Are you also confused about the roles of Trigger Price and Stop Loss Price? What is the relation between these two prices? Which one you should set for your trades?

It is like Enter the stop-loss order, it acts as your safety net in the volatile trading. But within this order lies two different prices: the trigger price and the stop price. But, wait! what actually these prices indicate? Don’t worry, this guide will help you understand the relationship between Trigger Price and Stop Loss Price and make you confident to use them effectively!

What is Stop Loss?

A stop-loss order is a future order that traders place with a broker to automatically buy or sell a security once it reaches a certain price level. It is also known as the “stop price”, “stop order,” or “stop market order.”

Benefits of Stop Loss Order

- It can help you limit your losses in a volatile market.

- You can use them to secure your profits while allowing for further upside movement.

- It helps you automate your trading and encourages disciplined trading.

How Stop Loss Works in Stock Market

Here’s an example of how a stop-loss order works in practical trade:

Scenario:

- You buy 100 shares of a stock for $50 each. Your total investment here is $5,000.

- You believe the stock price will go up to $60, but you are also concerned that the stock price may fall.

- You decide to set a stop-loss order at $45, which is 10% below your purchase price.

Outcome:

- If the stock price increases, your stop-loss order will not be activated. So, you can hold your shares and book profits until you reach your target price for gains.

- However, if the stock price falls to $45 or below, your stop-loss order will be activated, and your shares will be automatically sold. Here, your loss will be limited to $5 per share, or $500 total, on your investment of $5,000.

Two Price Components to A Stop Loss Order

The stop-loss (SL) order consists of two price components:

- The stop-loss price is also known as the stop-loss limit price.

- The stop-loss trigger price is known as the trigger price.

Let’s understand Trigger price meaning in stop loss order

What is Trigger Price

The trigger price in a stop-loss order is the specific price at which traders/investors buy or sell orders become active and are sent to the exchange for execution. It works like a threshold; your stop loss order only becomes active when the market price crosses this threshold, either above or below the stop-loss price.

How Trigger Price Works in Stock Market

- Let’s say you buy a stock at Rs. 100 and you want to limit your loss if the share price starts falling. So, here you can set the sell stop-loss order with a trigger price of Rs. 95.

- If the stock price increases and stays above Rs. 95, your stop-loss order remains inactive.

- But if the price falls to Rs. 95 or below, the trigger is activated and your stop-loss order is sent to the exchange.

- Your selling order will then be executed at the current market price, which could be Rs. 95, Rs. 94.50, or even lower, depending on the current bids going on in the market for the share.

Other Interesting Blog Posts to Read with Trigger Price Meaning:

What Is TBQ and TSQ In Share Market | Best Answer and Example

Short Build Up Meaning In Stock Market | Caution or Reward?

Long and Short Unwinding Meaning In Stock Market

What is CE and PE in Option Trading? Practical Examples

What is the Relation Between Trigger Price And Stop Loss Price?

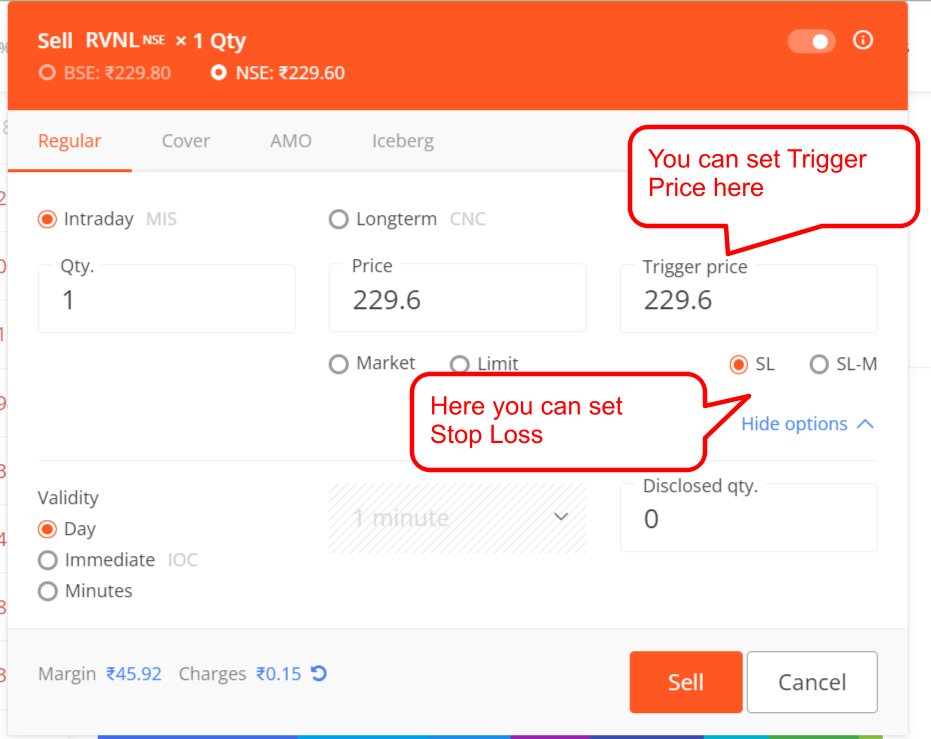

Image Credit: Zerodha Kite

Trigger Price:

- The trigger price is the price level at which a stop-loss order becomes active. Once the market price of a share reaches or breaches the trigger price, the stop-loss order is sent to the exchange for execution.

- It acts as a threshold or alert that tells the trading platform to watch for the next price movement.

Stop-Loss Price:

- The stop-loss price is the specific price at which the stop-loss order is intended to be executed. It is the maximum loss a trader wants to accept.

- Once the trigger price is activated, the stop-loss order becomes a market order if no limit price is specified. This means the order will be executed at the best available price in the market.

- In some cases, traders may use a stop-limit order, which combines a trigger price with a limit price. The limit price ensures that the order is only executed at a price equal to or better than the specified limit.

In simpler terms:

- Imagine the trigger price as an alarm that goes off when the price reaches a certain level.

- The stop-loss price is the predetermined price level at which you want to sell your shares to avoid further losses.

What is the Limit Price in Stop Loss?

The limit price is the maximum or minimum price that a trader/investor is willing to buy or sell the share.

- For buy orders: the limit price is the highest price you want to pay. If the market price never reaches or falls below the limit price, your order won’t be executed.

- For sell orders: the limit price is the lowest price you want to accept. If the market price never reaches or rises above the limit price, your order won’t be executed.

What Is the Relationship Between Trigger Price and Limit Price?

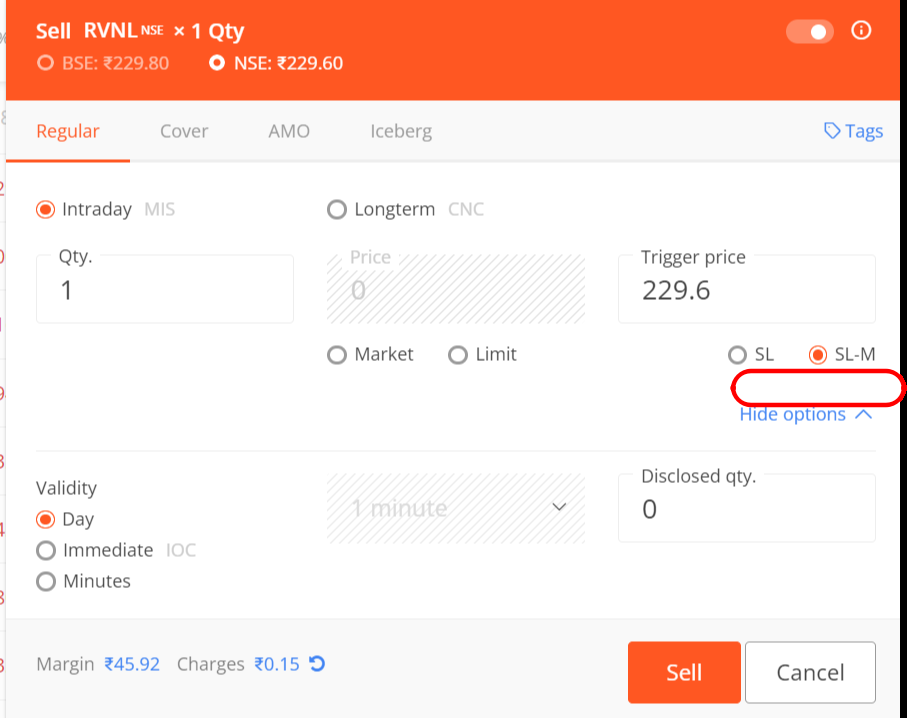

The trigger price and limit price work together in stop-loss orders. There are two main types of stop-loss orders:

- Stop-loss (SL): Here, the trigger price and the limit price are the same. Once the price hits the trigger, the order becomes a market order. It means it will be executed at the best available price in the market.

- Stop-loss limit (SL-L): Here, the trigger price and the limit price are different. Once the price hits the trigger, the order becomes a limit order. It means it will only be executed at a limit price or better.

Example Of Trigger Price and Limit Price

- Let’s say you buy shares at Rs. 100. You want to limit your loss if the price falls.

- You could set a stop-loss order with a trigger price of Rs. 95 and a limit price of Rs. 90.

- In this case, if the price falls to Rs. 95, the order would be triggered and converted into a limit order to sell at Rs. 90 (or better).

- However, if the price falls rapidly and goes straight to Rs. 85, your order won’t be executed because it won’t meet your minimum price requirement of Rs. 90.

Frequently Asked Questions

What is stop-loss and trigger price example?

A stop-loss order is a safety measure used in trading to automatically sell (or buy) a security when it reaches a specific price, limiting potential losses. The trigger price is the critical price point at which your stop-loss order becomes active.

What is the trigger price for a stop-loss limit order?

The trigger price for a stop loss limit order acts as a signal. It is not a guaranteed execution price. It triggers the order activation, however, the actual execution price depends on the market conditions when the trigger is hit.

What is the difference between a stop trigger and a limit price?

The difference between a stop trigger and a limit price is a stop trigger acts as an alarm clock. It activates the order when the market price reaches a specific point. But you still need to decide what to do after triggers like market order, or limit order, whereas limit price acts as a budget. It tells you how much piece you want to pay for a stock, regardless of its current price.

What is a triggered stop-loss?

A triggered stop-loss means the stop-loss order after its trigger price has been reached or crossed by the market price. In simple words, the order has been activated and is now waiting for execution by the stock exchange.

While travelling I was planning to ask you about difference between stop loss and trigger price. But I think you are not only finance expert rather an astrologer too.

Thanks for all the clarity.

Thanks a lot Vinay! Hope you found it useful.