower |

| Equity Futures | Rs 20 per executed order | Rs 20 per executed order or .03% whichever is lower |

| Equity Options | Rs 20 per executed order | Rs 20 per executed order |

| Currency Futures | NA | Rs 20 per executed order or .03% whichever is lower |

| Currency Options | NA | Rs 20 per executed order |

| Commodity Futures | NA | Rs 20 per executed order or .03% whichever is lower |

| Commodity Options | NA | Rs 20 per executed order |

Point of View: Groww gained popularity due to its user-friendly and commission-free investment platform, where as Zerodha became popular for its disruptive approach to brokerage services with the concept of a discount brokerage, offering lower brokerage fees compared to traditional brokers.

Use Zerodha Brokerage Calculator to get estimation of Zerodha Brokerage

Zerodha vs Groww other charges

| Other Brokerage Charges | Groww | Zerodha |

| Minimum Brokerage Charges | Rs 20 or 0.05% per executed order | 0.03% in Intraday and F&O |

| DP Charges (on sell side) | Rs 8 + Rs 5.50 (CDSL Charges) per ISIN | Rs 13.5 per scrip |

| Other Miscellaneous Charges | Physical Contract Note: Rs 20 + Courier Charges; Auto square off charges : Rs 50 | Physical contact notes: Rs 20, Trade SMS Alerts: Rs 1 per SMS |

Zerodha vs Groww Transaction Charges

| Transaction Charges | Groww | Zerodha |

| Equity Delivery | NSE Rs 325 per Cr (0.00325%) | BSE Rs 300 per Cr (0.003%) (each side) | NSE Rs 325 per Cr (0.00325%) | BSE Rs 375 per Cr (0.00375%) (each side) |

| Equity Intraday | NSE Rs 325 per Cr (0.00325%) | BSE Rs 300 per Cr (0.003%) (each side) | NSE Rs 325 per Cr (0.00325%) | BSE Rs 375 per Cr (0.00375%) (sell side) |

| Equity Futures | NSE: 002% | NSE Rs 190 per Cr (0.0019%) |

| Equity Options | NSE: 0.053% on premium | NSE Rs 6250 per Cr (0.0625%) (on premium) |

| Currency Futures | NA | NSE Rs 90 per Cr (0.0009%) | BSE Rs 25 per Cr (0.00025%) |

| Currency Options | NA | NSE Rs 3500 per Cr (0.035%) | BSE Rs 100 per Cr (0.001%) (on premium) |

| Commodity | NA | Group A – Rs 260 per Cr (0.0026%) |

Zerodha vs Groww Leverage (Margin)/Equity Exposure

| Leverage (Margin)/Equity Exposure | Groww | Zerodha |

| Equity Delivery | 100% of trade value (1x leverage) | 100% of trade value (1x leverage) |

| Equity Intraday | Up to 20% of trade value (5x leverage) | Up to 20% of trade value (5x leverage) |

| F&O (Equity, Currency, Commodity) | 100% of NRML margin (Span + Exposure) (1x leverage) | 100% of NRML margin (Span + Exposure) (1x leverage) |

Compare Groww And Zerodha Features

| Features | Groww | Zerodha |

| 3 in 1 Account | No | Yes |

| Charting | Yes | Yes |

| Automated Trading | Yes | Yes |

| SMS Alerts | Yes | No |

| Online Demo | Yes | Yes |

| Online Portfolio | Yes | No |

| Margin Trading Funding | No | No |

| Margin Against Shares (Equity Cash) | No | Yes |

| Margin Against Shares (Equity F&O) | No | Yes |

| Trading Platform | Groww | Kite Web, Kite Mobile for Android/iOS and Coin |

| Intraday Square-off Time | 3:10 PM | Eq Cash: 3:15 PM | Eq F&O : 3:25 PM | Currency: 4:45 PM |

Point of View: If you are a new or casual investor looking for a simple and user-friendly platform primarily for mutual fund investments and basic stock trading, Groww may be a suitable choice. On the other hand, if you are an active trader, require advanced charting and analysis tools, are interested in algorithmic trading, or need extensive SMS alerts, Zerodha may be a better fit.

Customer Support – Compare Zerodha vs Groww

| Customer Service Compare | Groww | Zerodha |

| 24/7 Customer Service | No | No |

| Email Support | Yes | Yes |

| Online Live Chat | Yes | No |

| Phone Support | Yes | Yes |

| Toll Free Number | No | No |

| Through Branches | No | Yes |

| Customer Care Number | 9108800604 | “+ 91 80 4040 2020” |

| Customer Support Email | support@groww.in | support@zerodha.com |

| Head Office Address | Groww Head Office 1st Floor, Proms Complex, SBI Colony, 1 A Koramangala, 560034 | Zerodha Headquater #153/154 4th Cross Dollars Colony, Opp. Clarence Public School, J.P Nagar 4th Phase, Bangalore – 560078 |

| Website | https://groww.in/ | https://zerodha.com/ |

| Broker Enquiry | Request a call back | Request a call back |

Zerodha Vs Groww Investment Options

| Investment options | Groww | Zerodha |

| Stock / Equity | Yes | Yes |

| Commodity | No | Yes |

| Currency | No | Yes |

| IPO | Yes | Yes |

| Mutual Funds | Yes | Yes |

| Bond / NCD | No | No |

| Debt | Yes | No |

| Other Investment Options | Digital Gold, US Stocks, Fixed Deposits | – |

Zerodha Vs Groww Research Report

| Research Report | Groww | Zerodha |

| Daily Market Report | No | No |

| Free Tips | No | No |

| Quarterly Result Analysis | No | No |

| News Alerts | No | No |

Zerodha vs Groww – Pros and Cons

| Groww | Zerodha | |

| Pros | · Zero Account opening fee. · Zero Maintenance Charges. · Direct MF investment platform Option to invest online in digital gold and US Stocks. | · You can open a 3-in-1 account, Demat + Trading + Bank A/c. · Flat fee of Rs. 20 per trade across segments and exchanges (BSE, NSE, MCX). · Free equity delivery trades. No brokerage charges for Cash-N-Carry orders. · Zero brokerage and direct investment in direct mutual funds on Coin. · Superfast and feature-rich web and app trading platform Kite. · Free UPI-based hassle-free fund transfer process. · Advanced order types, such as bracket order (BO), cover order (CO), after-market order (AMO), and GTT are available. NRI Trading account is available. |

| Cons | · No option to currently trade in derivatives (futures & options), commodity, and currency segment. · Doesn’t offer trading in SME shares. · No Call and Trade services. · No Branch support. · No Margin trading facility. · No Margin against shares. · Trailing stop loss orders are not available No NRI Trading. | · No stock tips, research, and recommendations. · High Call & Trade is charged an extra Rs 50 per order. · High Auto Square off is charged at an extra Rs 50 per order. No margin funding. |

Also Compare other Brokers with Zerodha

Zerodha vs Upstox ↗

Compare Zerodha vs Upstox share brokers

Finvaisa vs Zerodha ↗

Compare Finvasia vs Zerodha share brokers

Motilal Oswal vs Zerodha ↗

Compare Zerodha vs Motilal Oswal share brokers

Zerodha Vs Angel Broking ↗

Compare Zerodha Vs Angel Broking share brokers

ICICIDirect vs Zerodha ↗

Compare ICICIdirect vs Zerodha share brokers

Zerodha, Upstox, and Groww ↗

Compare Upstox vs Groww vs Zerodha share brokers

Other Groww Related Answers