Let’s have quick analysis of Jio Financial Services Business Model, Revenue Model, Fundamental and Technical Analysis to get Jio Financial Services Share Price Target 2025.

Jio Financial Services Business Model

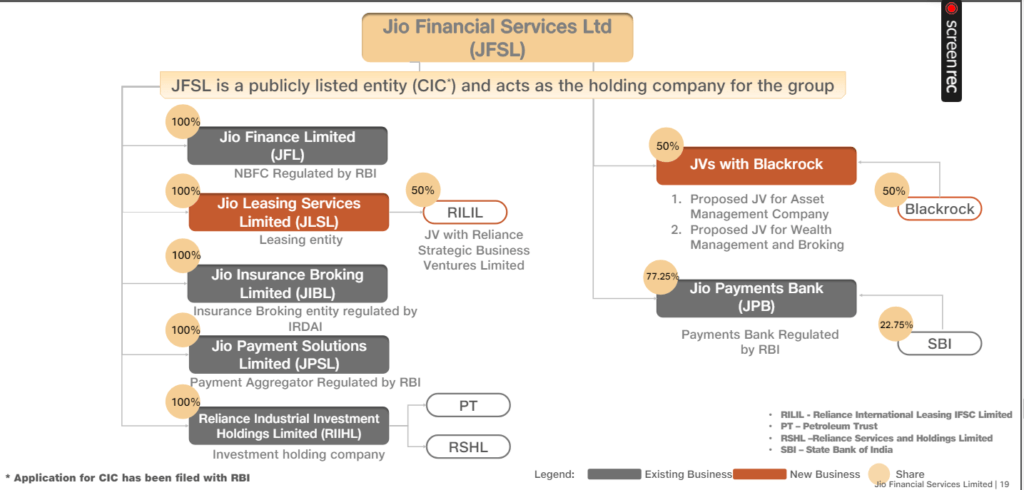

JFS acts as a holding company for various financial service providers, offering a comprehensive financial service under one roof or you can simply imagine JFS as a financial supermarket with different shops under one roof.

Let’s break down the services provided by its subsidiaries.

Also Check: IRFC Share Price Target

Also Check: How To Analyse Undervalued Banking Stocks |Fundamental Analysis of Bank Stocks

Jio Finance Limited (JFL)

Need a loan for a phone or something else? This shop offers regular loans and also helps you finance consumer durables from Reliance Digital stores. JFL has also introduced a new option to rent devices instead of buying them, providing an alternative to traditional loan options.

Jio Payment Solutions Limited (JPSL)

This shop is all about making payments digitally. Think of it like having a handy app to transfer money easily using your phone. Jio Financial Services Share Price Target 2025.

Jio Insurance Broking Limited (JIBL)

Confused about insurance plans? JIBL acts as a middleman between customers and insurance companies. They don’t directly sell insurance but help individuals compare plans from different companies and choose the best fit.

Jio Payments Bank Limited (JPBL)

This shop acts like a mini bank where you can keep your money safe, transfer it to others, and pay bills. They focus on providing these basic services to a wider range of people, even those who might not have a regular bank account. Jio Financial Services Share Price Target 2025.

Jio Financial Services Revenue Model

Interest Income

When they give out loans through Jio Finance Limited (JFL), they charge borrowers interest on the money they repay. This is the main revenue source for JFL.

Fees and commissions

JFS earns fees for various services like Jio Payment Solutions (JPSL) charge a small fee for processing digital payments like UPI transfers. Jio Insurance Broking (JIBL) earns a commission from insurance companies for connecting them with customers who buy policies.

Potentially from selling investment products

JFS recently partnered with BlackRock to launch an asset management company. This could allow them to sell investment products in the future and earn commissions on those sales.

Jio Financial Services Share Price Target 2025

Jio Financial Services Fundamental Analysis

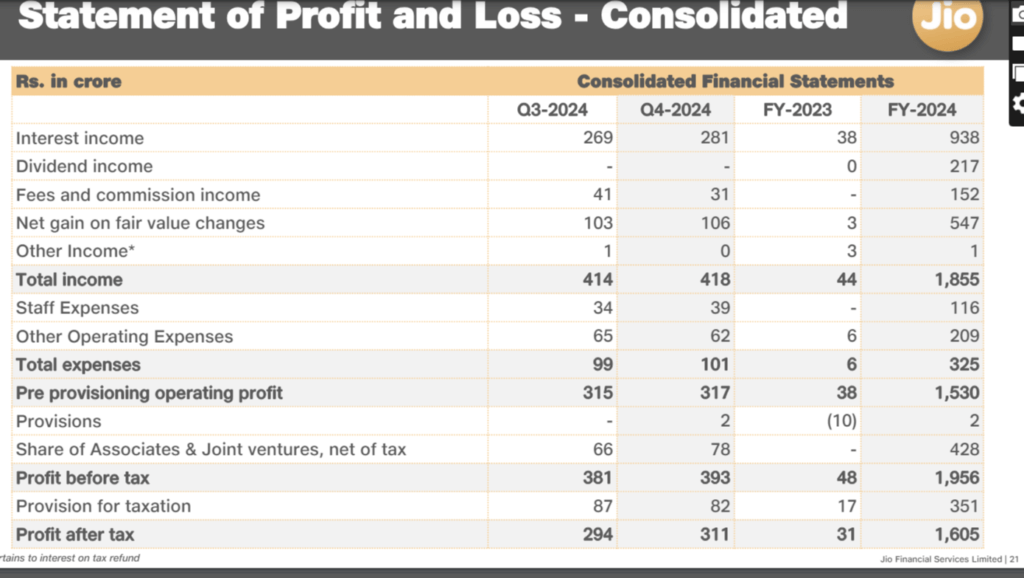

Source: Jio Financial Services Limited Earnings Presentation

Profitability

Positive Development: JFS’s net profit for FY24 (₹1,605 crore) witnessed a significant increase compared to FY23 (₹31 crore). This reflects a substantial improvement in profitability.

Total Income

Positive Development: JFS’s net profit for FY24 (₹1,855 crore) witnessed a significant increase compared to FY23 (₹44 crore). This reflects a substantial improvement in Income.

Debt

The debt-to-equity ratio is 0.00%. The company is debt-free.

Promotor’s holding

Promotor’s Holding increased from Sept 2023 (46.77%) to Dec 2023 (47.12%).

Jio Financial Services Technical Analysis for Jio Financial Services

Jio Financial Services (JFS) is a relatively new player, so in-depth technical analysis can be valuable. See how JIOFIN’s stock price has moved over time. You can gain some insights into potential entry and exit points based on technical analysis. Jio Financial Services Share Price Target.

Check how you can easily draw Support and Resistance in Stock Market: Find Turning Points Quickly

Disclaimer: The information provided on this website is for general informational purposes only and should not be construed as financial advice, investment recommendations, or guarantees of any kind. This information is not intended as a substitute for professional financial advice. You should always seek the advice of a qualified financial advisor before making any investment or financial decisions.