You know how you wouldn’t judge a book by its cover, right? Well, the same goes for banks! I mean to say that banking stocks requires a different lens than other sectors due to their unique business model.

This Sunday, I decided to analyse key ratios to understand a bank’s financial health and potential. I found these are some of the most important ratios that we should compare before investing in any bank. Let’s grab our magnifying glasses, we might just uncover some hidden gems.

Also Check: IRFC Share Price Target 2024 | Fundamental and Technical Analysis

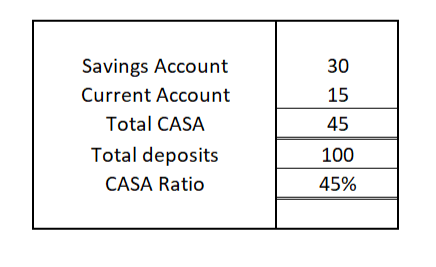

1. CASA Ratio

Measures the bank’s dependence on cheap, stable sources of funds like checking and savings accounts. A higher ratio is better as it indicates a stable & cost-effective funding base (more trust from depositors).

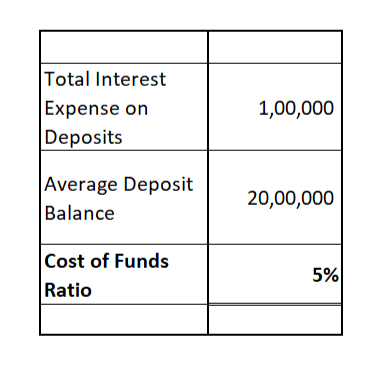

2. Cost of Funds Ratio

Reflects how much a bank pays to borrow money. A lower ratio is better for higher profit margins.

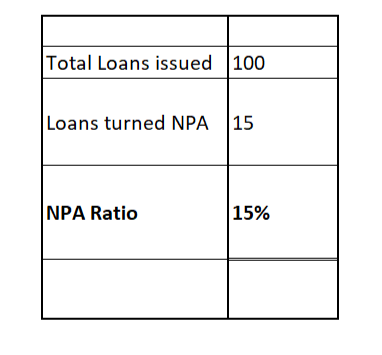

3. Non-Performing Assets (NPA) Ratio

Indicates the percentage of a bank’s loans that are overdue and unlikely to be repaid. A lower ratio is better, it means less risk of defaults and higher profitability.

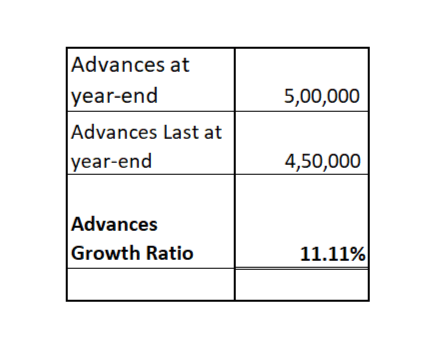

4. Loans/Advances Growth Ratio

Shows the year-on-year growth in a bank’s loan portfolio. Higher growth indicates business expansion but needs to be balanced with risk.

5. Capital Adequacy Ratio (CAR)

Measures a bank’s capital buffer to absorb potential losses. A higher ratio indicates a stronger financial position. Regulatory bodies set minimum CAR requirements. (Min. CAR requirements in India are set by RBI as follow: For Scheduled commercial banks (private banks) need a minimum CAR of 9% and for public sector banks must maintain a higher minimum CAR of 12%.)

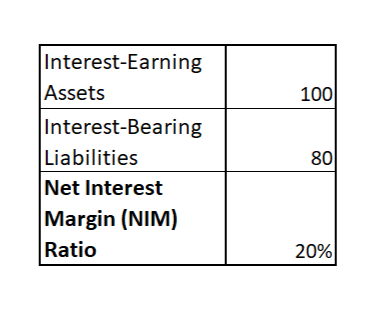

6. Net Interest Margin (NIM) Ratio

Shows the profitability of a bank’s core lending business. A higher ratio indicates better profitability. Minimum ROA benchmark 1% and around 2% is considered good.

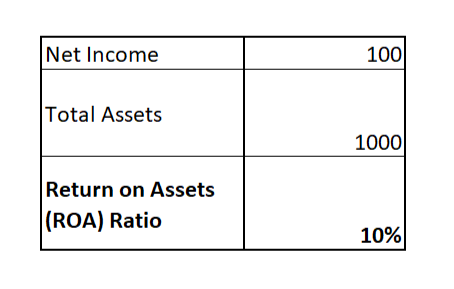

7. Return on Assets (ROA) Ratio

Measures how efficiently a bank generates profit from its assets. A higher ROA indicates better overall bank efficiency.

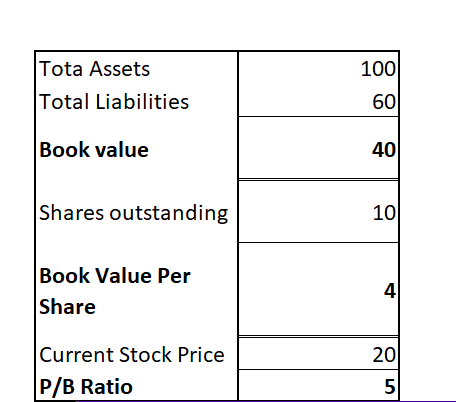

8. Price-to-Book Ratio (P/B Ratio)

Compares a bank’s stock price to its book value. A high P/B ratio might indicate future growth potential, while a low ratio could indicate undervaluation or risk.

By understanding these ratios, you can become a more informed investor in the banking sector.

Who is Winning based on the Above Parameters?

Disclaimer: The information provided on this website is for general informational purposes only and should not be construed as financial advice, investment recommendations, or guarantees of any kind. This information is not intended as a substitute for professional financial advice. You should always seek the advice of a qualified financial advisor before making any investment or financial decisions.