What is Dividend?

Dividends, a portion of a company’s profit shared with shareholders. It is an addition to your investment portfolio. But before you start celebrating, it’s important to understand how dividend income is taxed.

Here’s a breakdown of the current tax rules in India:

Goodbye DDT, Hello TDS:

Previously, companies paid a Dividend Distribution Tax (DDT) on dividends they distributed. This system changed in April 2020. Now, the tax burden (Tax On Dividend Income) has shifted to the recipient, which is you, the investor.

Old Vs New Provisions for Taxability of Dividend Income

| Provision | Tax on Dividend Income |

| Old (Until March 31, 2020) | Exempt in the hands of the investor/shareholder. Companies paid dividend distribution tax (DDT) before disbursing dividends. |

| New (Effective April 1, 2020) | Taxable in the hands of the investor/shareholder at their marginal income tax rate. DDT liability on companies and mutual funds withdrawn. |

Tax on Dividend Income

- Companies and mutual funds are required to deduct Tax Deducted at Source (TDS) on dividend income exceeding Rs. 5,000 in a financial year.

- The current TDS rate is 10% (From 14 May 2020 until 31 March 2021, the rate was 7.5% due to COVID).

Also Check: Income Tax on FD Interest in India FY 24-25|Save Tax on Fixed Deposits

You May Like: IRFC Share Price Target 2024 | Fundamental and Technical Analysis

Explore Further: MRF Share Price 1990 to 2024: A Massive 45255.09% Return Journey

Tax on Dividend Income Example

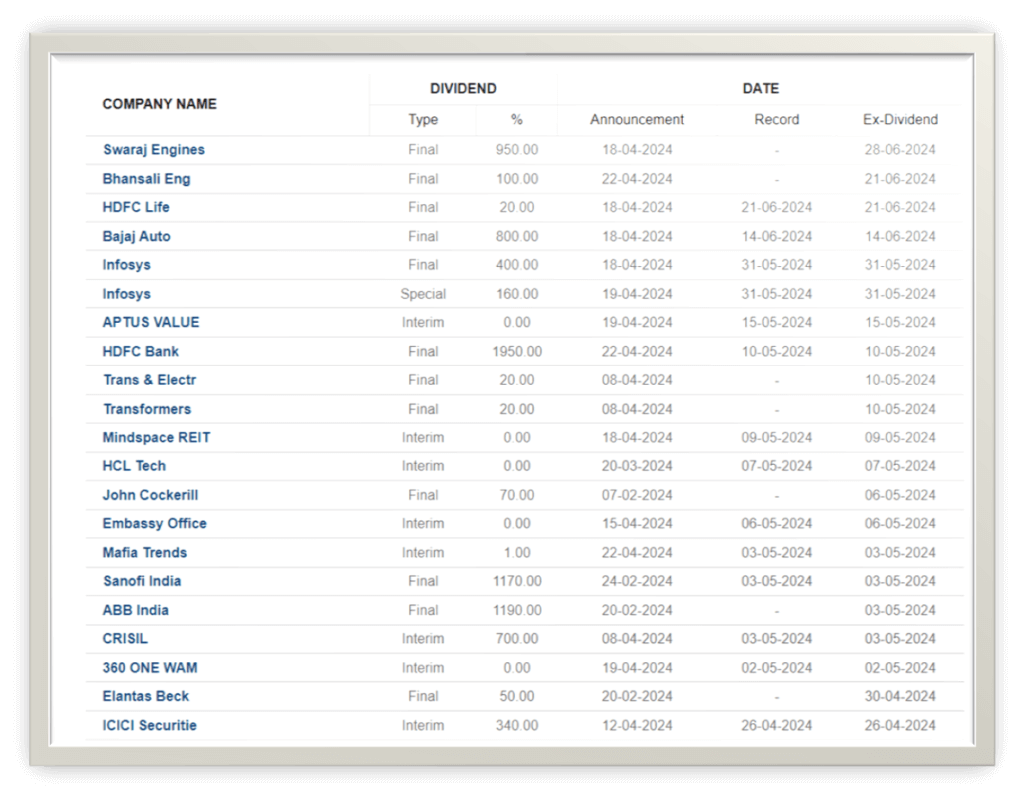

Don’t Miss a passive Income Source: Best High Dividend Stocks India 2024 | Dividend Stocks List

You can check complete Dividend Calendar Here.

Let’s assume Vipin got Rs 6,000 as a dividend from an Indian company in April 2024.

Since this amount is more than Rs 5,000, the company has to deduct tax before giving him the full amount. This tax is called TDS (Tax Deducted at Source).

Now, the company will deduct 10% of Rs 6,000, which is Rs 600 as TDS.

So, Ravi will actually receive Rs 6,000 (dividend) – Rs 600 (TDS) = Rs 5,400.

This Rs 5,400 that Ravi receives is considered his taxable income for the financial year 2024-25 (tax will be applied according to the tax rates for that year).

Deduction of Expenses from Dividend Income

When it comes to taxes on dividend income, Income tax allows you to deduct a limited amount of expenses.

- Allowed Deduction: You can deduct the interest you paid on any loans you took to invest in the shares that pay the dividend. There’s a maximum limit to get the deduction, which cannot be more than 20% of the total dividend income you received.

- Not Allowed Deductions: Any other expenses related to getting the dividend, like brokerage fees or advisor charges, cannot be deducted from your dividend income.

For instance, let’s say you received Rs 10,000 as dividend income and paid Rs 2,500 in interest on a loan for those shares. You can deduct only Rs 2,000 (20% of Rs 10,000) from your dividend income, not the entire Rs 2,500.

Important Points to Remember

- Dividend income is taxed at your marginal income tax rate. So, someone in a higher tax bracket will pay more tax on dividends compared to someone in a lower bracket.

- The Rs. 5,000 TDS exemption applies only to individual taxpayers. HUFs, firms, and companies don’t have this threshold.

- For non-resident taxpayers, the TDS rate is 20%, subject to any Double Taxation Avoidance Agreement (DTAA) with their country.

Dividend Received from Foreign Company

Dividends from foreign companies are generally considered taxable income in India. Here’s a simplified explanation:

- Taxes apply: The money you receive as dividends from a company outside India is subject to taxes in India.

- Tax rate: The tax rate depends on a couple of things:

- The country of the company paying the dividend

- Any tax treaty between India and that country

- Double taxation relief: You might have paid taxes on the dividend in the foreign country too. To avoid paying taxes twice (double taxation), India offers tax relief. This relief can come from:

- Double Taxation Avoidance Agreements (DTAAs) between India and the foreign country

- Section 91 of the Income Tax Act (if no DTAA exists)

Consulting a tax advisor is recommended to understand the exact tax treatment for your situation, considering the specific country and any applicable tax treaties.

How to Save Tax on Dividend Income?

Form 15G/15H: If you are a resident individual with annual income below the tax exemption limit (Rs. 2,50,000 for the old tax regime and Rs. 3,00,000 for the new tax regime) and senior citizens with no tax liability can submit Form 15G or 15H respectively. This helps avoid Tax Deducted at Source (TDS) on dividend income.

Expense Deduction: You can deduct a portion of the interest expense incurred for earning the dividend income. This deduction is capped at 20% of the total dividend income.

Planning for Tax Efficiency:

- Consider a tax-optimized investment strategy. Discuss this with a financial advisor to ensure your portfolio aligns with your tax goals.

- If you expect to be in a higher tax bracket in the future, you might want to reinvest your dividends to defer taxes.

Remember, this article provides a general overview. It’s advisable to consult a tax advisor for personalized guidance based on your specific situation and income level.

Frequently Asked Questions

How much tax will I pay on my dividend income?

The tax you pay on your dividend income depends on your total income and the applicable tax slab. However, a Tax Deducted at Source (TDS) of 10% is applicable at the time of receiving dividends if your dividend income exceeds Rs. 5,000 from a company or mutual fund. This deducted amount is credited towards your final tax liability when you file your Income Tax Return (ITR).

Are dividends taxable for individuals?

Yes, dividends are considered taxable income in India. If you buy and sell shares for trading purpose, then your dividend income will be taxed under the head of “income from business or profession.” If you hold shares for the investing purpose, then your dividend income will be taxed under the head of “income from other sources.

How am I taxed on dividend income?

Your dividend income is added to your other taxable income and taxed according to the income tax slab system applicable to you. For instance, if you fall under the 30% tax bracket, your dividend income will also be taxed at 30%.

How do I avoid dividend tax?

There’s no complete escape from dividend tax, but you can minimize the burden by submitting for 15G/15H, if applicable to you, claiming expense deduction, or by following dividend reinvesting strategy.

Are dividends taxed when declared or paid?

Dividends are taxable in the financial year in which they are credited to your account, irrespective of the declaration date.