When I started trading in the stock market. I was too confused: what is CE and PE in option trading?

Okay, a quick answer, the terms CE and PE in option trading means: CE refers to a call option, and PE to a put option.

For a moment I remember but the next moment when I open my Zerodha Trading Account, I get confused. What should I buy, CE or PE? When should I buy CE or PE? There are always lots of questions in a beginner’s mind when he/she enters into options trading.

So, to help you out, I tried to make the concept of What is CE and PE in Option Trading easy. I have also explained when and how to use CE and PE in option trading with examples.

In case you need an honest review about Zerodha, you can check here.

PE and CE in Option Trading

What is CE in Stock Market?

CE in the stock market means call option. It is a financial contract that gives the holder the right, but not the obligation, to buy a specific quantity of an underlying asset (such as stocks or indices) at a predetermined price. This predetermined price is known as the strike price.

In simpler terms, an option holder has the option to purchase the underlying asset at a fixed price regardless of its current market price.

Call options are purchased by traders who expect that the price of the underlying asset will rise in the future.

Key Components of a Call Option

Strike Price: The strike price or exercise price, is the predetermined price at which the option holder has the right to buy the underlying asset.

Expiry Date: The expiry date is the specified date by which the option holder must exercise the option if they choose to do so. After this date, a trader will not be able to execute the option right.

Premium: The premium is the price paid by the option buyer to the option seller (writer) to acquire the rights associated with the option. In simple terms, it is the cost of entering the option contract.

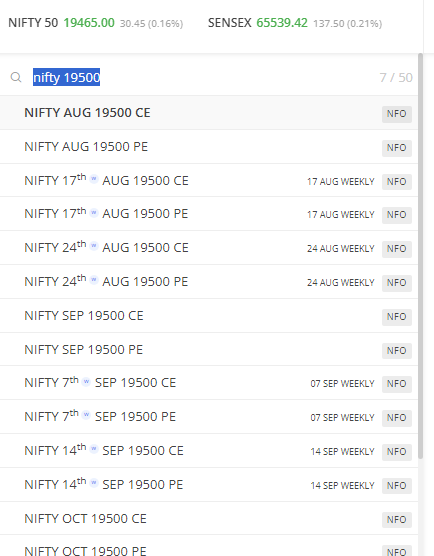

Options Symbol: Each option contract has its own unique option symbol which is the combination of the underlying asset, the expiration date, and the strike price. For example nifty 19500 ce 31 Aug.

Also Check: Long Build Up Meaning In Stock Market | Bullish Signs or False Alarm?

Also Check: Short Build Up Meaning In Stock Market | Caution or Reward?

Want to Join Trading course Free? Check our list of Best 7 Trading Course in India 2023

Examples of call option (CE)

Suppose you’re a trader and want to trade in the technology sector stock. You think that the company is About to launch a new product and the price of the stock will increase significantly. Now as you have predicted that the stock price will go up so you decide to buy a call option. Here Are the pricing details of the stock

- Current stock price: $100 per share.

- Strike Price: $110

- Expiry Date: 3 months from now

- Premium: $5 per contract (Assume 100 shares in a contract)

- You purchase one contract of 100 shares at a cost of $500 ($5 premium * 100 shares).

Scenario A: Stock Price Increases

So as you have predicted that the stock price will increase, it goes to $130 per share just before the expiry date. Since you have the right to buy shares at the $110 strike price, you can exercise your Call Option.

By exercising the Call Option, your profit would be as follows:

- Market Price per Share: $130

- Strike Price: $110

- Profit per Share: $130 – $110 = $20

- Total Profit = Profit per Share * Number of Shares = $20 * 100 = $2,000

Now your net profit would be $2,000 – $500 (Deducting the initially paid premium) = $1,500.

Scenario B: Stock Price Doesn’t Increase

On the other hand, if the stock price does not increase as predicted and goes below the $110 strike price by the expiry date, your Call Option would expire worthless. In this case, you would lose the initial premium of $500 that you paid to purchase the option.

So your net loss will be the premium paid of $500.

What is PE in stock market?

PE in the stock market means Put Options. Put options give the holder the right, but not the obligation, to sell a specific quantity of the underlying asset (such as stocks or indices) at a predetermined price on or before a specified expiry date. This predetermined price is known as the strike price.

Put options are purchased by traders who expect that the price of the underlying asset will fall in the future.

Key components of the Put option

Strike Price: The strike price is the predetermined price at which the option holder has the right to sell the underlying asset.

Expiry Date: The expiry date is the date by which the option holder must exercise the option if they choose to do so. After this date, the option will lapse and you will not be able to execute the same.

Premium: The premium for a Put Option is the price the option buyer pays to the option seller for the rights associated with the option.

Options Symbol: Each option contract has its own unique option symbol which is the combination of the underlying asset, the expiration date, and the strike price. For example nifty 19500 pe 31 Aug.

Examples of put option (PE)

Suppose you’re a trader who is negative (bearish) about the automobile industry’s stock prices in the near future, You decide to purchase a Put option of the automobile stock. Here are the pricing details of the stock.

- Current stock price: $75 per share

- Strike Price: $70

- Expiration Date: 1 month from now

- Premium: $2 per contract (Assume a contract has 100 shares)

You purchase one contract of 100 shares at a cost of $200 ($2 premium * 100 shares).

Scenario A: Stock Price Falls

As you have predicted correctly, the stock price falls over the next few weeks and reaches $60 per share just before the expiry date. Since you have the right to sell shares at the $70 strike price, you can exercise your Put Option.

By exercising the Put Option, your profit would be as follows:

- Strike Price: $70

- Market Price per Share: $60

- Profit per Share: $70 – $60 = $10

Total Profit = Profit per Share * Number of Shares = $10 * 100 = $1,000

And, your net profit would be $1,000 – $200 (deduct the initially paid premium amount) = $800.

Scenario B: Stock Price Doesn’t Fall

If the stock price doesn’t decline as predicted and remains above the $70 strike price by the expiration date, your Put Option would expire worthless. In this case, you would lose the initial premium of $200 that you paid to purchase the option.

Do you want to know how to do Trading in Zerodha? Here is step by step process for you. Check Now

How to use CE and PE in option Trading for Hedge

CE and PE are the Hedging instruments in the stock market. Hedging is a risk management strategy that means managing the risk in such a way that our losses are minimized or eliminated. A trader can use Both Call Options (CE) and Put Options (PE) for hedging purposes.

Let’s explore examples of how to use CE and PE for hedging against different market scenarios.

How to Use PE for Hedging

Imagine you are holding Tata Motors stock and you’re worried about a potential market downturn that will negatively impact your holding. Now, here, you can buy Put Options on a stock index to hedge against this risk.

Case Scenario:

- Stock Value: $100,000

- Stock Index ETF Price: $150 per share

- Strike Price: $140

- Expiration Date: 3 months from now

- Premium: $4 per contract

Hedging Strategy:

You decide to buy Put Options on the stock index ETF to protect your holding. You purchase 10 contracts, each covering 100 shares, for a total cost of $4,000 ($4 premium * 100 shares * 10 contracts).

Result:

If the market falls, and the stock index ETF price falls to $130 per share, it may also decrease the value of your portfolio. However, the value of your Put Options would increase and it will offset your portfolio losses to some extent.

So, you can either exercise the Put Options and sell the ETF shares at the higher strike price of $140 or sell the options themselves to realize the profit.

How to Use CE for Hedging

Example: Suppose you own shares of Tata Power company that you believe has the potential of giving good returns in the long run. However, you’re worried about short-term market volatility due to some upcoming economic data releases.

Case Scenario:

- Tata Power stock Price: $100 per share

- Strike Price for Call Option (CE): $105

- Expiry Date: 1 month from now

- Premium for Call Option (CE): $3 per contract

Hedging Strategy:

You decide to buy Call Options of Tata Power to hedge against potential short-term price fluctuations. By purchasing these options, you gain the right to sell your shares at a higher strike price if the market becomes volatile.

You purchase 5 contracts, each covering 100 shares, for a total cost of $1,500 ($3 premium * 100 shares * 5 contracts).

Result:

If the market experiences unexpected volatility and the stock price of Tata Power falls to $90 per share within the next month, the value of your stock position might decline. However, the value of your Call Options would increase as they provide the right to sell at the higher strike price of $105. This would help to hedge your long-term stock by mitigating some of the losses in your stock holdings.

Some important tips to consider for Options trading

Options trading can be a rewarding career, but it is also full of risks and complexities. Whether you’re a beginner or an experienced trader, follow some fundamental tips to become a successful trader:

Educate Yourself: Before trading options, ensure you have a clear understanding of how options work, their components, and the different strategies. Here are the best recommended books for Options Trading in India. Start your trading education today.

Risk Management: Options trading involves risks. Only take the risk to the extent you are ready to lose. Be clear with the risk-reward ratio.

Take baby steps: If you’re new to options, begin with a small capital and gradually increase your exposure.

Learn to hedge: Avoid putting all your capital into a single options trade. Diversify your option with hedging strategies and underlying assets to manage risk.

Paper Trading: If you’re new to options, start with paper trading to practice without real money.

Use Stop-Loss Orders: Never do trades without stop losses. Stop losses are like your best friends, they never let you fall to that level you can’t get up. This helps prevent larger losses.

Thank you for Reading Complete Article: Claim your Reward 35 Powerful Candlestick Patterns Free

Conclusion on CE and PE in Option Trading

In conclusion of What is CE and PE in Option Trading, we have learnt Call Options (CE) and Put Options (PE) provide the right, but not the obligation, to buy and sell respectively, a specific underlying asset at a predetermined price within a specified timeframe.

Both Call Options and Put Options have key components such as strike prices, expiration dates, and premiums. Using the option strategies includes speculations, hedging to income generation, and risk management.

Frequently Asked Questions

1. Can we buy PE and CE together?

Yes, it’s possible to buy Put Options (PE) and Call Options (CE) together, creating what’s known as a “straddle” strategy. In a straddle, a trader purchases both a Put Option and a Call Option with the same strike price and expiration date.

2. What is the premium in options trading?

In option trading, the “premium” means the price that an option buyer pays to the option seller (writer) to get the rights associated with the option contract. We can say, it is the cost of entering into an options contract.

What is the strike price?

The “strike price,” is also known as “exercise price.” It’s the predetermined price at which the underlying asset (such as a stock or index) can be bought or sold when the option is exercised.

What is the full form of CE in Stock Market?

The full form of CE is Call Option

What is the full form of PE in Stock Market?

The full form of PE is Put Option

Which platform is best for options trading?

When it comes to options trading, there are numerous stock trading platforms available. However, one platform that stands out for its simplicity and speed is Zerodha.

What is CE and PE with examples?

CE stands for “Call Option” in options trading and PE refers to “Put Option” in options trading. The Option provides the holder with the right, but not the obligation, to buy (Call option) or sell (Put Option) an underlying asset at a predetermined price (strike price) within a specified timeframe.

When to use CE and PE options?

Use Call Options (CE) when you expect an asset’s price to rise and Put Options (PE) when you expect it to fall. CE is for bullish outlooks, while PE is for bearish outlooks. Both options can be used for speculation, hedging, income generation, and risk management.