Hey Traders!

In this blog, I have discussed on topic “Can I Sell Delivery Shares on Same Day?” Well, the quick answer is “Yes, you can sell delivery shares on same day.” But what are the charges and how can you sell shares on same day? I have every point in this blog, so, let’s read a bit more to get all the answers.

What are Delivery Shares?

Delivery shares are the shares that you purchase for the long term, rather than selling them on the same day. It is the opposite of intraday trading, where shares are bought and sold within the same day. Delivery share orders are also called CNC (Cash and Carry Orders).

Delivery trades are settled on T+2 days. It means that the shares are credited to your demat account and the payment is debited from your trading account two days after the trade execution. And, you need to pay the full cost of the shares for the delivery trades.

Also Check: What is Convert Position in Zerodha and Its Charges in 2024

Now, let’s quickly answer your question.

Can I Sell Delivery Shares on Same Day?

Yes, you can easily sell delivery shares on same day. When you sell delivery shares on same day, then it is called Intraday trade (MIS) instead of delivery order (CNC).

For example, if you have bought HDFC shares at CNC (Cash and Carry) trade today and paid the full amount in cash as the CNC trades don’t provide margins.

Now, for any reason, you want to sell CNC shares (HDFC in our case) on the same day, you can do that simply by selling stock from a demat account. You can do this simply by converting the position from CNC to MIS order.

Read More: How To Convert Intraday to Delivery in Zerodha in 1 Min? Quick and Easy

Read More: What are CNC and MIS in Zerodha Kite 2024? Meaning with Example

Are There Any Charges to Sell Delivery Shares on The Same Day?

Delivery share sale on same-day charges: As we discussed above, when you sell delivery shares on the same day, it is considered as intraday, here intraday brokerage charges will be applicable.

If you are selling shares on the same day on Zerodha, then Zerodha charges Rs. 20 for intraday trading.

Is There Any Tax for Selling Delivery Shares on Same Day?

The tax implications of selling shares are as follows:

Short-Term Capital Gains (STCG) Tax: If you sell shares within 12 months from the purchase date, the profit is considered STCG and is taxed at 15% in India.

Long-Term Capital Gains (LTCG) Tax: If you hold shares for more than 12 months from the date of shares purchase, then any profit exceeding Rs. 1 lakh is considered LTCG and is taxed at 10%. However, there is no tax on LTCG up to Rs. 1 lakh per financial year.

Why Should You Sell Delivery Shares on The Same Day?

There are a few reasons you might do this:

Change in market sentiment: If you bought the shares based on specific news or analysis, but the market sentiments change quickly, you may want to sell to avoid losses.

Sudden need for funds: If you unexpectedly need money, you can quickly sell shares on the same day and get your funds back.

Profit-taking: If the share price increases after you buy it, you can book a quick profit.

Are There Any Risks Involved in Selling Delivery Shares on The Same Day?

Yes, there could be a few risks involved, such as:

Higher brokerage fees: Some brokers charge higher fees for selling delivery shares on the same day.

Missed potential growth: If you sell too soon, you could miss out on future gains in the share price.

Short-term volatility: You might not get the best price for your shares if you sell them impulsively due to market fluctuations.

How to Sell Delivery Stocks in Zerodha?

I’m sharing the step-by-step process to sell delivery stocks in Zerodha.

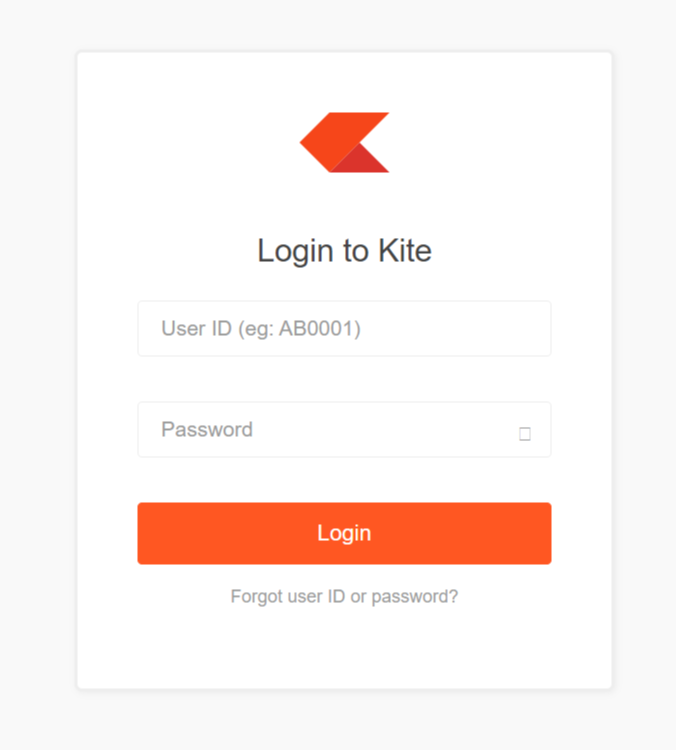

Step 1. Login to Zerodha Kite Web or Kite Mobile App.

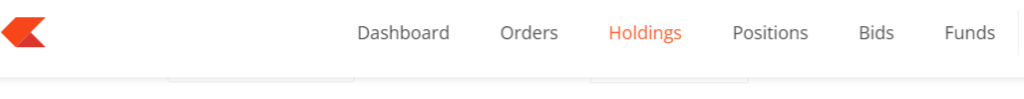

Step 2: Click on the “Portfolio” tab and then “Holdings.”

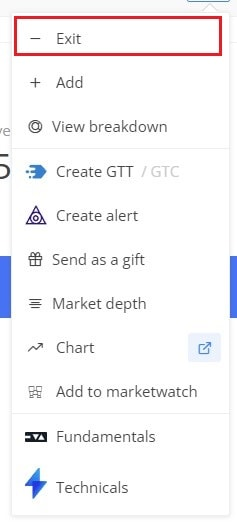

Step 3: Choose the stock you want to sell and click on it.

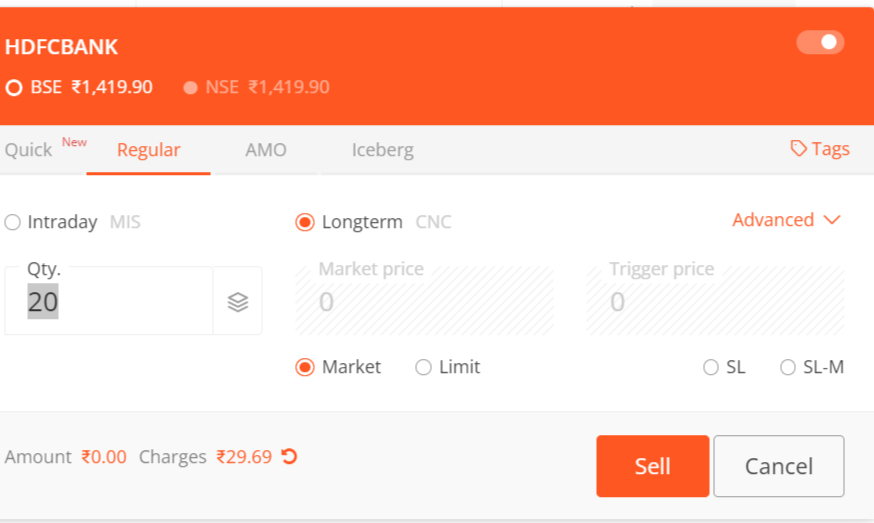

Step 4: Click on “Sell” or “Exit” and choose “CNC” (Cash on Delivery) for that particular stock.

Step 5: Select the order type (Market, Limit, SL, or SL-M) and enter the quantity you want to sell.

Step 6: Authorization to sell shares. If you have CDSL TPIN enabled, enter your TPIN and OTP received on your phone and email.

If not, click/tap “Continue” and follow the onscreen instructions to authorize the debit of securities using your Demat account password or PIN.

Step 8: Review the order details carefully, Swipe to sell (on mobile) or click on “Place Order” to confirm.