Taparia Tools Ltd. has been making headlines for its eye-popping dividend payouts. But before you jump in, let’s unpack what this means for investors and we will also see Taparia Tools Share Dividend history.

Taparia Tools Share Dividend

Companies distribute a portion of their profits to shareholders through dividends. These payments are typically a fixed amount per share.

Taparia Tools has been a generous dividend payer. In the latest quarter ending December 2023, they declared a dividend of ₹20 per share, a dividend yield of over 4,000%! That means for every share you own, you receive ₹20.

Taparia Tools Share Dividend History – Looking at the Track Record

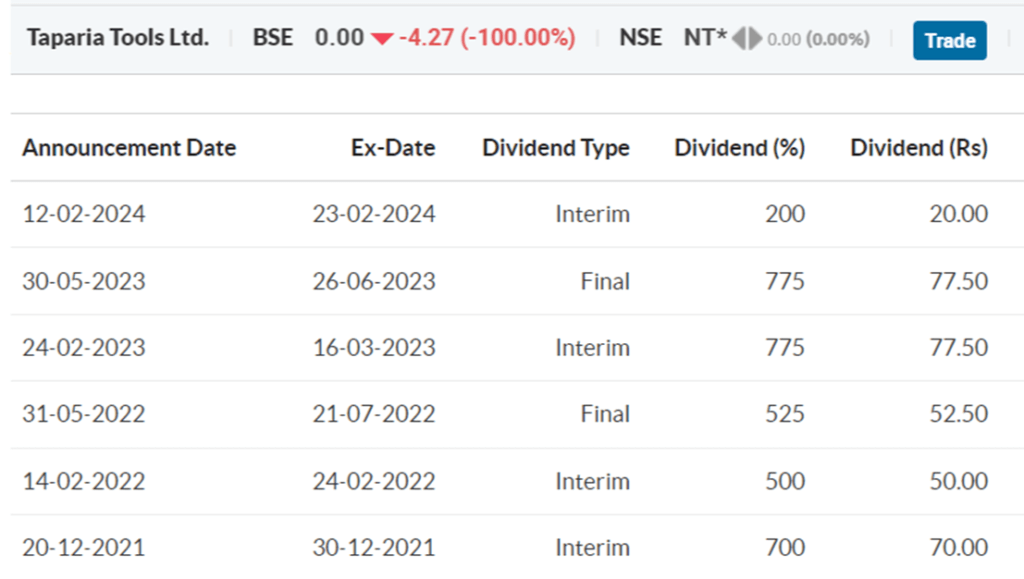

Taparia Tools Share Dividend isn’t a one-time thing. Taparia Tools has a history of impressive dividends. Here’s a glimpse into their recent payouts:

Source: Moneycontrol.com

Must Check: Why Taparia Tools Share Can Be a Risky Share |How to Buy Taparia Tools Share

Also Check: Also Check: Best High Dividend Stocks India 2024 | Dividend Stocks List

What to Consider Before Investing for Taparia Tools Share Dividend

While Taparia Tools’ dividend yield is attractive, it’s crucial to look beyond just the headline number. Here are some factors to keep in mind:

- Sustainability: Can the company maintain these high payouts? Look at their profitability and future prospects.

- Stock Price Fluctuations: High dividend yields can sometimes be accompanied by volatile stock prices.

- Growth Potential: Dividends are a return of profits, not fresh investment in the company’s growth. Consider your overall investment goals.

Do Your Research

Taparia Tools’ high dividend might seem tempting, but it’s vital to do your research. Consider the company’s financials, future plans, and overall market conditions before making any investment decisions.

Investing for the Long Term

Remember, chasing high dividends can be risky. A well-rounded investment strategy focuses on a company’s long-term potential, not just its current payouts.

Conclusion

Taparia Tools might be an interesting option for income-oriented investors, but make sure it aligns with your overall investment goals. By carefully evaluating the company and understanding the risks involved, you can make informed decisions about whether Taparia Tools fits your investment portfolio.

Disclaimer: The information provided on this website is for general informational purposes only and should not be construed as financial advice, investment recommendations, or guarantees of any kind. This information is not intended as a substitute for professional financial advice. You should always seek the advice of a qualified financial advisor before making any investment or financial decisions.