Choose the topic of your interest

ToggleIn this analysis, we explore HUDCO’s share price targets for 2024, 2025, 2027, 2030, and 2040. As a key player in the financial support sector for the housing industry, HUDCO’s performance offers valuable insights.

We have performed detailed research on HUDCO share price target and shared our insights on the same. In this article, we have shared a brief overview of HUDCO, financial growth, shareholding pattern, future growth perspective, and challenges in the housing sector.

Overview of HUDCO Limited

Housing and Urban Development Corporation (HUDCO) is a premier public sector enterprise in India. The company operates under the Ministry of Housing and Urban Affairs, Government of India. HUDCO is engaged in financing housing and urban infrastructure projects across the country.

HUDCO’s primary mission is to provide long-term finance for the construction of houses for residential purposes or urban development programs.

| Company Name | Housing and Urban Development Corporation |

| Current Market Price | ₹267 |

| Market Cap | ₹50,998 Crore |

| Book Value | ₹83.00 |

| Face Value | ₹10 |

| 52 Week High | ₹300 |

| 52 Week Low | ₹56.9 |

| Debt | ₹73,996 Cr. |

| DIV. YIELD | 1.54% |

HUDCO Current Financial Status

| Stock P/E | 24.1 |

| Industry P/E | 19.1 |

| EPS | ₹10.6 |

| Debt to Equity Ratio | 4.45% |

| Promotor Holding | 75% |

| ROE | 13.2% |

| Sales growth | 9.92% |

| Profit growth | 24.4% |

History of HUDCO Share Price Target From 2024 to 2040

Since its inception in 1970, HUDCO has cumulatively sanctioned a total of 17,335 housing and urban infrastructure projects with a total loan of 2,36,555 crore and disbursements of ₹1,96,612 crore.

Further, the Company has sanctioned financial assistance to more than ₹196.48 lakh housing units both in rural and urban areas in the Country, of which ₹187.27 lakh (95.31%) belongs to EWS / LIG categories.

In addition, under HUDCO Niwas, the company has cumulatively sanctioned financial assistance of ₹6,871 crore to 3.86 lakh individuals and released an amount of ₹5,178 crore.

HUDCO is in a bullish moment from November 2022 in the stock market.

In the last 6 months, HUDCO’s share jumped from ₹87.50 to ₹272 (a growth of 211.75%)

In the last 1 year, HUDCO share growth is ₹50 to ₹272 (growth of 447.46%)

The stock has touched a high of ₹299.

HUDCO is continuously in the bullish momentum due to an increase in demand for house construction and financing. The stock seems to be profitable in the long run also.

Also Read: LIC Share Price Target

HUDCO Share Price Target 2024

The first Union Budget of the Amrit Kaal, Union Budget 2023-24, outlined its focus on housing and urban infrastructure sectors. In the budget, capital investment outlay for infrastructure has been increased by 33 percent to ₹10 lakh crore, which is 3.3 percent of GDP.

The stock has given an average ROE of 11-13% in the time horizon of 1 to 5 years.

HUDCO Share Price Target for 2024 is ₹293.70 to ₹301.71.

| Year | HUDCO Share Price Target 2024 |

| 1st Price Target | ₹293.70 |

| 2nd Price Target | ₹301.71 |

Comparison based on Financial Year on Year Basis: HUDCO has reported total income for the financial year 2022-23 at ₹7086.18 crore (the previous year ₹6997.66 crore), while the Profit Before Tax (PBT) for the year was ₹2289.41 crore (previous year ₹2,345.94 crore) and Profit After Tax (PAT) was₹1701.62 crore (previous year ₹1,716.60 crore).

Comparison based on Y-o-Y basis: The total revenue amount was ₹7,082 Crore in March 2023 which became ₹7,784 Crore in March 2024. The financing margin increased from 32% to 35% from March 2023 to March 2024.

HUDCO Share Price Target 2025

The Company has established a long-standing association with the various state government agencies and its parastatals such as Development Authorities, Housing Boards, Urban Local Bodies, Water Supply & Sewerage Boards, Roads & Bridges Development Corporations, etc., throughout the country.

HUDCO has its own Training & Research Institute, the Human Settlement Management Institute (HSMI) for research activities as well as training & capacity building of in-house as well as outside professionals of the housing and urban development sector.

HUDCO Share Price Target for 2025 is ₹334.11 to ₹340.13

| Year | HUDCO Share Price Target 2025 |

| 1st Price Target | ₹334.11 |

| 2nd Price Target | ₹340.13 |

As at the end of the financial year ended 31st March, 2023, HUDCO reported Gross NPA of ₹2,759.17 crore, which constitutes 3.42% of total loan portfolio.

The Net NPA as on 31st March 2023 is ₹407.25 crore which constitutes 0.52% to Net loan outstanding.

Also Read: Wipro Share Price Target

HUDCO Share Price Target 2026

HUDCO Share Price Target for 2026 is ₹377.40 to ₹426.01

| Year | HUDCO Share Price Target 2026 |

| 1st Price Target | ₹377.40 |

| 2nd Price Target | ₹426.01 |

HUDCO Share Price Target 2027

HUDCO has a diversified funding profile with sources including tax-free bonds, taxable bonds, refinance from NHB, bank loans, commercial papers, and foreign currency borrowings. As on 31st March 2023, HUDCO’s overall borrowings stood at ₹62,905.08 crore, which comprised long-term borrowings of ₹61,135.58 crore and short-term borrowings of ₹1,769.50 crore. Further, as on 31st March, 2023, the long-term borrowings to Net worth, stood at 3.96 times, as against 4.09 times as on 31st March 2022.

HUDCO Share Price Target for 2027 is ₹472.86 to ₹533.36

| Year | HUDCO Share Price Target 2027 |

| 1st Price Target | ₹472.86 |

| 2nd Price Target | ₹533.36 |

HUDCO Share Price Target 2030

The overall weighted average cost of resources raised during the year was 7.46% p.a. and for borrowings outstanding as on 31st March, 2023 is 7.71% p.a. (7.43% p.a. as on 31st March, 2022).

| Year | HUDCO Share Price Target 2030 |

| 1st Price Target | ₹927.96 |

| 2nd Price Target | ₹1047.51 |

HUDCO Share Price Target From 2024 To 2040

The key to HUDCO’s growth prospect is crucially linked to the urbanization trend of the Country. India’s urban population is estimated to increase from 470 million in 2021 to ₹600 million by 2036 which would constitute about 40 percent urbanisation level, up from 31.2 percent in 2011 (World Bank Report 2022).

Further, as per the National Infrastructure Pipeline (NIP) Report, the total capital expenditure requirement in infrastructure sectors in India during fiscals 2020 to 2025 is projected at about ₹111 trillion, including ₹19.19 trillion for urban infrastructure projects.

| Year | 1st Target (in ₹) | 2nd Target (in ₹) |

| 2024 | 293.70 | 301.71 |

| 2025 | 334.11 | 340.13 |

| 2026 | 377.40 | 426.01 |

| 2027 | 472.86 | 533.36 |

| 2028 | 591.63 | 667.83 |

| 2029 | 740.37 | 836.20 |

| 2030 | 927.96 | 1047.51 |

| 2040 | 2,556.93 | 3,886.74 |

Also Read: Tata Motors Share Price Target

HUDCO Competitive Landscape

HUDCO has to increasingly contend with its competitors from Banking Sector and other Financial Institutions who have relatively cheaper sources of funds. This poses stiff competition to HUDCO’s business and pressure on the margins.

| S.No. | Name | CMP Rs. | Mar Cap Rs.Cr. | Div Yield % | Debt / Equity |

| 1. | H U D C O | 254.75 | 50998.35 | 1.54 | 4.45 |

| 2. | LIC Housing Fin. | 673.65 | 37055.01 | 1.27 | 8.03 |

| 3. | PNB Housing | 762.25 | 19797.46 | 0.00 | 3.68 |

| 4. | Aadhar Hsg. Fin. | 387.15 | 16512.66 | 0.00 | 3.14 |

| 5. | Aptus Value Hou. | 317.45 | 15839.93 | 1.40 | 1.38 |

| 6. | AAVAS Financiers | 1723.75 | 13641.71 | 0.00 | 3.29 |

| 7. | Can Fin Homes | 782.70 | 10421.94 | 0.77 | 7.34 |

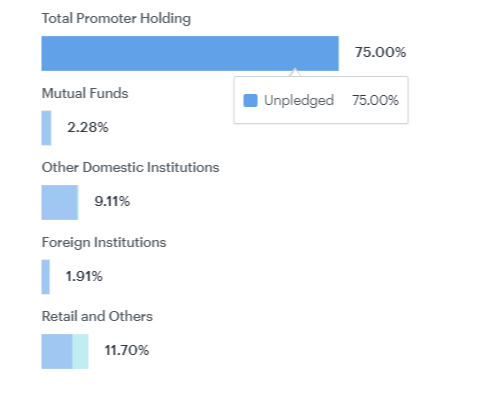

HUDCO Shareholding Patterns

Promoters are individuals or entities that have a significant controlling stake in the company. For HUDCO, the primary promoter is the Government of India with 75% holdings.

Institutional investors (FIIs and DIIs) include entities like mutual funds, insurance companies, pension funds, and foreign institutional investors (FIIs), holding 13.3% stake in HUDCO.

Public: Retail investors are individual investors who buy shares in smaller quantities. This category includes high net-worth individuals (HNIs) as well as small retail investors.

Change in Promotor’s Holding from Dec 2023 to March 2024 as follows:

| Dec 2023 | Mar 2024 | |

| Promoters | 75.17% | 75.00% |

| FIIs | 1.20% | 1.91% |

| DIIs | 11.80% | 11.39% |

| Public | 11.83% | 11.70% |

Also Read: Tata Steel Share Price Target 2025

Future Prospects and HUDCO Share Price Target

Growth Drivers

Government Initiatives

- Affordable Housing: HUDCO is well-positioned to benefit from government schemes that will drive demand for HUDCO’s financing services.

- Urban Development: Government programs like the Smart Cities Mission and Atal Mission for Rejuvenation and Urban Transformation (AMRUT) will increase the need for urban infrastructure, providing HUDCO with significant opportunities for growth.

Expanding Loan Portfolio

- Diverse Financing: HUDCO’s diversified loan portfolio, including housing, commercial real estate, and urban infrastructure projects. It ensures steady revenue streams and risk mitigation.

- Increasing Disbursements: Continued growth in loan disbursements, driven by rising demand for housing and infrastructure financing, will support revenue and profitability.

Economic Growth

- Urbanization Trends: Rapid urbanization in India will drive demand for housing and urban infrastructure, providing a steady stream of projects for HUDCO.

- Rising Middle Class: The growing middle class and their increasing purchasing power will boost demand for better housing and urban amenities.

Risks and Challenges

Competition

- Private Sector Competition: Increased competition from private financial institutions can affect HUDCO’s market share and margins. HUDCO needs to take constant action to make its financial products innovative to stay ahead in a competitive market.

- Alternative Financing Options: The availability of alternative financing options, such as NBFCs and fintech solutions, can pose a challenge to HUDCO’s growth.

Regulatory Risks

- Policy Changes: Sudden changes in government policies and regulations can impact HUDCO’s operations and profitability.

- Interest Rate Fluctuations: Rising interest rates can increase borrowing costs for HUDCO and its clients. It can lead to a reduction in loan disbursements and profitability.

Conclusion

In conclusion, based on the Fundamental analysis, HUDCO share price target appears promising for the long term. We have considered growth factors that are strongly associated with the housing sector and the increasing demand for financial support in this area.

It is necessary to do careful research based on your risk appetite to consider HUDCO as a long-term investment in your portfolio. Also, if you’re considering investing in HUDCO, it’s essential to monitor market trends in the housing finance sector and stay informed about industry developments to make informed decisions.

Frequently Asked Questions

HUDCO stands for Housing and Urban Development Corporation Limited. It is a government-owned company that specializes in providing finance and loans for housing and urban development projects. HUDCO has given a return of 192.10% in six months and 569.81% in the past 5 years, indicating a strong bullish trend in the long term. HUDCO Share price target for the long term is predicted at Rs. 1,047.51 by 2030. The future prediction of HUDCO's (Housing and Urban Development Corporation Limited) share price reflects a promising outlook based on several factors, including India's growing demand for affordable housing and urban infrastructure. The share price target for HUDCO in 2024 varies based on analyst forecasts, but targets can range from X to Y based on market conditions and financial performance. HUDCO Share Price Target for 2025 is ₹334.11 to ₹340.13. HUDCO Share Price Target for 2026 is ₹377.40 to ₹426.01. HUDCO Share Price Target for 2027 is ₹472.86 to ₹533.36 HUDCO Share Price Target for 2030 is ₹927.96 to ₹1047.51. Investing in HUDCO can be a good decision for long-term investors due to its government backing, financial stability, and positive market outlook. However, it is important to consider the risks associated with regulatory changes, execution delays, and market volatility.What is HUDCO?

Is HUDCO good for the long term?

What is the future prediction of HUDCO?

What is the share price target for HUDCO in 2024?

What is the HUDCO Share price target for 2025?

What is the HUDCO Share price target for 2026?

What is the HUDCO Share price target for 2027?

What is the HUDCO Share price target for 2030?

Should I invest in HUDCO?

Disclaimer: The share price target provided is for informational purposes only and does not constitute financial advice. It is based on current market analysis and subject to change due to market conditions. Investors should conduct their own research or consult a financial advisor before making investment decisions. Past performance is not indicative of future results. Investing in stocks involves risk, including the loss of principal.