The Zerodha kite app is very famous among traders and investors who have a Zerodha account to buy or sell shares. In this article, we have explained in detail How to Buy Shares in Zerodha Kite Long Term.

If you are a beginner and have no idea how to buy shares in Zerodha Kite App or web browser. Don’t worry, this article is for you.

Let us first clarify few questions for you:

How can I buy stock in Zerodha for long term?

You can login to the Zerodha Kite app, add stock in your watchlist, and then click on the Buy button to buy stock in Zerodha for Long term. Make sure to select the CNC option in the buy window to buy shares for the long term. We have explained in detail the step by step process in this article How can I buy stock in Zerodha for long term? (Scroll down to read)

Is Zerodha safe for long term investment?

Yes, Zerodha is completely safe for long term investment. It is one of the reputed trading brokers with the highest client base. In case you want to read my honest review on Zerodha, you can read here Is Zerodha Good For Beginners In India 2024? Honest Review. Read more for How to Buy Shares in Zerodha Kite Long Term.

Also Check : How to Add Nominee In Zerodha Kite Mobile App In Just 5 Min?

How to Buy Shares in Zerodha Kite Long Term from Desktop Browser

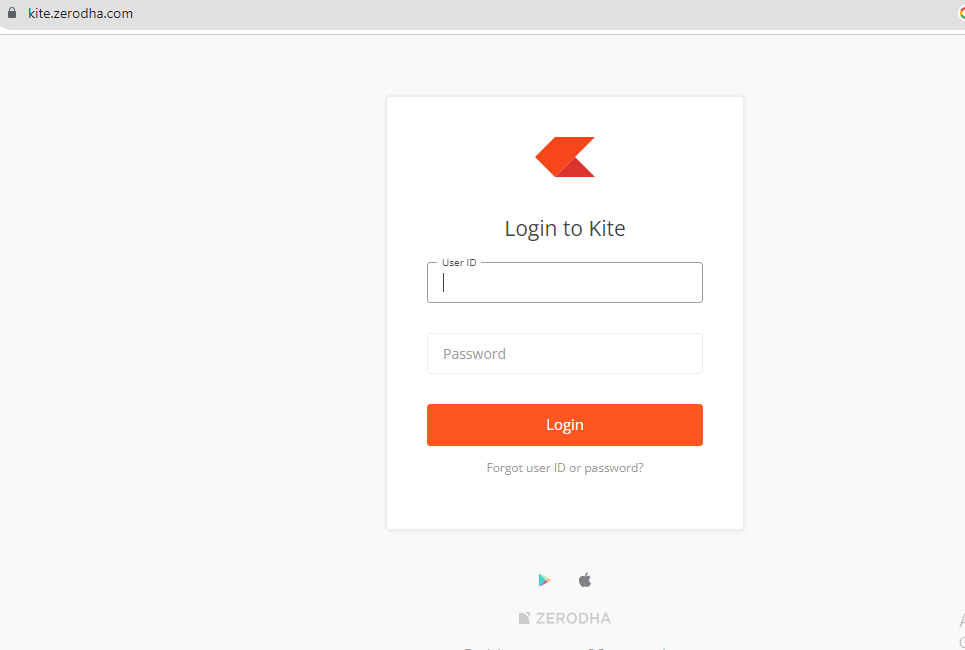

Step 1: Visit Kite.Zerodha.com.

Step 2: Log in with your Username and Password. Zerodha trading platform screen is as shown below:

Step 3: To buy the stock, type the name of the company you want to buy in the ‘Watchlist’ on the left side. For example, if you wish to buy shares of ‘Tata Motors’, type the name and click on ‘B’.

If you are interested in buying shares in US market, then check Can I Invest In US Stock Market From India Using Zerodha 2024?

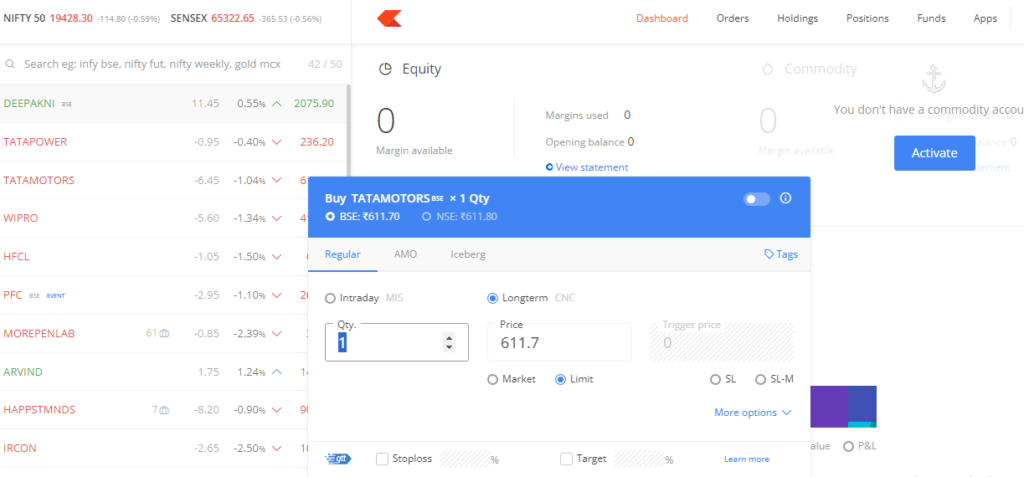

Step 4: Once you click on “B”, a new window will open in front of you, like this:

Let’s understand all the points about buying shares in Zerodha Kite

- Select the exchange: BSE or NSE.

- Product Type: MIS (Intraday) and CNC (long term) (in case you want to know how to convent MIS to CNC, check here)

- Quantity (Qty): The number of shares you want to buy

- Price: The price at which you want to buy the share. If you want to buy stock at the market price. then keep this option blank.

- Order Types: You can choose between a market order, a limit order, or a stop loss order.

Market Order (Market): A Market order is like telling the seller, “I want to buy or sell this stock right away at whatever the current price is.” Your order will be executed at the current market price.

Limit Order (Limit): A limit order means, “I want to buy or sell this stock, but only at a specific price or better (my choice, my rules).” So, if you want to buy that stock, you’ll only buy it if the price is within your set budget. Your order will be executed when the stock price is within your set budget or price better than your limit price.

Stop Loss Limit Order (SL): A stop loss limit order is like “If the price of this stock drops to a certain level, I want to automatically sell. It’s like saying, “If my stock’s price falls to this point, I’ll only sell it if I can get a good price around there.” It helps to prevent big losses.

Stop Loss Market Order (SL-M): “If the price of this stock drops to a certain level, I want to sell it immediately at whatever price is available.” It’s like saying, “If my stock’s price reaches this point, just sell it as fast as possible, even if the price isn’t great.” This helps you quickly get out of the stock to prevent bigger losses.

Also Check: What is BO and CO in Trading 2024? (Clear Examples and Explanations)

6. Margin required: At the bottom of the box, you will find the ‘Margin Required’ number. This means, how much funds you should have in your demat account to buy shares. It will be reflected once you fill in the quantity and price in the above boxes.

Step 5: Once you have filled in all the details, click on Buy’.

Now, how to check your executed order after How to Buy Shares in Zerodha Kite Long Term process.

Simply go to the ‘Orders’ tab and check if your order has been successful or not.

How to buy shares on Zerodha Kite Long Term from Mobile Phone?

Here is the step-by-step process on How to buy shares on Zerodha Kite Long Term from Zerodha Kite App.

Step 1: If you are a new user, download and install the ‘Kite’ app from the Android Play Store or iOS App Store.

Step 2: Log in to the Zerodha Kite App with your Username (Zerodha Client ID) and Password.

Step 3: Here, you can see the ‘Watchlist’.

Step 4: In ‘Search & Add’ type the name of the company whose share you want to buy. For example; Reliance Industries. As soon, as you type Reliance, the name of the company should be displayed below, click on it.

Step 5: Now, at the bottom of the screen, there are two options: ‘Buy’ or ‘Sell’. Click on Buy and a new window will open like this:

Can I Gift Shares From Zerodha to Another Demat Account?

Step 6: Fill the required details, such as:

1. Select the exchange: BSE or NSE.

2. Product Type: MIS is for the intraday and CNC is for the long term

3. Quantity (Qty): The number of shares you want to buy

4. Price: The price at which you want to buy the share. If you Want to choose the market order, Then keep this option blank.

5. Order Types: You can choose between a market order, a limit order, or a stop loss order.

Market Order (Market): A Market order is buying the stock at whatever the current price is.

Limit Order (Limit): A limit order means buying the stock at your desired place. Your order will be executed when the stock price is within your set budget/limit.

Step 5: Now, click on Buy’.

You can see the buying orders under the “Order” tab. How to Buy Shares in Zerodha Kite Long Term

How Much Do Day Traders Make Per Month 2024? | Can Intraday Make You Rich? | Day Trader Salary

Conclusion

It is an easy process to buy shares in Zerodha Kite long term, simply follow these steps. If you want to buy shares for the long term, make sure to select the CNC option and check the margin at the bottom. It will tell you how much money you need to buy shares.

I hope the above explanation on “How to Buy Shares in Zerodha Kite Long Term” helps you understand how to buy shares in Zerodha Kite Long Term. If you are still stuck anywhere, just post a comment, and I’ll guide you.

Keep Learning, Keep Earning !!