Hey, Trading Lover! Welcome to another learning blog

In this blog, we have discussed how to select stocks for swing trading based on FII Buying and using free tools. I have explained the step-by-step process to find swing trading stocks for next week by using this method.

Before that let me quickly explain Swing Trading meaning and how you can make money in the stock market with swing trading.

What is Swing Trading?

Swing trading is a trading strategy where you hold stocks for days or weeks to generate profits from short-term price movements. Swing traders hold stocks somewhere between day trading (holding positions for minutes or hours) and long-term investing (holding for weeks or months).

Profiting Strategy: Swing traders primarily rely on technical analysis to identify entry and exit points based on historical price charts and indicators.

Swing trading involves significant risk and potential for financial losses. It’s important to thoroughly understand the market, conduct your own research, and invest as per your risk appetite only.

My advice: Initially, you can choose the fundamentally strong stocks and then apply technical indicators for swing trading. Let’s learn further Select Stocks for Swing Trading.

Which Free Tools I Can Use To Select Stocks For Swing Trading?

In this blog, I have used two free tools or screeners to find stocks for swing trading:

1. Screener.in

2. TradingView.com (The Ultimate TradingView Paper Trading Tutorial 2024: Trade Your Way to Confidence)

Which Time Frame Is the Best for Swing Trading?

You can choose Daily, Weekly, or Monthly charts for swing trading to get a more accurate analysis of price action and select stocks for swing trading.

Also Check: Best Time Frame for Intraday Trading? Intraday Trading Time Analysis

How I Can Select the Stocks for Swing Trading?

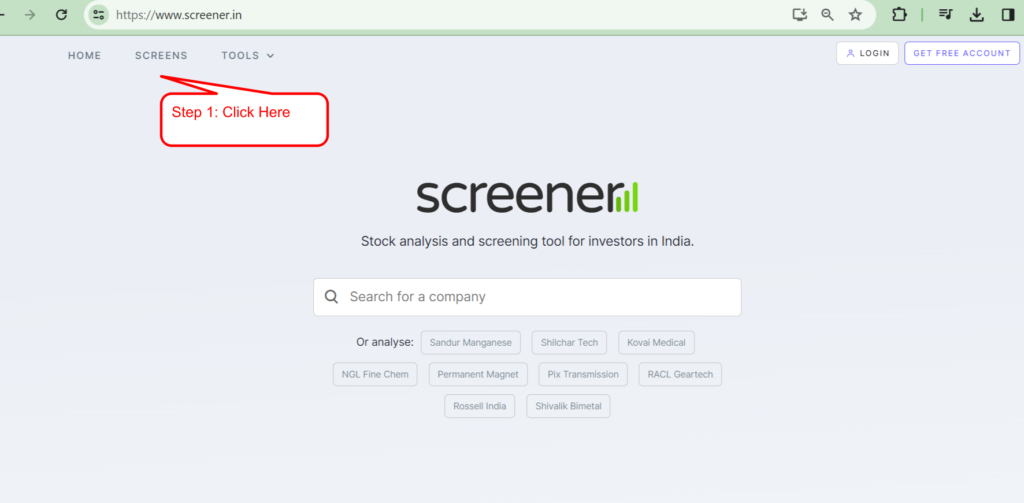

Step 1: Go to the Screener.in and log in (you can create a new account or simply use your Google account to login quickly to Select Stocks for Swing Trading.

Step 2: Click on the Screens showing in the left top corner.

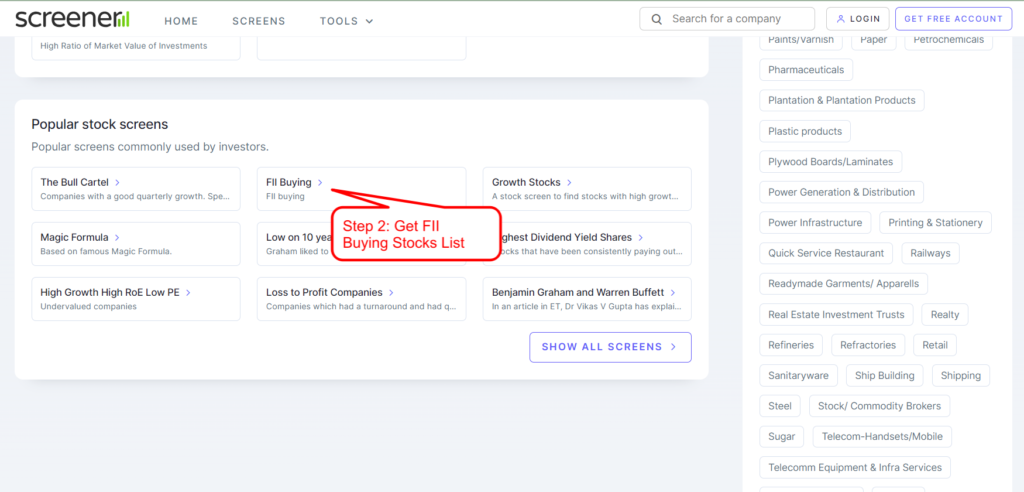

Step 3: Scroll down and look for the “Popular Stock screens.” Here click on the “FII Buying” to Select Stocks for Swing Trading.

What Does FII Buying Indicates?

On Screener.in, “FII Buying” means the increase in holdings of a particular stock by Foreign Institutional Investors (FIIs). This information is generally presented in two ways:

1. Change in FII Holding: It shows the percentage change in the total shares held by FIIs compared to a previous period (e.g., the previous day, previous quarter). A positive value indicates more buying, while a negative value indicates selling.

2. FII Holding Percentage: It shows the total percentage of outstanding shares currently held by FIIs in the company.

What Could Be the Impact of FII Buying on Stocks?

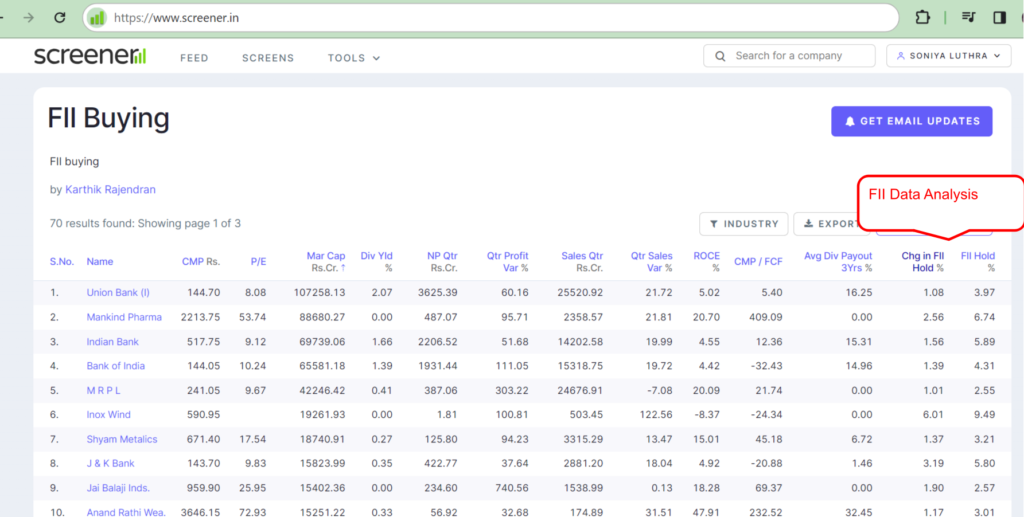

Increased Demand: FII buying injects fresh capital into the market, increasing demand for the stock, and potentially pushing up its price. This can trigger further buying from other investors, creating a positive momentum.

Signals Potential Investor Interest: FIIs are large, professional investors, and their buying activity can be seen as a vote of confidence in a company’s prospects. FII Buying could be a great indicator of stock potential. FII buy based on the fundamentals, we can add our technical to find the swing stocks that can give you 10-15% returns in a short period.

Improved Liquidity: Increased trading activity due to FII buying can enhance stock liquidity, making it easier for investors to buy and sell shares, fostering a healthier market. Select Stocks for Swing Trading.

Step 4: Perform technical analysis of stocks on a Trading view : TradingView is one of the powerful platforms for conducting technical analysis of stocks. You can simply choose your stock, select the time frame, and apply indicators to find the breakout stocks.

Also Check: What are the 5 Best Indicators for Intraday Trading in TradingView Free?

Frequently Asked Questions

What is swing trading?

Swing trading is a trading strategy where you hold positions for days or weeks. Traders aim to catch short-term price movements in stocks, currencies, or commodities and generate profits. It involves holding positions between day trading (holding positions for hours) and long-term investing (holding positions for months or years).

What are the risks involved in swing trading?

The risks involved in swing trading include market volatility, overnight/weekend risk, and psychological stress.

How much money do I need to start swing trading?

There is no minimum or maximum amount you need to start swing trading. It purely depends upon your risk tolerance limit. Initially, you can simply aim to generate 7-10% on whatever capital you are planning to start with.

What are some good trading platforms for swing trading?

All broker provides swing trading facilities in their brokerage apps. If you don’t have a demat account, you can open a demat account with Zerodha and start swing trading with small capital as well.

What are the best timeframes for swing trading?

Daily or weekly charts are the best timeframes for swing trading. Daily charts are used to capture short-term trends lasting from a few days to a couple of weeks, whereas weekly charts are used to identify longer trends of several weeks to a few months.

Should I consider news and events when selecting swing trades?

You should consider Major economic data releases, company earnings reports, and political events that can impact significant price movements, confirming or contradicting your technical analysis.

What are some good technical indicators for swing trading?

Moving averages to Identify trends and support/resistance levels, RSI for overbought/oversold conditions., and Fibonacci retracements for Potential support/resistance levels based on prior price movements can be used for swing trading.

Disclaimer: The information provided on this website is for general informational purposes only and should not be construed as financial advice, investment recommendations, or guarantees of any kind. This information is not intended as a substitute for professional financial advice. You should always seek the advice of a qualified financial advisor before making any investment or financial decisions.