Zomato (or maybe Tomato), is one of the buzzing stocks since listed on the stock market. Many investors are still invested in Zomato shares and looking forward to knowing should they stay invested or not and Zomato share price target 2025. So, we have done a detailed analysis of Zomato share price. Let’s analyze whether should you buy, hold, or sell Zomato Limited shares.

About Zomato

Incorporated in 2008, Zomato Ltd. is an Indian restaurant search and discovery service company. The company provides information and reviews on restaurants. It has become a popular brand for its comprehensive restaurant listings, detailed menus, and user reviews.

Zomato also offers online ordering, table reservations, and point-of-sale systems. It also operates a one stop procurement solution Hyperpure. Hyperpure’s main purpose is to supply high-quality ingredients to restaurant partners.

The Company has two core businesses:

1. To customer B2C offerings Food delivery and Dining Out

2. Business-to-business B2B offering and Hyperpure.

In 2022, Zomato acquired Blinkit for Rs 4,447 crore (about $568 million). Blinkit is a 10-minute delivery platform.

| Organisation | Zomato Ltd |

| Headquarters | Gurgaon |

| Industry | E-Commerce/App based Aggregator |

Zomato Share Price Target 2025

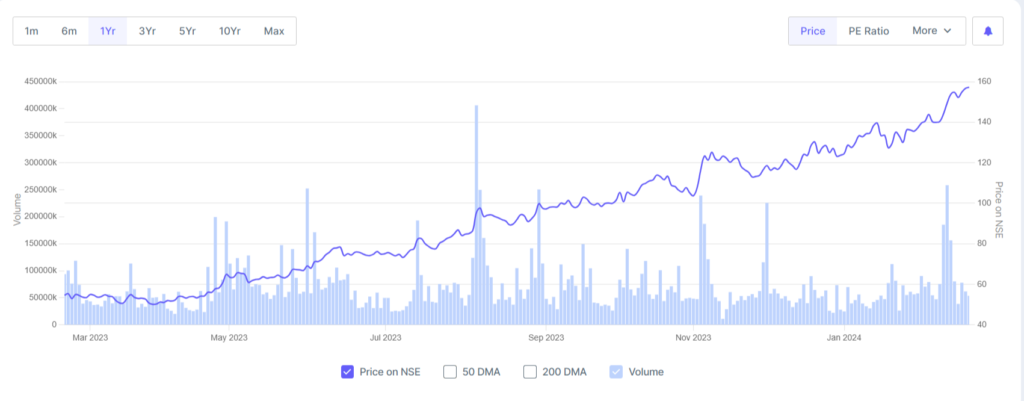

Currently, Zomato’s shares are trading around Rs. 130 per share. According to market analysts, Zomato share price target 2025 is between Rs. 180 to Rs. 220 per share.

If you want to buy Zomato Share, you must have Demat Account, you can easily open Zerodha Demat Account here.

If you are interested in TATA Shares, check the Tata Share Price Targets:

Tata Steel Share Price Target 2025 (Updated Dec 2023)

Tata Power Share Price Target 2025, 2026, 2027, 2030?

Tata Motors Share Price Target 2025

Zomato Positive and negative insights

| Positive Insights | Negative Insights |

| Revenue is up for the last 5 quarters. i.e., Rs. 1.35K Cr to 2.22K Cr. It is an average increase of 11.7% per quarter. | Retail Investor have decreased holdings from 35.15% to 33.55% in Jun 2023 quarter |

| Net profit is up for the last 2 quarters, i.e., Rs. 346.6 Cr to 188.2 Cr, with an average increase of 84.2% per quarter | |

| In the last 6 months, ZOMATO stock has increased by 82.6% | |

| In the last 1 year, ZOMATO has outperformed top 5 stocks with highest market-cap in Online Services | |

| Mutual Funds have increased holdings from 6.40% to 8.30% in Jun 2023 quarter | |

| Foreign Institutions investors (FII) have increased holdings from 31.62% to 33.32% in Jun 2023 quarter |

Zomato Price Target from 2023 to 2030

| Years | Zomato share price target – 1st Target | Zomato share price target – 2nd Target |

| 2023 | ₹80 | ₹100 |

| 2024 | ₹120 | ₹150 |

| 2025 | ₹180 | ₹220 |

| 2026 | ₹250 | ₹300 |

| 2027 | ₹300 | ₹350 |

| 2030 | ₹400 | ₹500 |

| 2040 | ₹600 | ₹800 |

| 2050 | ₹800 | ₹1000 |

Also Check: Wipro Share Price Target 2025 | What will be the Wipro share price target in 2023, 2024, 2025, and 2030?

Also Check: Suzlon Share Price Target 2025 (Updated Dec 2023)

Fundamental Analysis of Zomato

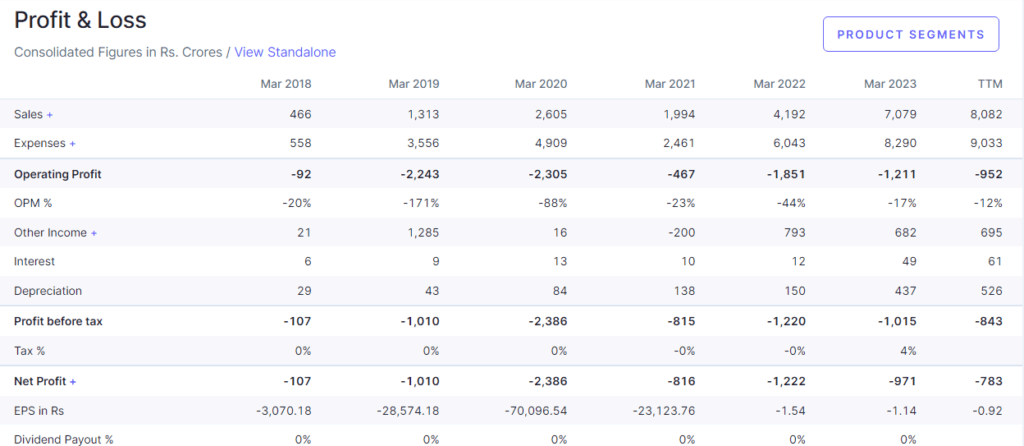

Revenue: Zomato Ltd’s revenue jumped 64.16% from last year’s same period to ₹2,597Cr in Q1 2023-2024. Comparing the quarterly growth of Zomato, the company has generated a 16.61% jump in its revenue in the last 3-months.

Net Profits: Zomato Ltd’s net profit jumped 101.08% from last year’s same period to ₹2Cr in the Q1 2023-2024. Comparing the quarterly growth of Zomato, it has has generated a 101.06% jump in its net profits in the last 3-months. Amazingly, it was the company’s first-ever quarterly profit after being listed in July 2021.

Zomato Q1FY24 Results: Share Price Performance

| 1 month | 1 Year | Since IPO |

| 15.57% | 49.44% | -31.39% |

Net Profit Margins: Zomato Ltd’s net profit margin jumped 100.66% from last year’s same period to 0.08% in the Q1 2023-2024. Comparing the quarterly growth of Zomato, it has generated a 100.91% jump in its net profit margins in the last 3-months. Zomato Share Price Target 2025.

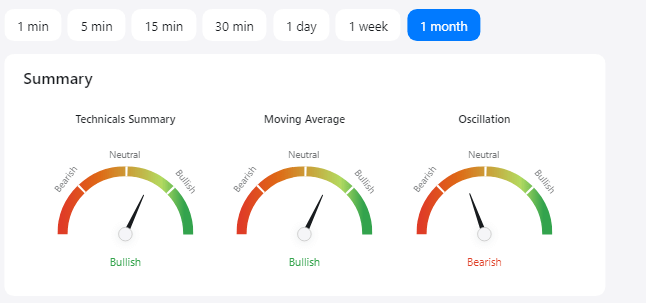

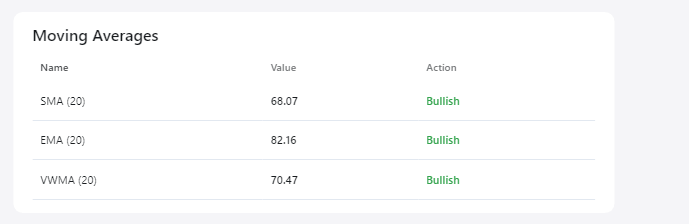

Technical Analysis of Zomato

As per the technical analysis indicators, Zomato Ltd is currently (October 2023) in a Bullish trading position.

Reasons to Increase Zomato Share Price

Revenue Growth: Consistent and robust revenue growth, driven by increased order volumes and higher average order values, can boost investor confidence. Expanding the customer base and improving monetization strategies can contribute to revenue growth.

| Operating Metrics | Q1 FY2023 | Q1 FY2024 | % change |

| Avg Monthly Transacting Customers | ₹1.67 Crores | ₹1.75 Crores | 4.79% |

| Avg Monthly Active Food Delivery Restaurant Partners | ₹2.08 Crores | ₹2.26 Crores | 8.65% |

| Financial Metrics | Q1 FY2023 | Q1 FY2024 | % change |

| Gross Order Value (GOV) | ₹6,425 Crore | ₹7,318 Crore | 13.90% |

| Adjusted Revenue | ₹1,470 Crore | ₹1,742 Crore | 18.50% |

| Adjusted EBITDA | ₹-113 Crore | ₹181 Crore | -260.18% |

Market Dominance: Maintaining or strengthening its position as a market leader (competitor Swiggy) in the online food delivery industry in key markets like India can be a positive driver for Zomato’s share price. Market dominance often translates into pricing power and competitive advantages.

Expansion into New Markets: Entering and successfully expanding into new geographic markets can open up additional revenue streams. Expanding internationally or into underserved regions can be seen as a growth opportunity.

Diversification of Services: Expanding beyond food delivery into related services, such as grocery delivery or cloud kitchens, can provide a diversified revenue stream and reduce dependence on a single business segment. Zomato Share Price Target 2025.

Efficient Cost Management: Effective cost control and operational efficiency can lead to higher profitability. Investors often appreciate companies that can maintain a healthy balance between growth and profitability.

Zomato Dividend History

Zomato does not distribute dividends to its shareholders.

Read More: Yes Bank Share Price Target 2025

Read More: LIC Share Price Target 2025

Zomato Competitors

Conclusion on Zomato Share Price Target 2025

I hope you are now aware of the Zomato Share Price Target 2025 based on our Fundamental and Technical Analysis. If you want any more information, then you can ask by commenting. We will try our best to reply to you. Please share this article with your stock market lovers.

Frequently Asked Questions

What is the target price of Zomato shares in 2025?

The highest target price for Zomato shares in 2025 is Rs 180 to Rs 220, while the average target price is Rs 200.

Is Zomato stock good for investments?

Zomato is a good option for the short term movements. You can expect good returns in short term horizons.