Choose the topic of your interest

ToggleKey Highlights Vested vs INDmoney

Investment Options:

- Focus: Vested focuses on US stocks and ETFs, while INDmoney offers a wider range including Indian equities, mutual funds, and US stocks.

- Fractional Shares: Both platforms offer fractional shares for US stocks, making investing accessible with smaller amounts.

Fees and Charges:

- Account Opening: Vested charges fees for both basic and premium plans, while INDmoney has no account opening fees.

- Annual Maintenance: Both platforms have no annual maintenance charges.

- Brokerage: Vested’s brokerage is slightly higher than INDmoney’s for US stocks.

- Withdrawal: Vested has a fixed withdrawal fee, while INDmoney charges only for withdrawals below $2,000.

Platform Focus:

- Vested: Purely investment-focused and offers basic order types and research tools

- INDmoney: Comprehensive financial management platform including budgeting, tracking, family finance tools, and neo-banking features like virtual debit cards with investing as a core feature.

Let’s have in depth analysis of Vested vs IndMoney !!

You May Like: Top Ayodhya Stocks: 9 Stock Picks Across 3 Key Sectors to Watch

Vested vs INDmoney; Which is Best?

Vested: Investors primarily interested in US stocks, prioritizing low fees for US trades, and not needing additional financial management tools.

INDmoney: Investors wanting more investment variety, preferring fractional shares for US stocks, and seeking additional financial planning and management features.

What Is Vested Finance?

Vested Finance is a popular investment platform for Indian investors that allows users to invest in US stocks and ETFs and alternative investment options like P2P lending and INR bonds.

Key Features of Vested Finance:

1. Focus on US markets (Fractional Investing): Vested makes it easy for Indian investors to access the US stock market, even with small amounts of money. They offer fractional shares, so you don’t have to buy a whole share of a stock if you can’t afford it.

2. Alternative investments: Vested also offers a variety of alternative investment options, such as P2P lending and INR bonds, which can help you diversify your portfolio and earn higher returns.

3. Easy to use: Vested has a user-friendly platform that makes investing accessible, even for beginners. They also have a helpful customer support team that can answer your questions. Vested vs Indmoney

4. Low Capital: Start investing as low as ₹1, making it accessible even for those with limited capital.

5. Regulatory Compliance: Vested Vested Finance Inc. is registered with the Securities and Exchange Commission (SEC). The company has all necessary licenses and regulatory approvals, ensuring security and reliability.

Also Check: Can I Invest In US Stock Market From India Using Zerodha?

Who Can Invest With Vested?

Indian residents: Access US stocks, ETFs, P2P loans, and INR bonds.

Non-Resident Indians (NRIs): Invest in US stocks and ETFs with additional documentation requirements.

What Is Indmoney?

INDmoney is a “Super Finance App” that combines features for investing, saving, planning, and managing your and your family members in one platform. The app is a one-stop shop for all your financial needs.

Key Features:

Investing:

- Invest in Indian stocks, mutual funds, and US stocks.

- Open a free Demat account with zero account maintenance charges.

- Set up free SIPs (Systematic Investment Plans) for Indian stocks and mutual funds.

- Invest in fractional shares of US stocks.

Saving:

- Create savings goals and track your progress.

- Open fixed deposits with various banks and compare interest rates.

Planning:

- Use calculators to plan for goals like retirement or child education.

- Track your net worth and liabilities.

Family Finance:

- Manage finances for your entire family in one place.

- Create shared goals and track progress together.

- Invest and track investments for other family members.

Other features:

- Neo-banking features: Get a virtual debit card, pay bills, and transfer money.

- Financial Tracking & Management: Track your income, expenses, and investments across different accounts all in one place. Vested vs Indmoney.

- Tools & Calculators: Utilize various financial tools and calculators for planning, budgeting, and goal setting.

For an in-depth look at their secure platform, check out our INDmoney app reviewarticle!

Also Check: INDmoney Insta Cash Reviews

Vested Vs Indmoney : Quick Comparison

Here’s a table summarizing the quick comparison of Vested and Indmoney:

Feature | Vested Finance | INDmoney |

Focus | US Stocks & ETFs | US & Indian Investments |

Fractional Shares | Yes | Yes |

Account Opening Fees | Account opening fee for basic plan is Rs. 250 and Premium plan is Rs. 375 per month | No Account opening fee |

AMC | Zero | Zero |

Brokerage | 0.20% of trade amount, with a maximum of $20. | 0.15% of trade value |

Minimum Investment | None | None |

Withdrawal Fee | Vested: A fixed $5 fee per withdrawal transaction. | Withdrawal below $2,000 – $5 and Withdrawal above $2,000 – No charges |

Investment Security | US SIPC insurance up to $500k | Depends on ICICI Securities |

Data Security | Limited data handling | More data collected for broader features |

Additional Features | Basic order types only | Budgeting, tracking, family finance tools |

Platform Focus | Investment-only | Comprehensive financial management |

Best for | Investors who primarily want US stocks, prioritize low fees for US trades, and don’t need additional financial management tools | Investors who want more investment variety, prefer fractional shares for US stocks, and want additional financial planning and management features |

Website |

Read a detailed analysis of INDMoney Charges | Is IndMoney Free in 2024? The Truth About Hidden

Vested Vs Indmoney: Investment Options

When comparing Vested and Indmoney for investment options, there are some key differences to consider:

Types of Investments:

Vested:

- Offers only US stocks. You can buy and sell whole shares of popular US companies like Apple, Tesla, Amazon, etc. You can also buy US shares in a fraction.

Indmoney: Offers a broader range of investment options:

- Indian equities: Invest in individual stocks across Indian exchanges.

- Indian mutual funds: Choose from a curated selection of mutual funds across various categories.

- US stocks: Similar to Vested, you can buy and sell whole shares of US companies.

- Fractional US stocks: Buy a portion of a share in popular US companies, making it accessible with smaller investments. Vested vs Indmoney.

- Fixed deposits: Invest in fixed deposits from multiple banks and compare interest rates conveniently.

Variety and Flexibility:

- Vested: Offers a wider selection of US stocks than Indmoney’s US stock options. However, it needs more diversity as you’re limited to US equities.

- Indmoney: Provides more flexibility with diversified investment options across Indian and US markets, catering to short-term and long-term financial goals.

Additional Features:

- Vested: Primarily focuses on US stock investing and offers research tools and market insights.

- Indmoney: Offers a broader financial management platform with features like goal-based planning, budgeting tools, and family finance management. Vested vs Indmoney.

Don’t Trade Blindly! Read the Updated Indmoney vs. Zerodha Review Now.

Vested Vs Indmoney: Fees And Brokerage Charges Comparison

Here’s a comparison of fees and brokerage charges between Vested and Indmoney:

Account Opening and Maintenance:

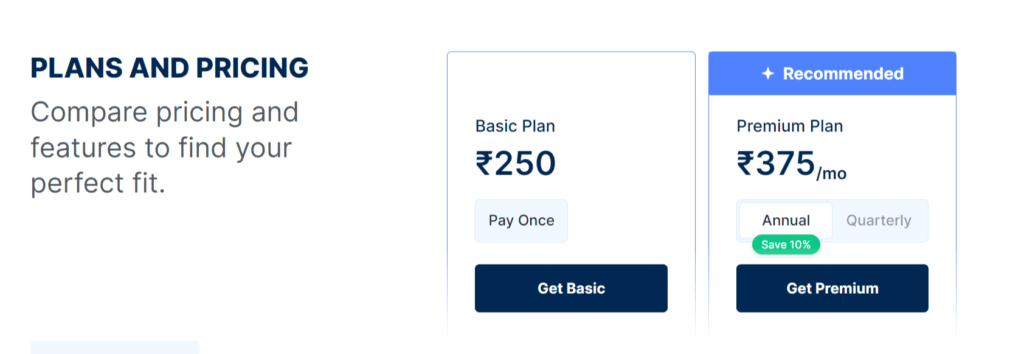

- Vested: The account opening fee for the basic plan is Rs. 250, and the Premium plan is Rs. 375 per month. Vested doesn’t have any annual maintenance charges. Also, there is no minimum balance required to maintain your Vested account. Indmoney vs Vested.

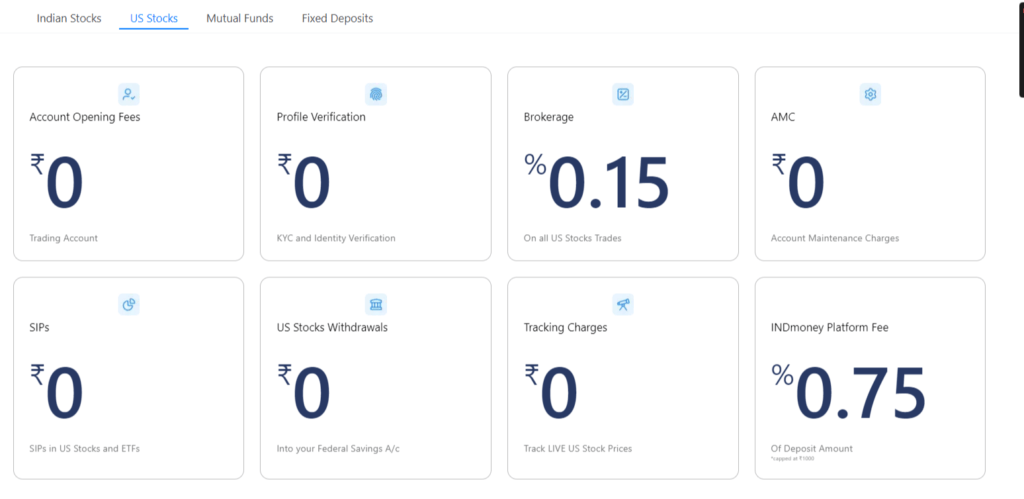

- Indmoney: Free account opening and no annual maintenance charges for the Demat account. Also, there are no charges for buying U.S. Stocks and ETFs.

Trading Fees:

Vested:

- US stocks Brokerage: 0.20% of trade amount, with a maximum of $20.

- Invest in OTC securities (Crypto funds, European companies): $0.10 per share (Min. $0.75, Max: 1% of order value)

Indmoney:

- Indian equities Brokerage: 0.05% of trade value or Rs. 20, whichever is lower.

- F&O brokerage: Rs. 20 per executed order.

- Mutual Funds: Zero account opening, zero AMC, and Zero commission.

- US stocks Brokerage (whole shares): 0.15% of trade value.

Withdrawal Fees:

- Vested: A fixed $5 fee per withdrawal transaction.

- Indmoney: Withdrawal below $2,000 – $5 and Withdrawal above $2,000 – No charges

Vested vs INDmoney: Which is Safe?

Both Vested and INDmoney are considered safe platforms for Indian investors to access US stocks. Here are their:

Regulatory Safety Highlights for Vested: Vested is generally considered safe for investing. Here are quick reasons:

- FINRA-registered broker-dealer: Vested is registered with FINRA, the top regulatory body for US brokers and dealers. This means they operate under strict financial regulations and oversight.

- SIPC insurance: Your US securities held through Vested are insured by the Securities Investor Protection Corporation (SIPC) for up to $500,000 in securities and $250,000 in cash, offering protection against broker failure. Vested vs Indmoney.

- Partner with DriveWealth: Vested partners with DriveWealth, a reputable US broker-dealer, to hold your US investments in your name, not Vested’s. This provides an additional layer of security.

Regulatory Safety Highlights for IndMoney: Investing via INDmoney is generally considered safe:

- SEBI-registered: INDmoney is registered with the Securities and Exchange Board of India (SEBI), providing basic regulatory oversight.

- US investments held by partner: They hold US investments through ICICI Securities, an established Indian broker, adding an extra layer of risk compared to direct ownership. Vested vs Indmoney.

- Data privacy concerns: INDmoney collects more data than Vested due to its wider feature set, potentially raising privacy concerns for some users. Indmoney vs Vested.

Security Features:

- Data Encryption: Both platforms use industry-standard data encryption methods to protect user information.

- Two-factor Authentication: Both offer two-factor authentication for added security to your account.

- Compliance: Both platforms comply with relevant US regulations for security and investor protection.

Potential Concerns Should be Considered

Vested Finance

- Focus on US markets: If you’re primarily interested in Indian investments, Vested might not be the best fit.

- Newer platform: Founded in 2019, Vested is relatively new compared to INDmoney. Although there is no issue, it may still raise concerns for some users. Vested vs Indmoney

- Limited platform features: Vested mainly focuses on US stock and ETF investing, lacking the broader financial management tools INDmoney offers.

IndMoney

- Investment security model: While regulated by SEBI, INDmoney holds your Indian investments with their partner broker, ICICI Securities. This introduces an additional layer of counterparty risk compared to Vested’s SIPC-insured model for US assets.

- Data handling concerns: Given INDmoney’s wider range of features, they likely collect and store more user data than Vested, which raises privacy concerns for some users. Vested vs Indmoney

Overall Vested vs Indmoney:

It’s difficult to definitively say which platform is “safer” as both offer adequate security and regulatory compliance. Ultimately, the “safer” platform depends on your priorities:

- Vested might be a better choice if data privacy and US investment security are paramount.

- If you prefer a comprehensive financial platform with broader functionalities, INDmoney could be more suitable.

Vested vs IndMoney Plans & Pricing

Conclusion Vested Vs Indmoney: Which Is Better For You for US Stocks?

Choosing the right platform between Vested vs Indmoney depends on your investment goals and priorities:

Vested might be a good fit if you are primarily interested in investing in US stocks and prefer a simple platform.

If you want more variety and flexibility, including the ability to invest in Indian markets and use additional financial management tools, Indmoney could be a better choice. Indmoney vs Vested.