BO ID means Beneficial Owner Identification Number. It’s a unique 16-digit code to identify your Demat account within the Central Depository Services (India) Limited (CDSL).

Key Highlights

- BO ID in Groww: Stands for Beneficial Owner Identification Number, your unique 16-digit demat account number registered with CDSL.

- Structure: First 8 digits are your DP ID (broker/platform) and last 8 are your Client ID.

- Importance: Identifies you as the owner of demat securities in Groww. Used for selling stocks, transferring shares, accessing account info.

- Finding BO ID in Groww App:

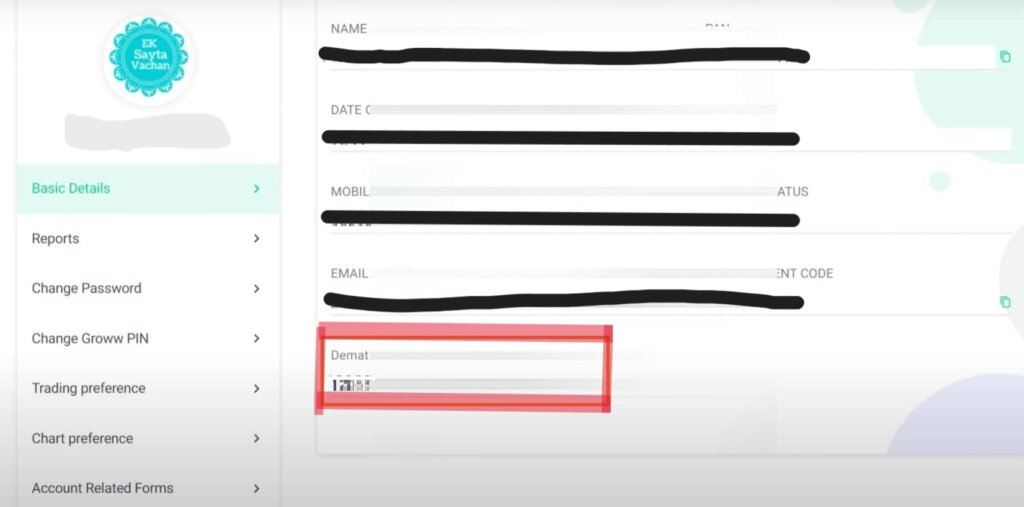

- Login > Click photo icon/Tap “You” icon > “Personal Details”.

- Under “Demat Account,” find your 16-digit BO ID.

What is BO ID in Groww?

BO ID in Groww is your 16-digit Demat account number registered with the Central Depository Services India Limited (CDSL). It’s unique to each broker/platform.

BO ID has 2 parts:

- First 8 digits DP: Depository Participant (DP) ID. It indicates the broker or financial institution that opened your Demat account. DP is same for all the individuals having Groww Demat account.

- Last 8 digits Client ID: It is assigned specifically to you by your DP. Client ID is unique for individual.

Importance of BO ID

Your BO ID is a unique identification number in the dematerialized security holding system. It’s used for various purposes, including:

- Selling stocks: When you sell shares on Groww, you’ll be asked to enter your BO ID and an OTP (that you receive on your registered mobile number) for verification purposes.

- Transferring shares: If you want to transfer shares from another broker to Groww, you’ll need to provide your BO ID and other details.

- Accessing account information: Some other platforms or services within the Indian financial system might require your BO ID to access your Demat account information related to Groww.

How To Find BO ID In Groww In Groww App?

- Log in to your Groww account using your registered email ID or mobile number and password.

- Click on the photo icon at the top right corner of your mobile or computer screen. Tap on the “You” icon at the bottom right corner of the app.

- Select “Personal Details” option.

- Under the “Demat Account” section, you’ll find your 16-digit BO ID of Groww.

Other Groww Related Answers

How To Know My BO ID Groww?

You can simply follow the above procedure to know your BO ID in Groww. Please note that:

- It’s a 16-digit number unique to your Groww demat account.

- Keep your BO ID confidential and only share it for authorized transactions.

- If you still can’t find your BO ID, you can contact Groww’s customer support. They can help you to find BO ID in Groww.

What is BO ID in CDSL?

BO ID stands for Beneficial Owner Identification Number. It’s a 16-digit unique number that serves as your Demat account number within the Central Depository Services (India) Limited (CDSL). Here are few things that you should know about BO ID in CDSL:

- Key Identifier: It identifies you are the rightful owner of the securities held in your CDSL Demat account.

- Importance for Transactions: It’s required for various activities related to your Demat account, including:

- Buying and selling securities

- Participating in IPOs

- Receiving dividends and interest

- Transferring securities

- CDSL Linkage: It links your Demat account with the CDSL to ensure the security and centralized holding of your electronic securities.

- Confidential Number: Similar to a bank account number, it’s important to keep your BO ID confidential and only share it with authorized entities for legitimate transactions.

How do I Find My DP ID and client ID in Groww? (3 Methods)

As we explained above that DP ID and Client ID combinedly means BO ID in Groww. So, you can follow the below procedure to know your DP ID and Client ID in Groww:

Method 1. Using the Groww App

- Open the Groww app and log in.

- Tap the “You” (Profile Picture) icon at the bottom right.

- Select “Personal Details.”

- Under “Demat Account,” you’ll find:

- DP ID: It’s the 16-digit number displayed, starting with 12088700.

- Client ID: The last 8 digits of the DP ID are your client ID.

Method 2. From Account Opening Documents

- Check your email inbox for Groww account opening confirmations or statements.

- Review the Client Master Report (CMR) you received during Groww Account Opening process.

- If you opened your Groww account with Zerodha, check your Zerodha demat account details.

3. Contacting Customer Support

- Call Groww’s customer support at 91-9108800604, for assistance.

- They can provide your DP ID and client ID over the phone or email.

Conclusion

Your BO ID in Groww is your unique 16-digit Demat account number, serving as a key identifier and access point for managing your dematerialized securities. Understanding its meaning, structure, and importance empowers you to confidently navigate various transactions and interactions within the Indian financial system.

Remember, your BO ID is as crucial as your bank account number. Protect it diligently and only share it when necessary for authorized activities related to your Groww Demat account. If you ever encounter any difficulty locating or managing your BO ID, Groww’s customer support is readily available to assist you.

Disclaimer: The information provided on this website is for general informational purposes only and should not be construed as financial advice, investment recommendations, or guarantees of any kind. This information is not intended as a substitute for professional financial advice. You should always seek the advice of a qualified financial advisor before making any investment or financial decisions.