Calling all Indian crypto enthusiasts! Confused about the new tax regulations? The Indian government has taken a big step towards regulating cryptocurrency, and that includes “Tax on Crypto in India.” Let’s break down everything you need to know about Cryptocurrency Taxation.

![Cryptocurrency Taxation | Ultimate Guide to Tax on Crypto in India | [Updated 2024]](https://financefundaa.com/wp-content/uploads/2024/05/Crypto-Tax-1024x463.png)

What are Cryptocurrencies?

Unlike physical cash, cryptocurrencies exist electronically. Cryptocurrencies are digital currencies that you can use to buy goods and services.

The thing you should know here is traditional currencies controlled by governments or banks. However, cryptocurrencies operate on a decentralized network. This means there is no single authority managing them.

You can directly send and receive cryptocurrency from another person anywhere globally, without intermediaries like banks. We will further discuss on Tax on Crypto in India.

A few Major cryptocurrencies include

Bitcoin (BTC),

Ethereum (ETH),

Tether (USDT),

Binance Coin (BNB),

Litecoin (LTC), etc.

Is Cryptocurrency an Asset?

Cryptocurrencies are classified as Virtual Digital Assets (VDAs) and yes, VDAs are considered movable assets for income tax purposes as per Section 2(47A).

Now, as the cryptocurrency is an asset, is it taxable in India?

Is Crypto Taxed In India?

Yes, cryptocurrencies are taxed in India. As we have discussed above they are classified as Virtual Digital Assets (VDAs) under section 2(47A) of the Income Tax Act and the Indian government introduced crypto tax regulations in the 2022 Union Budget, there is a tax on crypto in India.

Also Check: Tax On Dividend Income for Individuals FY24-25 | Save Tax on Dividend Income

Also Check: Income Tax on FD Interest in India FY 24-25|Save Tax on Fixed Deposits

Which Cryptocurrencies Transactions Are Liable To Tax?

In India, most of the cryptocurrency’s transactions are liable to tax if they result in a capital gain. Here are the further details:

- Selling Crypto for Fiat (Rupees): Disposing of your crypto holdings for Indian rupees incurs a 30% tax on the profits (sale value minus purchase value).

- Exchanging cryptocurrencies for other cryptocurrencies: Exchanging/swapping one crypto for another involves a transfer and hence liable for tax.

- Trading Crypto for Crypto: Swapping one cryptocurrency for another is also considered a taxable event. Any profits generated are subject to the 30% tax rate.

- Spending Crypto: If you use your cryptocurrency to directly purchase goods or services, and there is a capital gain involved (meaning you bought it for less than you are spending it for), the profit is taxable at 30%.

Which Cryptocurrencies Transactions Are Exempt from Tax?

- Buying Crypto: Buying cryptocurrency with rupees is not taxable.

- Holding Crypto: Simply holding onto your crypto without any transactions is not liable for any tax.

- Transferring Crypto Between Your Wallets: When you transfer your crypto holdings between your own wallets (even if they are with different exchanges) is also not taxable.

Tax on Crypto in India

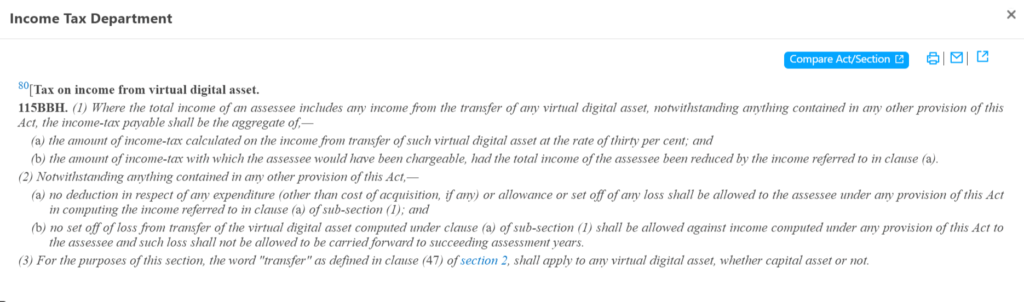

Tax on Profits: Gains from crypto trading, selling, or spending are subject to a flat 30% tax (plus a 4% cess) under Section 115BBH of the Income Tax Act. This applies to all investors, irrespective of their trading frequency or volume. Additionally, the tax rate is the same for short-term and long-term gains. Tax on Crypto in India.

Tax Deducted at Source (TDS): A 1% TDS is deducted at source on crypto transfer exceeding ₹50,000 (or ₹10,000 in specific cases) within a financial year, as per Section 194S. This applies from July 1, 2022, onwards. Please note that the TDS will be deducted from the final sale amount, not just the profits. For TDS, it does not matter if you earn a profit or book a loss on your trade. It will be deducted, no matter what.

Deductions: While computing Tax on Crypto in India, there are no deductions allowed for losses from VDAs currently except for the cost of acquisition.

Restriction of loss set-off: The income tax does not allow setting off losses from one trade against profits from another. Losses cannot be carried forward to future tax years either.

Income Tax Return: Investors will have to declare their income from crypto and other virtual digital assets as capital gains if held as investments or as business income if held for trading purposes. Those with business income should use ITR-3, not ITR-2.

Disclosure of Crypto Assets in Schedule VDA: You need to disclose Crypto Gains under Schedule VDA in the ITR.

Calculate Tax on Crypto in India in Seconds: Crypto Tax Calculator

source: Income Tax Act

How To Calculate Tax on Cryptocurrency?

Simple Case for Tax on Crypto in India: Where a single transaction is involved

Step 1: Calculate capital gains

Capital Gains = Sale Price of Crypto – Purchase Price of Crypto

Step 2: Multiply the capital gain amount with the tax rate of @30%

Step 3: Add cess @4% on the amount computed in step 2.

Let us understand with a simple example

If you bought Bitcoin (BTC) for ₹10,000 and later sold it for ₹20,000.

Capital Gains = ₹20,000 (Sale Price) – ₹10,000 (Purchase Price) = ₹10,000

Tax on Capital Gains = ₹10,000 (Capital Gains) x 30% = ₹3,000

Cess on Tax = ₹3,000 (Tax on Capital Gains) x 4% = ₹120

Total Tax Payable = ₹3,000 + ₹120 = ₹3,120

Complex Case for Tax on Crypto in India: Where multiple transactions are involved

Step 1: Maintain a record of all your cryptocurrency transactions, including the Date of the transaction, Type of transaction (buy/sell/swap), Cryptocurrency involved, Price per unit at the time of the transaction, and Quantity bought/sold/swapped.

Step 2: Use the FIFO method

Step 3: Calculate Capital Gains for Each Transaction

Step 4: Apply tax rate @ 30% and add cess on tax.

For complex cases, I would highly recommend you to check Best Free Crypto Calculator | Koinly Review #1 Choice

Tax on Airdrops

An airdrop is a marketing strategy where free tokens or coins are distributed to a large number of wallet addresses. It is a way for a new project to gain attention, build a user base for their cryptocurrency, and increase liquidity in the early stages.

- Airdrops are also taxable @30% under the income from other sources head.

- Airdrops will be taxed on the fair market value (FMV) of the airdropped tokens at the time of receipt. This fair value is determined as per Rule 11UA. The rule says that if the total FMV of all airdrops you receive in a financial year exceeds ₹50,000, the entire amount becomes taxable.

Tax On Crypto Gifts

As the cryptos are VDAs, these are covered under the scope of movable properties. Cryptos can be gifted either through gift cards, crypto tokens, crypto paper wallets, or even as airdrops. Crypto received as gifts from relatives will be tax-exempt.

However, if the value of the crypto gift from a non-relative exceeds Rs 50,000, it becomes taxable in the hands of the receiver. The tax shall be at the rate of 30 percent (additional cess and surcharge as applicable).

A Quick Summary on Tax on Crypto in India

| Situations | Tax on Crypto in India |

| Crypto to INR (Selling) | Taxable at 30% on capital gains (profit from sale). |

| Crypto to Crypto (Trading & Selling) | Taxable at 30% on capital gains (profit from each trade) |

| Crypto Gifts | Taxable @30% if exceeding ₹50,000 under “Income from other sources” |

| Crypto Airdrops | As airdrops categorize under gifts, it is taxable @30% if exceeding ₹50,000 (potentially under “Income from other sources” |

| Holding | Since no buying or selling, it is not taxable (no capital gains realized). |

| Wallet Transfers | Not taxable (movement between your own wallets) |

How To Save Tax on Crypto in India?

Simple, you cannot! there is no legal way to save or avoid tax on crypto in India. In fact, you will have to face the following consequences:

- Under-reporting or misreporting income

- Late filing of Income Tax return

- Non-compliance with Tax Deducted at Source (TDS) obligations

- Failure to file a TDS return

Seeking Professional Help for Tax on Crypto in India

Crypto tax regulations are still evolving, and the process can be complex. Consider consulting a tax advisor or using a crypto tax calculator to ensure you comply with tax regulations and avoid any penalties. Tax on Crypto in India.

Frequently Asked Questions

1. What is the tax rate on crypto gains in India?

A flat rate of 30% is applied to profits earned from transferring virtual digital assets (VDAs), which includes cryptocurrency.

2. Do I need to pay tax if I receive crypto as a gift?

Crypto gifts exceeding ₹50,000 in a financial year from non-specified relatives are taxable under “Income from other sources” at a 30% rate. Gifts from specified relatives (parents, siblings, spouse, etc.) below ₹50,000 are exempt.

3. How much tax do I pay on cryptocurrency in India?

You pay a flat 30% tax on the capital gains (profits) earned from selling or transferring cryptocurrency in India. This tax applies under the “Income from other sources” category.

4. How to avoid tax on crypto in India?

There is no legal way to avoid tax on crypto gains in India. You are required to comply with the rules and pay the applicable taxes on the gains arising from crypto transactions.

5. How are airdrops taxed?

If the total fair market value (FMV) of all airdrops you receive in a financial year exceeds ₹50,000, the entire amount is taxable at 30%.

6. Can I offset crypto losses against other income?

No, currently section 115BBH of the Income tax act does not allow offset losses from crypto transactions against your other income sources while calculating your tax liability.

7. How do I report crypto gains/losses in my Income Tax Return (ITR)?

You need to report your crypto gains/losses under the new Schedule VDA introduced in the ITR forms.

8. Is there a tax deducted at source (TDS) for crypto transactions?

Yes, a 1% TDS applies to crypto purchases exceeding ₹10,000 (or ₹50,000 in specific cases) in a financial year. This TDS is deducted by the cryptocurrency exchange platform.

9. What if I do not pay crypto tax?

Non-payment of crypto tax can lead to penalties and interest charges, such as Under-reporting or misreporting income, Late filing of Income Tax return, Non-compliance with Tax Deducted at Source (TDS) obligations, and Failure to file a TDS return.

10. Will the crypto tax regulations change in the future?

The crypto tax regulations in India are relatively new and evolving. It is recommended to stay updated on official clarifications from the Income Tax Department. You can check all updates at FinanceFundaa.com also.

11. Should I consult a tax advisor for crypto tax filing?

Consulting a chartered accountant or tax advisor specializing in cryptocurrency taxation is highly recommended. They can provide personalized guidance based on your specific situation and help you navigate the complexities of crypto tax regulations.

Disclaimer: The information provided on this website is for general informational purposes only and should not be construed as financial advice, investment recommendations, or guarantees of any kind. This information is not intended as a substitute for professional financial advice. You should always seek the advice of a qualified financial advisor before making any investment or financial decisions.

![Cryptocurrency Taxation | Ultimate Guide to Tax on Crypto in India | [Updated 2024]](https://financefundaa.com/wp-content/uploads/2024/05/IRFC-Share-Price-Target-5.jpg)