The defence sector is one of the sectors with high potential to benefit from Budget 2024, considering both geopolitical tensions and India’s strategic focus on self-reliance in defence technology.

A sustained or increased allocation in the capital expenditure (capex) budget for defence is expected, likely exceeding the 5-7% increase projections. This would translate to more funds for modernization, infrastructure development, and procurement of critical equipment.

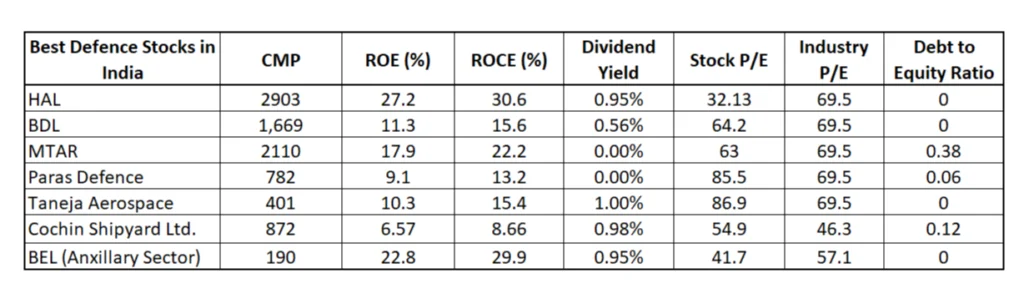

Key Highlights Defence Stock Picks:

Hindustan Aeronautics Limited (HAL):

- Major beneficiary of increased fighter jet program allocation.

- Focus on self-reliance in manufacturing plays to its advantage.

Bharat Dynamics Limited (BDL):

- Boosted by rising demand for missile systems and modernization programs.

- Opportunities in technology transfer and collaborations with foreign companies.

Bharat Electronics Limited (BEL):

- Increased spending on radars and electronic warfare systems benefits BEL.

- Investments in cyber security and AI create new avenues for growth.

Other Promising Companies:

- MTAR Technologies: Expertise in UAVs and niche defence technologies.

- Paras Defence: Focus on border infrastructure and public-private partnerships.

- Cochin Shipyard Ltd. (CSL): Modernization of Indian Navy fleet presents opportunities.

- Taneja Aerospace: Growth in private space industry and potential collaboration with ISRO.

Best Defence Stocks in India

Hindustan Aeronautics Limited (HAL)

- Increased allocation for indigenous fighter jet programs: HAL is the primary manufacturer of fighter jets for the Indian Air Force (IAF). Under the Narendra Modi government, an order of Rs 36,468 crore for the delivery of 83 LCA Mk 1A Tejas aircraft has been placed with HAL. Increased budgetary allocation for programs like Tejas Mk1A and Advanced Medium Combat Aircraft (AMCA) could boost HAL’s order book and production.

- Focus on self-reliance in defence manufacturing: The government’s push for “Atmanirbhar Bharat” (self-reliant India) in defence manufacturing could benefit HAL, as it is a major player in domestic production.

Top Pradhanmantri Suryodaya Yojana Stocks: 11 Stocks Picks Across 3 Key Sectors to Watch

Atal Setu Bridge: The Hidden GEM Stock You Need in Your Portfolio

BDL

- Boost for missile programs: BDL manufactures a range of missiles for the Indian armed forces. Increased spending on missile defence systems and modernization programs could benefit BDL.

- Focus on technology transfer and collaboration: The government’s emphasis on technology transfer and collaboration with foreign defence companies could open up new opportunities for BDL in joint ventures and production partnerships.

Is India’s Market About To Boom? 8 Key Players Join A Prestigious Global Club

Top Ayodhya Stocks: 9 Stock Picks Across 3 Key Sectors to Watch

Bharat Electronics Limited (BEL)

- Rise in demand for radars and electronic warfare systems: BEL manufactures various radars and electronic warfare systems crucial for border security and military operations. Increased spending on these areas could benefit BEL.

- Investments in cyber security and artificial intelligence: The growing focus on cyber warfare and AI integration in defence systems could create new business opportunities for BEL in these areas.

MTAR Technologies

- Emphasis on unmanned aerial vehicles (UAVs): MTAR specializes in UAVs and drones used for surveillance and reconnaissance. Increased procurement of UAVs by the Indian Army and Navy could benefit MTAR.

- Investments in niche defence technologies: The government’s support for research and development in niche defence technologies like robotics and miniaturization could benefit MTAR’s innovation and growth.

Paras Defence

- Focus on border infrastructure and coastal security: Paras Defence is involved in manufacturing shelters, bunkers, and other infrastructure for border areas. Increased spending on border security and coastal defence could benefit the company.

- Opportunities in public-private partnerships: The government’s encouragement of public-private partnerships in defence infrastructure development could create new avenues for Paras Defence.

Cochin Shipyard Ltd. (CSL)

- Modernization of Indian Navy fleet: CSL builds warships and submarines for the Indian Navy. Increased allocation for naval modernization programs could lead to new orders for CSL.

- Focus on indigenous shipbuilding: The government’s emphasis on building warships domestically could benefit CSL, as it is a leading shipyard in India.

Taneja Aerospace

- Growth in private space industry: Taneja Aerospace is involved in satellite manufacturing and launch services. The government’s support for the growing private space industry could benefit the company.

- Collaboration with Indian Space Research Organisation (ISRO): Partnerships and joint ventures with ISRO for space exploration and development programs could provide Taneja Aerospace with valuable contracts and expertise.

How Can I Invest in Defence Stocks India?

1. Opening a Zerodha Account: If you haven’t already, open a Demat and trading account with Zerodha online through their website (https://zerodha.com/). You can check here Zerodha Account Opening Process.

2. Researching Defence Stocks: Analyze individual companies within the defence sector. Consider factors like financials, growth prospects, government contracts, competitive advantages, and valuations.

3. Placing Orders: Once you’ve identified stocks, use Zerodha’s Kite platform (https://kite.zerodha.com/) to place your orders. Read here: How to Buy Shares in Zerodha Kite Long Term in 2024?

4. Managing Investments: Track your investments through Zerodha’s user-friendly interface. Monitor performance and news related at FinanceFundaa.com News Section.

Disclaimer: The information provided on this website is for general informational purposes only and should not be construed as financial advice, investment recommendations, or guarantees of any kind. This information is not intended as a substitute for professional financial advice. You should always seek the advice of a qualified financial advisor before making any investment or financial decisions.