Suzlon is one of the most demanding penny stock, which is currently standing at an attractive price. Many Indian Retail Investors stay curious to know about Suzlon Share Price Target 2025. So, we have done a detailed analysis of Suzlon share price. Let’s analyze should you buy, hold, or sell Suzlon Energy Limited share.

The stock has also lost 9.3% from its 52 week high of Rs 44 hit on November 17, 2023.

About Suzlon Energy Limited

Started in 1995, Suzlon Energy Limited is a leading renewable energy company based in India, specializing in design, development, manufacturing, and operation of wind energy solutions.

The company provides renewable energy solutions and is in the business of manufacturing, project execution operation and maintenance of wind turbine generators and sale of related components.

| Organisation | Suzlon Energy Ltd |

| Headquarters | Pune |

| Industry | Capital Goods – Electrical Equipment |

It has installed 20+ GW of wind energy in 17 countries and 111+ wind farms with a capacity of 13,880 MW. The company’s client portfolio includes power utilities and electricity producers in both the private and public sectors.

Today, the company has established its presence in 18 countries and is known as a global renewable energy solutions provider.

In 2008, the company was trading at a price of around Rs. 398 – 400. However, after 2008, the company’s share price started declining and started trading between Rs.1.90 to 8. Even till May 2023, the stock was stuck between Rs. 8 to 9.

If you want to buy Suzlon Share, you must have Demat Account, you can easily open Zerodha Demat Account here.

Also Check: Yes Bank Share Price Target 2025

One question that arises is why did Suzlon fall in 2008.

The reason for Suzlon’s share fall in 2008 was the market crash and crises. At that time, Suzlon was on the expansion stage and hence, started taking huge debts to expand business entirely on European and US markets. When Lehman Brothers collapsed in 2008 Suzlon made huge losses in both regions due to the global economic crisis.

However, the company’s management focused on restructuring its business and debt management. Consequently, Suzlon has successfully reduced its debt in the past few years.

Now, the stock has started gaining momentum, which is making Suzlon an attractive option to buy as the stock has broken its resistance level of RS. 9 – 10 and started trading above Rs. 14. As of 09.09.2023, the stock is trading at RS. 40.

Suzlon Share Price Target

As we discussed above, in September 2023, Suzlon Energy stock gave a breakout and reached the level of Rs. 25. According to current analyst opinions, a breakout over Rs 42 could steer upside in the direction of Rs 50. The estimated target price is based on the company’s current financial performance and growth prospects, as well as the overall economic conditions of the country.

Suzlon Share Price Target 2024

Suzlon Share Price Target 2024: The Suzlon share price target for 2024 ranges between a minimum of ₹45 and a maximum of ₹55, with an average target of ₹50.

Suzlon Share Price Target 2025

Suzlon Share Price Target 2025: The Suzlon share price target for 2025 is from minimum ₹56 to maximum ₹69, with an average target of ₹63.

Suzlon Share Price Target 2026

Suzlon Share Price Target 2026: The target for Suzlon energy for 2026 is from minimum ₹70 to maximum ₹86, with an average of ₹78.

Suzlon Share Price Target 2030

Suzlon Share Price Target 2030: By 2030, we can expect the Suzlon share price target between ₹172 and ₹210, averaging at ₹191.

Also Check: Tata Steel Share Price Target 2025

Also Check: Tata Power Share Price Target 2025, 2026, 2027, 2030?

Reasons for the sudden increase in Suzlon’s share price in Aug – Sep 2023

One of the primary reasons to increase Suzlon’s share price is its strong results for the Jan – Mar 2023.

Although the income from operations witnessed a yearly decline of 35.4%. However, the company is winning from losses to profits.

Suzlon Energy Positive and negative insights

| Positive impact | Negative impact |

| Mutual Funds have increased holdings from 0.74% to 4.98% in Aug 2023 quarter | Retail Investor have decreased holdings from 71.78% to 64.93% in Aug 2023 quarter |

| In the last 6 months, SUZLON stock has moved up by 180.2% | Promoters have decreased holdings from 14.50% to 13.29% in Aug 2023 quarter |

| In the last 3 years, SUZLON has outperformed top 5 stocks with highest market-cap in Renewable Energy Equipment & Services | |

| Revenue is up for the last 3 quarters, 1.44K Cr → 1.95K Cr (in ₹), with an average increase of 13.2% per quarter | |

| Netprofit is up for the last 3 quarters, 57.43 Cr → 279.89 Cr (in ₹), with an average increase of 49.4% per quarter | |

| Foreign Institutions have increased holdings from 7.80% to 9.97% in Aug 2023 quarter |

As the Suzlon share price targets are based on the fundamental, and technical analyses. Let’s have a look at the fundamental & technical analysis of Suzlon Energy for Suzlon Share Price Target 2025.

Also Check: Tata Motors Share Price Target 2025

Also Check: Wipro Share Price Target 2025 | What will be the Wipro share price target in 2023, 2024, 2025, and 2030?

Suzlon Share Price Target from 2023 to 2030

| Suzlon Share Price Target | Minimum Target | Maximum Target |

| 2023 | ₹28 | ₹32 |

| 2024 | ₹45 | ₹55 |

| 2025 | ₹56 | ₹69 |

| 2026 | ₹70 | ₹78 |

| 2027 | ₹65 | ₹70 |

| 2030 | ₹172 | ₹210 |

Fundamental Analysis of Suzlon

Revenue: Suzlon Energy Ltd’s revenue fell -64.44% since last year’s same period to ₹1,351 Cr in Q1 2023-2024. Comparing the quarterly growth of Suzlon, the company has generated a -29.8% fall in its revenue in the last 3 months.

Net Profits: Suzlon Energy Ltd’s net profit fell -95.85% since last year’s same period to ₹101 Cr in Q1 2023-2024. Comparing the quarterly growth of Suzlon, the company has generated -a 63.95% fall in its net profits in the last 3 months.

Net Profit Margins: Suzlon Energy Ltd’s net profit margin fell -88.34% since last year’s same period to 7.37% in Q1 2023-2024. On a quarterly growth basis, Suzlon Energy Ltd has generated -a 48.64% fall in its net profit margins in the last 3 months. Suzlon Share Price Target 2025.

Also Check: Yes Bank Share Price Target 2025

Also Check: LIC Share Price Target 2025

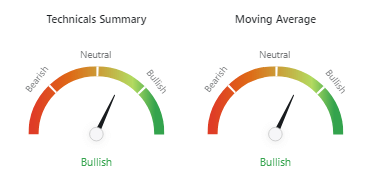

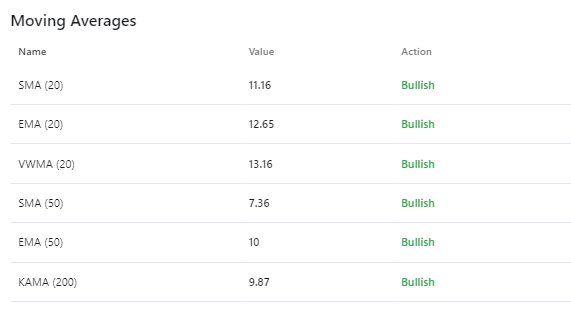

Technical Analysis of Suzlon Share Price

Suzlon Energy Ltd is currently in a Bullish trading position according to technical analysis indicators.

Reasons to Increase Suzlon’s Share Price

Here are some reasons that could contribute to an increase in Suzlon’s share price:

Growing Renewable Energy Demand: As the world continues to focus on reducing carbon emissions and transitioning to cleaner energy sources, there is a growing demand for renewable energy solutions. Suzlon, as a wind energy company, stands to benefit from this global shift.

Government Policies and Incentives: Supportive government policies, subsidies, and incentives for renewable energy projects can create a favorable operating environment for companies like Suzlon. Any positive changes in these policies can boost the company’s growth prospects.

Expansion of Wind Energy Capacity: Suzlon’s ability to expand its wind energy capacity through new installations and projects can drive revenue growth. Expanding the company’s presence in emerging markets with strong wind resources can be particularly beneficial.

Technological Advancements: Improvements in wind turbine technology can lead to increased efficiency, reduced maintenance costs, and higher energy output. Suzlon’s ability to adapt and innovate with these technologies can enhance its competitiveness.

Suzlon dividend history

| Ex Dividend Date | Type | Dividend Amount | Declaration Date | Record Date |

| 17/07/2008 | CASH | ₹1 | 20/05/2008 | 21/07/2008 |

| 16/03/2007 | CASH | ₹5 | 12/03/2007 | 20/03/2007 |

Suzlon Competitors

Conclusion on Suzlon Share Price Target 2025

I hope you are now aware of the Suzlon Share Price Target 2025 based on our Fundamental and Technical Analysis. If you want any more information, then you can ask by commenting. We will try our best to reply to you. And please share this article if possible.