Welcome to the LIC Share Price Target 2025 report. In this analysis, we will explore LIC Share Price Target 2025. We will explore the expected future performance of LIC’s shares and set a target price for potential investors.

To Predict the LIC Share Price Target, we will analyze the present business and future business prospects of the company. It includes an analysis of the company’s financials, market trends, and other relevant factors that can affect the LIC share price target in the coming years. Let’s discover the potential growth prospects of this renowned insurance company.

About LIC

- Life Insurance Corporation (LIC) is the largest insurance provider company in India with more than 66.2% market share of health insurance in India (source irdai.gov.in).

- The company offers participating and non-participating insurance products like unit-linked insurance products, saving insurance products, term insurance products, health insurance, and annuity & pension products.

- LIC is ranked fifth by life insurance GWP and 10th globally in terms of total assets.

What is the LIC Share Price Target 2025?

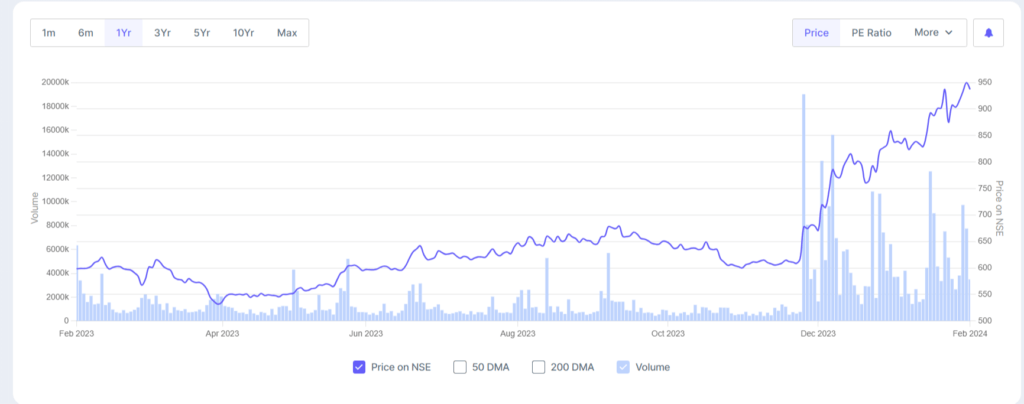

As we know that LIC got listed in the Indian Share market on 17 May 2022 at Rs 871 and the share hit the price of Rs. 918.95. The stock has a price band between Rs. 902 – Rs. 949, which was quite good. However, the LIC share price is volatile since its listing.

The stock tries to lift up but hasn’t stabilized for a long time and it reached its all-time low of INR 530 on March 29, 2023. Since then the stock is trying for some recovery but not substantial. Now, LIC Share is trading at around Rs. 1,004 per share.

Let’s first understand why LIC share remained volatile:

Reduction in market share: LIC share in the market reduced from 67.73% as of November 2022 to 63.8% in January 2023. However, it has not impacted much on the company’s profitability because LIC’s premium income rose at the rate of 14.5%, which has compensated for the lost market share.

Hindenburg Report: In January 2023, Hindenburg Research published a report alleging the Adani Group of manipulating the market and indulging in accounting fraud. The report has also created insecurity in the market among the investors because LIC has investments in multiple Adani Group companies to a total exposure of 4.23%. The Hindenburg report created a negative scenario for LIC with a label mark of “bad investment by LIC.”

So, these were two major reasons due to which LIC stock remained volatile and couldn’t sustain at higher levels to create new higher highs.

However, as per the company’s strong fundamentals and current market analysis, the LIC share price target by 2025 is expected to be around Rs. 1,500 – 2,100 per share. Being India’s largest life insurance company and 5th in the world by total premiums and financial stability, we can expect good growth in LIC share.

LIC Share Price Target 2025

| Year | LIC Share Price Target |

| LIC Share Price in 2023 | Rs. 800 |

| LIC Share Price in 2024 | Rs. 1,151.43 |

| LIC Share Price in 2025 | Rs. 1,363.98 |

| LIC Share Price in 2026 | Rs. 1,571.20 |

| LIC Share Price in 2027 | Rs. 1,783.93 |

| LIC Share Price in 2028 | Rs. 1,995.58 |

| LIC Share Price in 2030 | Rs. 2,420.33 |

Also Check: Yes Bank Share Price Target 2025

Also Check: Tata Steel Share Price Target

Also Check: Wipro Share Price Target 2025

Also Check: Tata Motors Share Price Target 2025

Also Check: Adani Power Share Price Target 2025, 2026, 2027, 2030

Major Reason to Increase in LIC Share Price in the Future

LIC has shared its profitability plans in a conference call with analysts that will help to increase its share price:

LIC is aiming to diversify its product mix by increasing the non-participating business share. Non-participating (Non-par) products, such as term insurance policy or fixed life insurance policy are generally better-margin products in a favorable interest rate cycle. This is evident from LIC’s individual business share of Non-participating business climbing higher to 8.89 percent in FY23, from 7.12 percent in FY22.

LIC believes in a gradual shift in the mix will aid VNB (value of new business) margin expansion by 400bps to 19 percent in FY25 from 15.1 percent in FY22. LIC share price target 2025.

Fundamental Analysis of LIC Share

A quick Overview

LIC Pros

- The company is almost debt free.

- The company has delivered good profit growth of 71.6% CAGR over the last 5 years

- The company has a good return on equity (ROE) track record: 3 Years ROE 108%

LIC Cons

- No Serious cons found

Financial Analysis of LIC

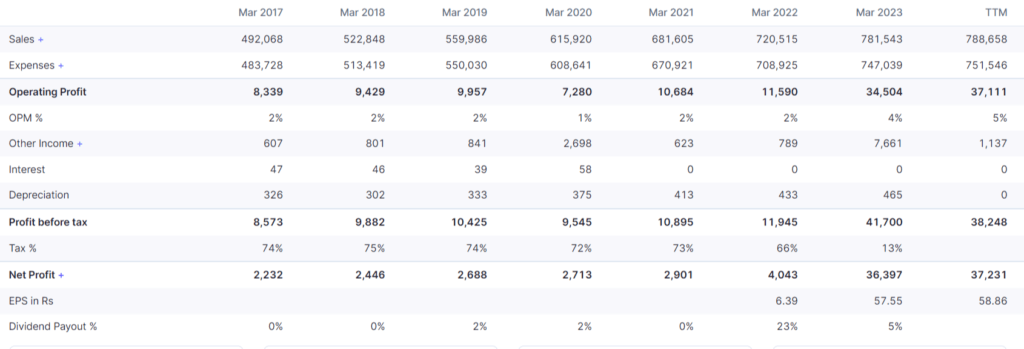

Sales Growth: Net Sales at Rs 1,087,933 crore in March 2023 increase substantially from Rs. 720,314 crore in March 2022.

Profitability: Life Insurance Corporation of India recorded a standalone net profit of Rs. 36,397 crore in March 23, growing 800% over the last year.

Solvency Ratio: LIC Solvency ratio is improved to 1.87 from 1.85 a year earlier. The solvency ratio measures an insurer’s ability to meet its long-term debt obligations.

Persistency Ratio: LIC Persistency ratio increased to 70.16 percent for the quarter ended March FY23, from 69.24 percent a year ago. The persistency ratio indicates policyholder loyalty. This means more policyholders are sticking with the company beyond one year.

LIC financial stability and profitability indicate the company’s potential for future growth, which can positively impact its share price.

Factors that Can Affect LIC Share Price in 2025

Financial Performance: LIC’s financial performance, including revenue growth, profitability, and return on investments, will play a significant role in determining its share price. Positive financial results may attract investors and drive the share price higher.

Economic Conditions: Currently, the insurance sector is providing a favorable compound annual growth rate (CAGR) of 15% over the last five years. An increase in demand for insurance products will give a superior advantage to LIC.

Regulatory Changes: Any regulatory changes or policies related to the insurance industry can affect LIC’s operations and profitability. Favorable regulatory developments may positively impact the share price, while adverse changes could have the opposite effect.

Competition: Currently, LIC is dominating the insurance market share in India at around 63%. The level of competition in the insurance industry can affect LIC’s market share and financial performance. Strong competition may put pressure on pricing and profitability, impacting the company’s valuation.

Also Check: IRFC Share Price Target 2024, 2025, 2026, 2030

CAGR of LIC

LIC Competitors

Conclusion

As per market analysis, LIC Share Price Target is around Rs. 1,500 – 2,100. However, we need to track the market at regular intervals as the market remains highly volatile due to external factors as well. Given LIC’s robust fundamentals, it would be wise to assume the stock is on strong footing and that the company is here to stay.

Disclaimer: There is no accurate way to predict the share prices for the future. We analyze the current market scenario and keep tracking the market on a regular basis to set our targets. It is advisable to learn stocks fundamentals and technicals to understand the market.