If you are looking at Adani stock for investment purposes, then you should know about Adani Green share price target. We know that Adani energy share has grown significantly in recent years. Due to this, it is shares are becoming attractive for the investors. In this article, we will provide a basic analysis of Adani Green share price target for 2024, 2025, 2027, 2030, and 2040.

We did research and analysis by considering various factors including industry trends, government policies, technological advancements, and other market conditions.

In this article, we will discuss about company’s growth, financial performance, shareholding pattern, and share price target. It will be helpful if you are looking to invest in Adani Green energy share now for 2024, 2025, 2026 and 2030.

Overview of Adani Green Energy Limited

Adani Green Energy Limited (AGEL) is a leading renewable energy company based in India. The company is a part of the Adani Group.

The company specializes in the development, operation, and maintenance of solar and wind power projects. All the operations are contributing significantly to India’s green energy transition. AGEL is one of the largest renewable energy companies globally, with a focus on sustainable energy solutions.

Here is the quick overview about Adani Green:

| Company Name | Adani Green Energy Limited |

| Current Market Price | ₹1,887 |

| Market Cap | ₹ 2,97,925 Cr |

| Book Value | ₹47.3 |

| Face Value | ₹10 |

| 52 Week High | ₹2,174 |

| 52 Week Low | ₹816 |

| Debt | ₹ 64,858 Cr. |

| Div. Yield | 0.00% |

Adani Green Current Financial Status

| Stock P/E | 236 |

| Industry P/E | 34.7 |

| EPS | ₹ 6.94 |

| Debt to Equity Ratio | 8.65 |

| Promotor Holding | 56.4 % |

| ROE | 17.1% |

| Sales growth | 18.6% |

| Profit growth | 11.6% |

History of Adani Green Share Price Target From 2024 to 2040

Adani Green has delivered a return of 12,256% since its listing price of Rs. 24.

Short run analysis: In the last 6 months, Adani Green share has given a return of 22.30% (+341.20), whereas, in the last 1 year, Adani Green share has given a return of 94.69% (+910.10).

Long run analysis: The stock has given a return of 4,292.49% (+1,828.60) in the past 5 years.

The stock has touched a high of ₹2,174.10.

Adani Green Share Price Target 2024

In FY 24, the company delivered a very robust financial performance across all metrics.

- On a year-on-year basis, company revenue from power supply increased by 33% to Rs. 7,735 crores.

- EBITDA increased by 30% to Rs. 7,222 crores.

- Cash profit has increased by 25% to Rs. 3,986 crores.

- Consistently high operational performance has delivered an industry-leading EBITDA margin of 92%.

Adani Green Energy Limited has a total renewable energy capacity of approximately 4.6 GW, which includes 2.9 GW from solar and 1.7 GW from wind. The company developed and operates the largest solar power plant in the world, with a capacity of 648 MWAC, located in Tamil Nadu.

In the fiscal year 2024, energy sales rose by 47% year over year to 21,806 million units, primarily driven by substantial capacity expansion.

| Year 2024 | Adani Green Share Price Target 2024 |

| 1st Price Target | ₹1,880.74 |

| 2nd Price Target | ₹2,025.26 |

Also Read: HUDCO Share Price Target

Adani Green Share Price Target 2025

AGEL is developing the world’s largest renewable energy project, with a capacity of 30,000 MW, on barren land in Khavda, Gujarat. Covering an area of 538 square kilometres—five times the size of Paris—the project has already become operational with 2,000 MW just 12 months after groundbreaking.

AGEL is utilizing advanced renewable energy technologies, including n-type bifacial solar modules and India’s largest 5.2 MW wind turbine, to enhance energy output and reduce the levelized cost of electricity.

| Year 2025 | Adani Green Share Price Target 2025 |

| 1st Price Target | ₹2,207.79 |

| 2nd Price Target | ₹2,245.53 |

Adani Green Share Price Target 2026

The company is on track to achieve the 2030 target with locked-in land parcels and transmission connectivity fully de-risked in Gujarat and Rajasthan.

Adani is also committed to leading India’s energy transition and aims to more than double our greenfield capacity addition to 6,000 MW.

| Year 2026 | Adani Green Share Price Target 2026 |

| 1st Price Target | ₹2,626.65 |

| 2nd Price Target | ₹2,671.55 |

Also Read: Wipro Share Price Target

Adani Green Share Price Target 2027

| Year | ADANI GREEN Share Price Target 2027 |

| 1st Price Target | ₹3,125.07 |

| 2nd Price Target | ₹3,178.49 |

Adani Green Share Price Target 2030

The company aims to achieve 50 GW by 2030 in alignment with India’s goals for decarbonization.

AGEL is dedicated to utilizing technology to minimize the Levelized Cost of Energy (LCOE), fostering widespread access to affordable clean energy.

AGEL’s operational portfolio has been certified as “water-positive for plants over 200 MW capacity,” “single-use plastic-free,” and “zero waste-to-landfill,” highlighting the company’s commitment to promoting sustainable growth.

| Year 2030 | Adani Green Share Price Target 2030 |

| 1st Price Target | ₹5,263.83 |

| 2nd Price Target | ₹5,353.81 |

Adani Green Share Price Target From 2024 To 2030

Adani Green Energy intends to invest an additional Rs500 billion in renewable projects nationwide. These investments are part of the company’s comprehensive strategy to expand its operational portfolio to 45 GW by 2030, a substantial increase from its current capacity of 10.9 GW.

| Year | 1st Target (in ₹) | 2nd Target (in ₹) |

| 2024 | 1,880.74 | 2,025.26 |

| 2025 | 2,207.79 | 2,245.53 |

| 2026 | 2,626.65 | 2,671.55 |

| 2027 | 3,125.07 | 3,178.49 |

| 2028 | 3,718.26 | 3,781.82 |

| 2029 | 4,423.77 | 4,499.39 |

| 2030 | 5,263.83 | 5,353.81 |

Also Check: Tata Motors Share Price Target

Adani Green Competitive Landscape

Competitors investing in cutting-edge renewable energy technologies, such as more efficient solar panels and advanced wind turbines, can gain a competitive edge by reducing costs and increasing energy output.

Companies expanding their renewable energy portfolios to include a mix of solar, wind, hydro, and other renewable sources can reduce risk and tap into various market segments. Recently Tata Power has invested in the FDRE Project which could be a game changer and give strong competition to Adani Green.

| S.No. | Name | CMP Rs. | Mar Cap Rs. Cr. | Div Yield % | Debt / Equity |

| 1. | NTPC | 364.90 | 353733.25 | 1.99 | 1.48 |

| 2. | Adani Green | 1880.35 | 297925.46 | 0.00 | 8.65 |

| 3. | Adani Power | 769.70 | 296791.20 | 0.00 | 0.80 |

| 4. | Power Grid Corpn | 315.80 | 293713.07 | 3.50 | 1.42 |

| 5. | Tata Power Co. | 448.00 | 143183.50 | 0.45 | 1.66 |

| 6. | Adani Energy Sol | 1026.80 | 114415.40 | 0.00 | 2.93 |

| 7. | JSW Energy | 629.65 | 110145.02 | 0.32 | 1.52 |

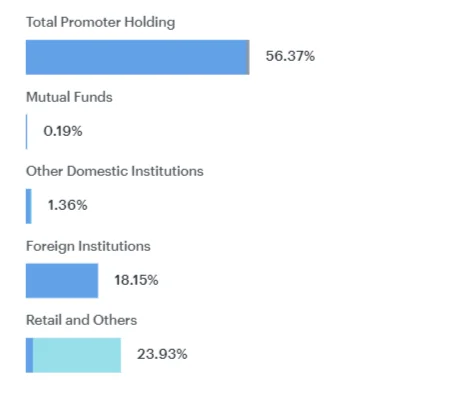

Adani Green Shareholding Patterns

Promotor Group: The company has a high promoter holding of 56.37%, which is consistent from the previous quarter. This includes the Adani family and entities controlled by them. The promoter group typically holds a significant majority stake in AGEL, reflecting their strong control and influence over the company.

FIIs and DIIs have increased their holding in the company, indicating a strength in the company’s future. It shows the interest and confidence in the company’s prospects.

Retail Investors (Public): Individual investors who buy and hold shares of AGEL. Retail investors’ shareholding can provide insight into the general public’s perception and trust in the company.

| Dec 2023 | Mar 2024 | |

| Promoters | 56.37% | 56.37% |

| FIIs | 18.03% | 18.15% |

| DIIs | 1.50% | 1.55% |

| Public | 24.10% | 23.93% |

Prospects and Adani Green Share Price Target

Growth Drivers

Government Policies and Initiatives:

- The Indian government’s push towards renewable energy through various policies and incentives creates a favourable environment for companies like Adani Green.

- Adani is one of the biggest contributors towards the Initiatives, i.e., the National Solar Mission and commitments under the Paris Agreement for the growth of the renewable energy sector.

Expanding Capacity:

- Adani Green is aggressively expanding its renewable energy capacity. The company’s goal to reach 25 GW by 2025 highlights its ambitious expansion plans.

Risks and Challenges:

Regulatory and Policy Risks:

- Changes in government policies or regulatory frameworks can impact the profitability and viability of renewable energy projects.

Financial Risks:

- High capital expenditure requirements for new projects necessitate substantial funding, which may lead to increased debt levels.

Market Competition:

- The renewable energy sector is highly competitive, with many players vying for market share. Competitive pressures can impact pricing and margins.

Environmental and Social Risks:

- Ensuring compliance with environmental regulations and maintaining a positive corporate social responsibility image are essential to avoid reputational risks.

Also Check: LIC Share Price Target

Conclusion

We hope we have provided valuable insights into Adani Green Share Price Target based on our in-depth research. Adani Green Energy Ltd.’s (AGEL) future is looking promising due to the rising demand for renewable energy.

Key factors include Adani’s potential for renewable energy capacity expansion, supportive government policies, and technological advancements.

The global shift towards clean energy and AGEL’s strong financial performance, along with strategic partnerships and acquisitions.

Frequently Asked Questions

What does Adani Green do?

Adani Green Energy Ltd. is involved in generating renewable energy, including solar and wind power.

What are the growth prospects for Adani Green?

Adani Green’s growth prospects depend on the increasing global and regional focus on renewable energy and government policies.

What is the future prediction of Adani Green?

Adani green future seems promising with an increase in demand for renewable energy and support from the Government. The company has a strong position in the market. Positive trends in renewable energy adoption and environmental regulations could benefit Adani Green.

What is the share price target for Adani Green in 2024?

The share price target for Adani Green in 2024 is 1st target ₹1,880.74 and 2nd target is ₹2,025.26.

What is the price target for Adani Green in 2025?

Adani Green Share Price Target for 2025 is ₹2,207.79 to ₹2,245.53.

What is the Adani Green Share price target for 2026?

Adani Green Share Price Target for 2026 is ₹2,626.65 to ₹2,671.55.

What is the Adani Green Share price target for 2027?

Adani Green Share Price Target for 2027 is ₹3,125.07 to ₹3,178.49.

What is the Adani Green Share price target for 2030?

Adani Green Share Price Target for 2030 is ₹5,263.83 to ₹5,353.81

Should I invest in Adani Green?

Investing in Adani Green is a personal decision that depends on various factors, including your financial goals, risk tolerance, investment horizon, and market conditions. Conduct thorough research into Adani Green’s financial performance, industry trends, and the company’s position in the renewable energy sector and its growth plans.

Disclaimer: The share price target provided is for informational purposes only and does not constitute financial advice. It is based on current market analysis and is subject to change due to market conditions. Investors should conduct their own research or consult a financial advisor before making investment decisions. Past performance is not indicative of future results. Investing in stocks involves risk, including the loss of principal.