Start Tradingview paper trading by logging in to use Paper Trading Tradingview. By default, your account balance starts at $100,000, which you can reset anytime. The chart has “buy/sell” buttons that let you enter orders quickly. You can buy any security that actually trades.

Key Highlights

Tradingview Paper Trading:

- Practice trading: Use virtual money to buy and sell various assets like stocks, futures, forex, and cryptocurrencies.

- Real-time data: Access live market data and charts for a realistic trading experience.

- Order types: Place different orders as in real trading, including market orders, limit orders, and stop-loss orders.

- Track performance: Analyze your trading history and identify areas for improvement.

How to Start Paper Trading TradingView:

- Create a free TradingView account.

- Access the Trading Panel at the bottom of any chart.

- Connect to Paper Trading.

- Adjust your virtual balance (optional).

- Start placing trades using the Buy/Sell buttons or the right-click menu.

- Monitor your trades and performance in the Trading Panel.

Trading Panel:

- Place orders with Buy/Sell buttons or choose various order types.

- Monitor account information like balance, equity, and P&L.

- Manage open positions and view trading history.

- Customize the Panel and add features like Depth of Market.

Paper Trading vs. Live Trading:

- Risk: No risk in paper trading; real money at stake in live trading.

- Market Dynamics: Simulated or delayed data in paper trading; real-time market fluctuations in live trading.

- Psychological Impact: No emotional pressure in paper trading; potential for fear and greed in live trading.

- Learning Curve: Safe environment for learning in paper trading; requires experience and discipline in live trading.

What is Paper Trading?

In TradingView, Paper Trading is a feature that allows you to practice trading various securities like stocks, futures, forex, and cryptocurrencies with virtual money. It provides access to real-time data where you can test your trading strategies and enhance your trading skills without risking any real capital.

Features:

Virtual balance: You start with a pre-defined virtual balance (usually $100,000) that you can use to place trades.

Live market data: You have access to live market data and charts, just like real trading, which provides a realistic trading experience. Check How to Invert Chart in TradingView | 3 Quick Methods

Order types: You can place various order types, including market orders, limit orders, and stop-loss orders, just like in real trading.

Trading history: You can track your trading history, analyze your performance, and identify areas for improvement.

Also Check: 7 Best Youtube Channels For Trading in Stock Market

Why Choose Paper Trading on TradingView?

There are several compelling reasons to choose paper trading on TradingView over other alternatives:

Platform Integration:

Seamless Trading Experience: TradingView paper trading is directly integrated into the platform’s advanced charting and analysis tools. This means you can easily test your strategies on the same charts and indicators you’d use in real trading, offering a familiar and convenient experience.

Wide Variety of Assets: You can practice trading various instruments, including stocks, futures, forex, and cryptocurrencies, all within the same platform. This versatility allows you to explore different markets and find your niche.

Advanced Order Types: TradingView paper trading supports diverse order types like market orders, limit orders, stop-loss orders, and trailing stops, allowing you to practice sophisticated trading techniques without risk.

Key Benefits of Paper Trading with TradingView

Risk-free practice: You can explore different markets and trading techniques without fear of losing real money. This is especially helpful for beginners who want to get comfortable with the platform and understand market dynamics before venturing into live trading.

Strategy testing: You can put your trading strategies to the test in real-time market conditions and see how they perform. This allows you to refine your strategies and identify any weaknesses before risking real capital.

Emotional control: Without the pressure of real money involved, you can learn to manage your emotions and make rational trading decisions, which is crucial for successful trading in the long run.

Top 7 Paper Trading Apps in India For Stocks And Option Trading

How to Start Paper Trading on TradingView?

Starting paper trading TradingView is a simple and straightforward process. Here’s how you can get going:

Account Setup:

1. Create a TradingView Account:

If you haven’t already, sign up for a free TradingView account. You can choose the basic free plan for Paper trade tradingview.

2. Access the Trading Panel:

Once logged in, see the bottom of any chart. You’ll see a horizontal bar called the “Trading Panel.”

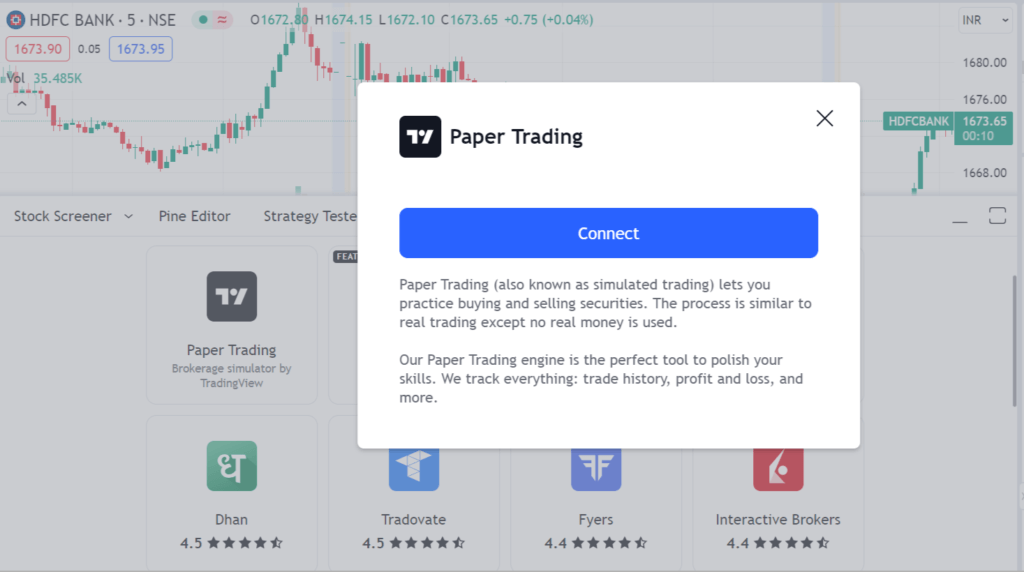

3. Connect to Paper Trading:

Click on the “Trading Panel” and select “Paper Trading” from the brokers list.

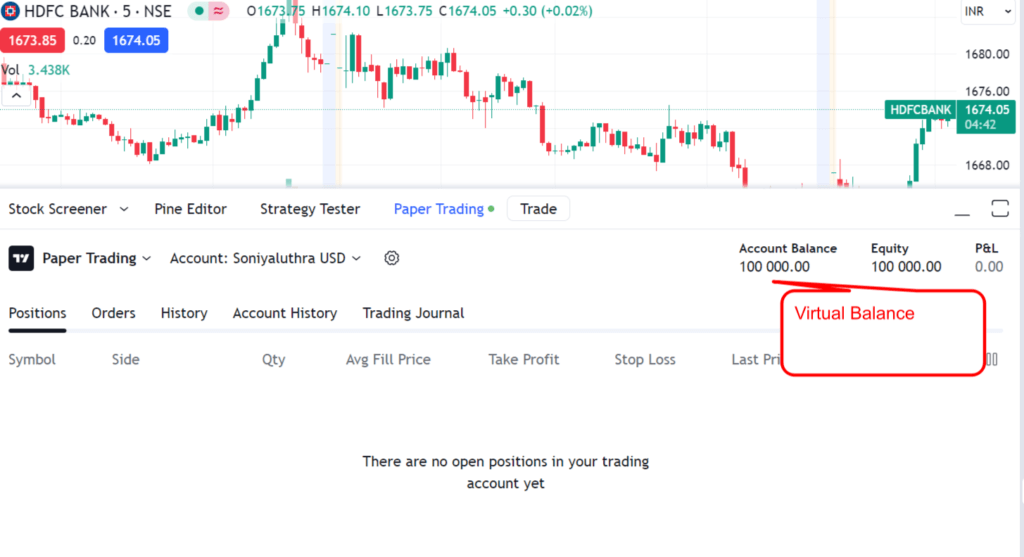

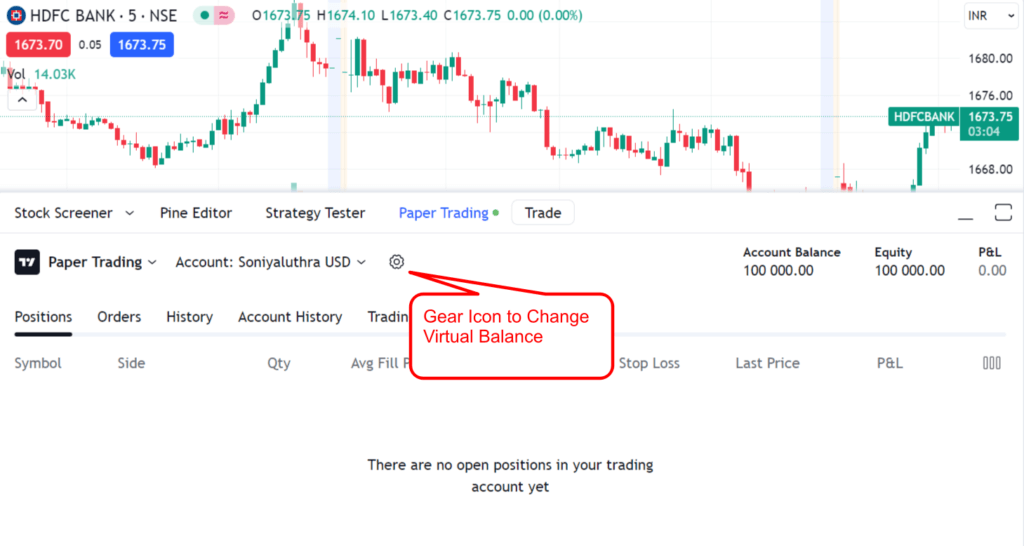

4. Adjust your Virtual Balance (Optional):

By default, the Tradingview paper trading account provides a balance of $100,000 (virtual balance for paper trading Tradingview). You can change this amount by clicking the gear icon in the “Trading Panel” and selecting “Reset Paper Trading Account.”

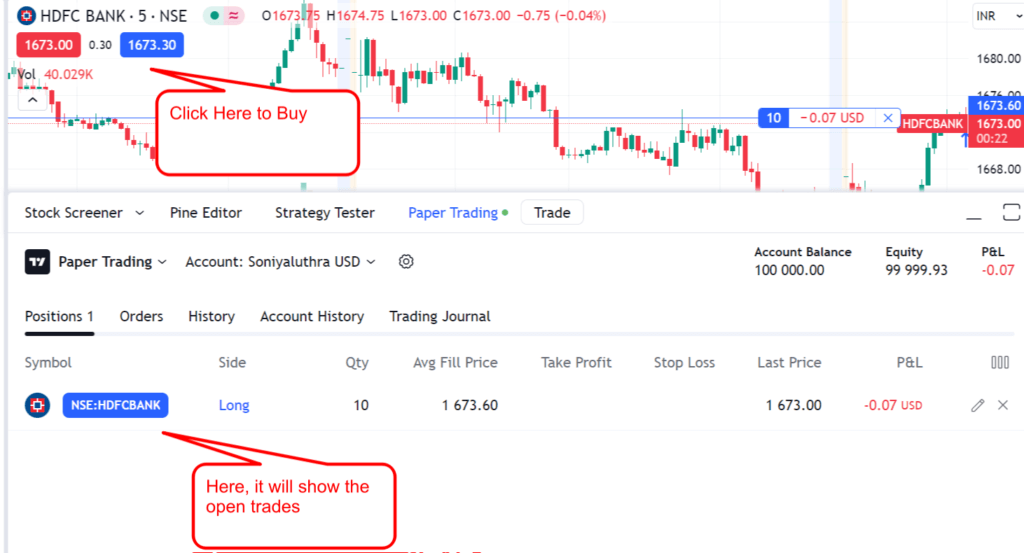

5. Start Placing Trades:

You can place trades directly from the chart! There are two ways:

- Buy/Sell Buttons: These buttons appear on the chart by default. Click “Buy” or “Sell” to buy shares.

- Right-click Menu: Right-click anywhere on the chart and select “Buy” or “Sell” from the context menu. This lets you specify the order type (market, limit, etc.) and price.

6. Monitor your Trades:

The “Trading Panel” displays your open positions, orders, account balance, and P&L (profit and loss) in real-time. You can manage your trades through this panel as well.

The Trading Panel of Paper Trading Tradingview

The Trading Panel in TradingView paper trading is vital in managing your virtual trades and monitoring your portfolio performance. Here’s a breakdown of its key features:

Order Placement:

Buy/Sell Buttons: These buttons allow you to enter long (buy) quickly or short (sell) positions with a single click.

Order Types: You can choose various order types for more precise control over execution. Market orders execute immediately at the best available price, while limit orders specify a desired price at which you’re willing to buy or sell.

Position Size: Specify the quantity of the asset you want to buy or sell. You can choose units (for stocks or ETFs) or dollar amounts (for currencies).

Account Information:

Balance: This displays your current virtual account balance. It is the sum of your open positions’ values and available cash.

Equity: This represents the total value of your portfolio, including unrealized gains or losses from open positions.

P&L (Profit/Loss): This shows your overall profit or loss on all closed positions since you started trade. You can also see individual P&L for each closed trade.

Open Positions:

List: This section displays your currently open positions, including the asset symbol, quantity, average price, current price, unrealized P&L, and percentage change.

Close Buttons: For each position, you’ll find buttons to quickly close it at the market price or open the order window for more granular control.

Additional Features:

Trading History: Access a list of all your executed trades, with details like timestamps, order types, prices, and P&L.

Settings: Customize the Trading Panel by adjusting the displayed information, adding additional tools like the Depth of Market, and configuring hotkeys for faster order placement.

Difference Between Paper Trading and Live Trading

| Feature | Paper Trading | Live Trading |

| Risk | No real money at stake | Real money at stake, risk of financial loss |

| Market Dynamics | Simulated or delayed data, may not reflect real-time market | Real-time market fluctuations and complexities |

| Psychological Impact | No emotional pressure, easier to take risks | Emotional responses like fear and greed can influence decisions |

| Learning Curve | Safe environment to learn and experiment | Requires experience and emotional discipline |

| Overall | Ideal for beginners to practice and gain confidence | Ultimate test of skills and emotional control |

If you want to start with real trading, then you must check my views on Zerodha: Zerodha Reviews 2025: Is Zerodha Good For Beginners In India? Honest Review

Test Drive with TradingView Paper Trading Before You Invest

Imagine buying a new car without taking it for a spin. In trading, that’s akin to investing real money based on a strategy you haven’t tested. The good news? You can practice driving different approaches before hitting the real market road!

Think of it like a video game for your finances. Try out various strategies in a risk-free demo account offered by most brokers. This lets you:

Play with virtual money: No sweat, no tears, just pure experimentation.

Get comfortable with the platform: Learn the tools and buttons before trading with real cash.

Test different strategies: From trend following (riding market waves) to swing trading (catching short-term swings) to mean reversion (buying dips and selling peaks), experiment and see what clicks for you.

Popular Trading Strategies to Start with Paper Trading Tradingview

Here’s a sneak peek at some popular trading strategies:

Trend following: Like surfing a wave, you buy assets on an upward trend and hold on for the ride. Think of spotting companies in fast-growing sectors like renewable energy.

Swing trading: Picture yourself as a pit stop mechanic for stock prices. You buy assets during temporary dips and sell when they bounce back. Imagine finding a promising tech stock that dipped after a bad earnings report but has strong long-term potential.

Mean reversion: Have you ever seen a pendulum swing? Mean reversion is like that. You buy assets that have fallen sharply, betting they’ll eventually swing back toward their average price. Think of a blue-chip stock that took a hit due to market panic but has solid financials.

Read More: 5 Best Indicators for Intraday Trading in TradingView Free

Remember, every strategy has its own risks and rewards. The key is to find one that fits your personality and risk tolerance.

Bonus tip: Don’t just blindly follow any strategy. Understand its logic, adjust it to your preferences, and track its performance in the demo account. Only then should you consider taking it to the real market.

Conclusion Tradingview Paper Trading

Remember, paper trading is a valuable learning tool, but it doesn’t replicate the emotional and psychological aspects of real trading. Use it to practice and refine your skills before venturing into live trading.

Frequently Asked Questions

How Do I Set Paper Trading In Tradingview?

Open a chart.

Open the bottom Trading Panel.

Select “Paper Trading” from the broker.

Does Tradingview Paper Trading Have Options?

Yes, TradingView paper trading does have options! You can trade various options contracts on the platform, including calls, puts, spreads, and more. This makes it a great way to practice options trading strategies without risking any real money.

Is Tradingview Paper Trading Real?

Paper trading simulates real market conditions but uses virtual money, so it’s not real in terms of financial risk.

How To Enable Paper Trading In Tradingview

Open any chart in TradingView.

Look for the Trading Panel at the bottom of your screen.

In the broker list, select “Paper Trading”. You can now paper trading with $100,000 virtual currency. You can reset your balance anytime and experiment with different trading strategies safely.

How To Use Paper Trading In Tradingview Mobile App

Paper trading is currently not available on the TradingView mobile app.

How to automate paper trading in Tradingview?

Automated trading (bots) are not allowed in TradingView paper trading.