If you are looking at Bharti Airtel shares for investment purposes, then you should know about Bharti Airtel share price target. We know that Bharti Airtel share has grown significantly in recent years. Due to this, it is shares are becoming attractive for the investors. In this article, we will provide a basic analysis of the Bharti Airtel share price target for 2024, 2025, 2027, 2030, and 2040.

These targets can help you to make the right decision about your investments. In this article, we will examine the factors behind Bharti Airtel’s growth, such as ARPU, market demand, and strategic expansion plans. It will help you understand how Bharti Airtel shares might perform in the future and whether investing in them for the long term is a good idea.

Overview of Bharti Airtel Limited

Bharti Airtel Limited is a leading global telecommunications company with its headquarters in New Delhi, India. Established in 1995 by Sunil Bharti Mittal, Airtel has grown to become one of the largest mobile service solutions providers with over 500 Mn customers in 17 countries across South Asia and Africa.

The company is one of the top three mobile operators in the world, with networks covering over two billion people. Airtel is the largest communication services provider in India and the second-largest mobile operator in Africa.

| Company Name | Bharti Airtel Ltd |

| Current Market Price | ₹1,435 |

| Market Cap | ₹ 8,56,867 Cr. |

| Book Value | ₹145 |

| Face Value | ₹5 |

| 52 Week High | ₹1,456 |

| 52 Week Low | ₹821 |

| Debt | ₹2,15,592 Cr. |

| Div. Yield | 0.28% |

Bharti Airtel Current Financial Status

| Stock P/E | 71.9 |

| Industry P/E | 50.8 |

| EPS | ₹13.2 |

| Debt to Equity Ratio | 2.63 |

| Promotor Holding | 53.5% |

| ROE | 14.9% |

| Sales growth | 7.79% |

| Profit growth | 37.2% |

History of Bharti Airtel Share Price Target From 2024 to 2040

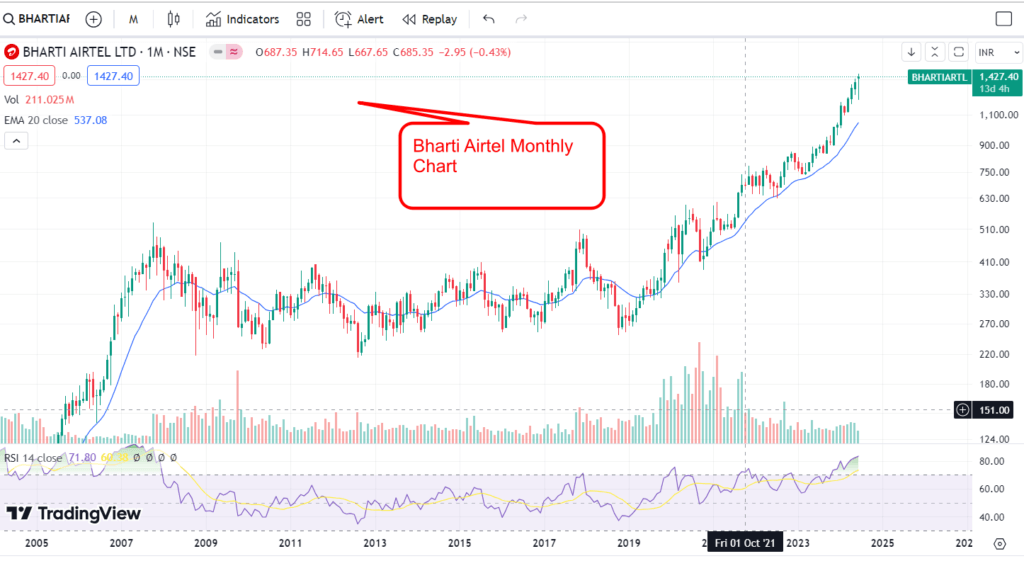

Short-term analysis: In the past 6 months, Wipro has given a return of 44.01% (+436.85) and in the past 1 year, Wipro has given a return of 72.28% (+599.70).

Long-term analysis: In the long term, we are considering the past 5 years’ return, which is 323.58% (+1,091.94%), and the maximum return the company has provided is 7,226.50% (+1,409.89).

Also Check: Reliance Share Price Target

Bharti Airtel Share Price Target 2024

India’s revenues for Q4 2024 were Rs 28,513 crore, up 12.9% from last year. Mobile revenues also grew by 12.9% due to better earnings and more 4G/5G customers. The average revenue per user (ARPU) for the quarter was Rs 209, compared to Rs 193 in Q4 2023, thanks to focusing on getting quality customers and improving the customer mix.

| Year 2024 | Bharti Airtel Share Price Target 2024 |

| 1st Price Target | ₹1,592.85 |

| 2nd Price Target | ₹1,650.25 |

Also Check: WIPRO Share Price Target

Bharti Airtel Share Price Target 2025

Nxtra by Airtel is growing quickly in the data center market. They have 12 large and over 120 smaller data centers all over India, and they manage important submarine landing stations.

With Airtel’s global network, they provide secure and scalable solutions to big tech companies, large Indian businesses, start-ups, small to medium businesses, and governments. Nxtra’s strong and growing network of data centers allows them to create innovative solutions for long-term business benefits.

To strengthen its leading position, Airtel announced a `50 billion investment by 2025 to triple Nxtra’s capacity to over 400 MW.

| Year 2025 | Bharti Airtel Share Price Target 2025 |

| 1st Price Target | ₹1,831.50 |

| 2nd Price Target | ₹1,897.50 |

Bharti Airtel Share Price Target 2026

Motilal Oswal believes Bharti Airtel will benefit from industry consolidation and higher prices, leading to strong cash flow over the next 2-3 years. They think that upcoming price increases and a slowdown in spending on infrastructure could be positive signs.

| Year 2026 | Bharti Airtel Share Price Target 2026 |

| 1st Price Target | ₹2,105.67 |

| 2nd Price Target | ₹2,181.55 |

Bharti Airtel Share Price Target 2027

According to May 2024 analysis, Bharti Airtel’s average revenue per user (ARPU) is expected to increase by 38% to Rs 286 over the next three years. Currently, Airtel’s ARPU is Rs 208.

Analysts believe the increase in telecom companies’ growth and revenue will increase in the future due to tariff hikes, upgrades from 2G to 4G, customers moving to higher data plans, and more people adopting postpaid connections.

Further, analysts also expect a 15-17% tariff hike. In contrast, Jio is expected to focus on boosting data consumption to improve ARPU without raising prices.

| Year 2027 | Bharti Airtel Share Price Target 2027 |

| 1st Price Target | ₹2,420.91 |

| 2nd Price Target | ₹2,508.15 |

Also Check: HUDCO Share Price Target

Bharti Airtel Share Price Target 2030

The India Telecoms Report suggests that mobile subscriptions and fixed broadband users will keep driving growth in the telecom sector from 2023 to 2030. Over the past six years, more than 700 million people have become Internet users, and it’s expected that another 200 million will start using the Internet by 2030.

| Year 2030 | Bharti Airtel Share Price Target 2030 |

| 1st Price Target | ₹3,680.76 |

| 2nd Price Target | ₹3,813.40 |

Bharti Airtel Share Price Target From 2024 To 2040

| Year | 1st Target (in ₹) | 2nd Target (in ₹) |

| 2024 | 1,592.85 | 1,650.25 |

| 2025 | 1,831.50 | 1,897.50 |

| 2026 | 2,105.67 | 2,181.55 |

| 2027 | 2,420.91 | 2,508.15 |

| 2028 | 2,783.88 | 2,884.20 |

| 2029 | 3,201.24 | 3,316.60 |

| 2030 | 3,680.76 | 3,813.40 |

| 2040 | 7,458.89 | 7,858.93 |

Also Check: Adani Green Share Price Target

Bharti Airtel Competitive Landscape

Bharti Airtel faces significant competition in the Indian telecom market from major players listed on the Indian stock market. Bharti Airtel Jio, known for its aggressive pricing and extensive 4G and 5G coverage, pressures Airtel’s market share.

Vodafone Idea, formed from the merger of Vodafone India and Idea Cellular, offers strong network coverage and customer loyalty.

BSNL, a state-owned entity, has a strong presence in rural areas and benefits from government backing. Airtel must continually innovate, expand its network, enhance customer experience, and diversify its services to compete effectively in this dynamic and competitive landscape.

| S.No. | Name | CMP Rs. | Mar Cap Rs.Cr. | Div Yield % | Debt / Equity |

| 1. | Bharti Airtel | 1434.60 | 856866.64 | 0.28 | 2.63 |

| 2. | Vodafone Idea | 16.37 | 108767.22 | 0.00 | |

| 3. | Bharti Hexacom | 1104.45 | 55222.50 | 0.00 | 1.75 |

| 4. | Tata Communication | 1877.00 | 53521.33 | 0.89 | 6.30 |

| 5. | Tata Tele. Mah. | 80.10 | 15624.24 | 0.00 | |

| 6. | Railtel Corpn. | 418.50 | 13431.24 | 0.60 | 0.02 |

| 7. | Nazara Technolo. | 854.60 | 6541.28 | 0.00 | 0.01 |

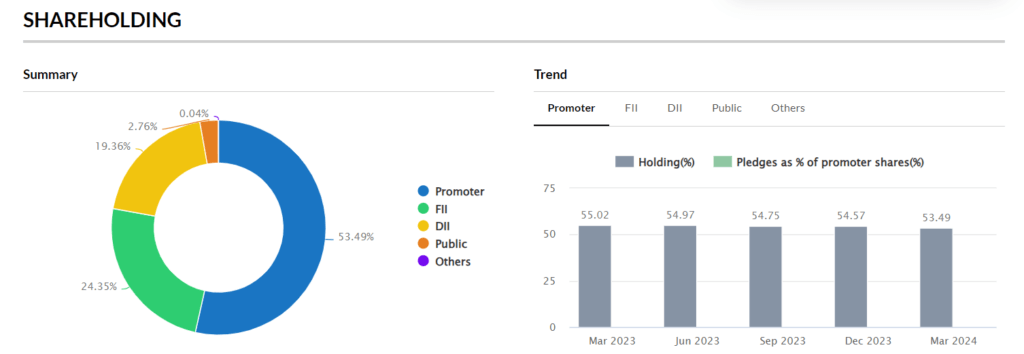

Bharti Airtel Shareholding Patterns

Source: Moneycontrol.com

Promoters

Bharti Group: The Bharti family and associated entities hold a significant stake, i.e., 53.48% in Bharti Airtel. The founder, Sunil Bharti Mittal, and his family play a crucial role in the company’s strategic direction.

Institutional Investors

Foreign Institutional Investors (FIIs): These include global investment firms and hedge funds that invest in Indian equities. FIIs hold 24.35% of Bharti Airtel’s shares, reflecting strong international interest.

Domestic Institutional Investors (DIIs): This category includes Indian mutual funds, insurance companies, and financial institutions. DIIs hold 19.20% in Bharti Airtel, showing strong backup.

Public and Others

Retail Investors: Individual shareholders are the retail investors, holding 2.80% in Bharti Airtel shares.

Employees: Employees of Bharti Airtel may hold shares through stock option plans, aligning their interests with the company’s growth and success.

Other Entities: This includes trusts, non-resident Indians (NRIs), and other corporate bodies.

| Dec 2023 | Mar 2024 | |

| Promoters | 54.57% | 53.48% |

| FIIs | 22.69% | 24.35% |

| DIIs | 19.51% | 19.20% |

| Government | 0.12% | 0.12% |

| Public | 3.07% | 2.80% |

| Others | 0.06% | 0.05% |

Future Prospects and Bharti Airtel Share Price Target

Growth Drivers

- Expanding Data Center Business: With the investment in Nxtra by Airtel, the company is set to significantly increase its data center capacity. This expansion plan will help the company to fulfill the growing demand for data storage and management solutions.

- 5G Rollout: Bharti Airtel is at the forefront of the 5G rollout in India, which will boost data consumption and service revenues.

- Rising Mobile Subscriber Base: The increasing number of mobile users in India opens the opportunity for growth for Airtel’s services.

- Diversification of Services: Airtel’s expansion into areas like digital payments, entertainment, and cloud services provides multiple streams of income.

Risks and Challenges

- Regulatory Risks: Changes in government regulations and policies can impact operations and profitability.

- Intense Competition: The telecom market in India is highly competitive, with major players like Jio and Vodafone-Idea.

- High Capital Expenditure: The investment required for 5G infrastructure and data center expansion is substantial and can impact short-term profitability.

Conclusion

Bharti Airtel’s market share and customer base growth are the important indicators that helped to predict the Bharti Airtel share price target. The company’s ability to maintain or increase its market position affects investor confidence.

Please note that the Bharti Airtel share price targets shared above are just a suggestion. We are not giving any buy or sell recommendations here. The target prices for any stock can change anytime based on market conditions. We recommend you consult your own experts before investing in Bharti Airtel stock.

If you found this website helpful, please share it with others. If you have any questions, feel free to ask in the comment box—we’ll do our best to respond and help you out. Thank you for visiting and for being part of FinanceFundaa!

Frequently Asked Questions

Is Bharti Airtel a good buy?

Bharti Airtel is one of the leading telecom companies in India, along with Jio and Vodafone. Many analysts have a positive outlook on its future growth due to the growing demand for internet and subscriber base.

Can I invest in Bharti Airtel?

Yes, you can invest in Bharti Airtel by purchasing its shares through a stockbroker or an online trading platform. Make sure to consider your financial goals and risk tolerance before investing.

What is the prediction of Bharti Airtel?

Analysts have an optimistic view of Bharti Airtel. Shareholders also have positive expectations and expect growth due to its strong market position and investments in new technologies like 5G.

Who is the owner of Bharti Airtel?

Bharti Airtel was founded by Sunil Bharti Mittal, who is the chairman and main shareholder of the company. The company has other investors also like FIIs, DIIs, and public interest.

What is the Bharti Airtel Share price target for 2024?

The Bharti Airtel Share price target for 2024 is ₹1,592.85 to ₹1,650.25

What is the Bharti Airtel Share price target for 2025?

The Bharti Airtel Share price target for 2025 is ₹1,831.50 to ₹1,897.50

What is the Bharti Airtel Share price target for 2026?

The Bharti Airtel Share price target for 2026 is ₹2,105.67 to ₹2,181.55

What is the Bharti Airtel Share price target for 2027?

The Bharti Airtel Share price target for 2027 is ₹2,420.91 to₹2,508.15.

What is the Bharti Airtel Share price target for 2028?

The Bharti Airtel Share price target for 2028 is ₹2,783.88 to₹2,884.20.

What is the Bharti Airtel Share price target for 2030?

The Bharti Airtel Share price target for 2030 is ₹3,680.76 to ₹3,813.40.

Disclaimer: The share price target provided is for informational purposes only and does not constitute financial advice. It is based on current market analysis and is subject to change due to market conditions. Investors should conduct their own research or consult a financial advisor before making investment decisions. Past performance is not indicative of future results. Investing in stocks involves risk, including the loss of principal.