Gifting is always a grateful gesture towards your loved ones; be it your family or friends. But, how about gifting shares in your loved ones’ accounts and helping them to grow financially? If you also want to Gift Shares from Zerodha to Another Demat Account, then you are at the right place.

We have covered all your questions and answers related to gifting shares through the Demat account, i.e. Can I Gift Shares from Zerodha to Another Demat Account? If yes, how can I gift stock to my family members or friends?

Let’s explore this in detail Can I Gift Shares From Zerodha to Another Demat Account in 2023?

Can you gift stock for free?

Yes, Zerodha users can gift Stocks, ETFs, and gold bonds to anyone with a Zerodha account. You and the recipient (to whom you wish to send the gift), both must have a Zerodha account to send and receive the gift.

If the recipient does not have a Zerodha account, they can create a new account and receive the gift.

Is Varsity by Zerodha Free 2023? Zerodha Varsity Mobile App Review

What is the charges for gifting stocks in Zerodha?

Zerodha charges a standard off-market transfer fee of ₹25 or 0.03% per stock, + 18% GST whichever is higher. The charges are automatically debited from the sender’s trading account.

There are no additional or hidden charges for gifting securities in Zerodha. Let’s understand with an example Can I Gift Shares From Zerodha to Another Demat Account in 2023:

| Share | Quantity | Share Price | Share Amount | Off-market transfer fee at 0.03%(in Rs) (a) | Off-market transfer fee at Rs. 25 (b) | Gifting charges will be the higher of (a) or (b) |

| Tata Power | 50 | 300 | 15000 | 4.5 | 25.00 | 25.00 |

| HAL | 20 | 3000 | 60000 | 18 | 25.00 | 25.00 |

| Reliance | 40 | 3800 | 152000 | 45.6 | 25 | 45.60 |

| Applicable fees | 95.60 |

A few Things you should know before gifting shares from Zerodha to another demat account

Here are a few limitations of Can I Gift Shares From Zerodha to Another Demat Account in 2023? You can say that you should know while gifting stocks from Zerodha to another Demat Account:

1. You can only gift stocks to the person who has a Zerodha account.

2. You cannot gift stocks to your own account.

3. You need to consider the tax implications on stock gift amounts above Rs. 50,000.

If you want to transfer shares from Upstox to Zerodha Demat account, then you can follow the process in our detailed guide on How to transfer shares from Upstox to Zerodha for a better understanding.

What are the tax implications of gifting shares?

The tax implications depend on the value of the stocks gifted. The recipient may have to pay tax if the value of the gift exceeds ₹50,000.

Also Read: How to Do Intraday Trading in Zerodha 2023 (5 Simple Steps)

How to gift shares from Zerodha to another demat account?

You can gift shares from Zerodha to another Demat account with the simple steps mentioned below:

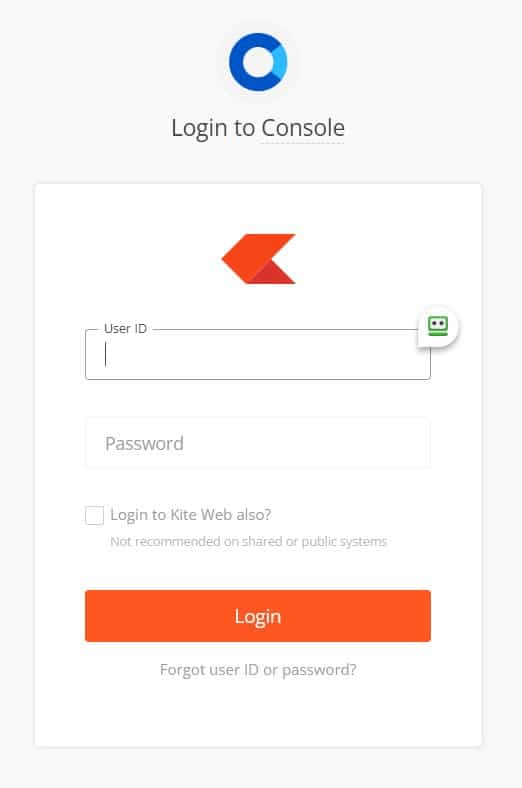

Step 1: Log in to console.zerodha.com Zerodha account.

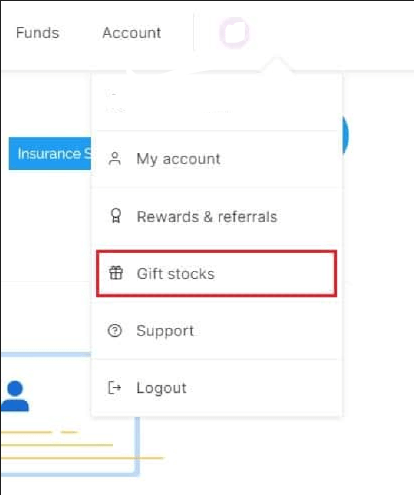

Step 2: Click on the top right Client ID.

Step 3: Click on the “Gift stocks” option

Step 4: Enter the recipient’s name, mobile number, email address (optional), and gift message (optional) and click on continue.

Step 5: Select the stocks and quantity you wish to gift.

Note: Here the available quantity means the number of shares you hold in your Demat of that particular stock.

Step 6: Click on the “Confirm & Send.” As you confirm, Zerodha sends an email and SMS notification to the recipient of the gifted stocks. The recipient has to accept the gift within 7 days.

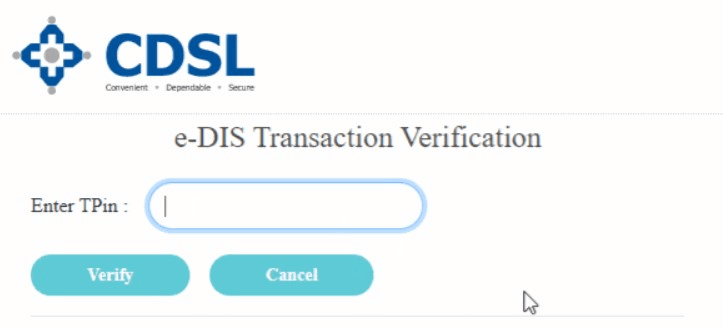

Step 7: Once the recipient accepts the gift, you will get an email and SMS notification to approve the gift. Just click on “Approve” from your Console’s gift stocks page. It will take you to the CDSL portal, where you need to authorize your share transfer using CDSL TPIN at the CDSL portal.

Step 8: After authorizing, the securities are moved to the recipient’s demat account.

How to do Option Trading in Zerodha Kite App 2023? Activate Options in Zerodha (F&O)

How to Accept Gifted Stocks in Zerodha?

Once you have been gifted stocks on Zerodha by following the above procedure, you need to accept the gift to add them to your demat account. Here are the steps to accept gifted stocks in Zerodha:

Note: As we have discussed in Step 6 above, once you click on the “Confirm & Send,” Zerodha sends an email and SMS notification to the recipient of the gifted stocks. The recipient has to accept the gift within 7 days.

Step 1: Recipients need to click on the link they have received in the email or SMS regarding gifted stocks.

Step 2: Login to Zerodha account and click on “Accept gift”.

Now the sender will have to follow step 7 (as mentioned in the above heading) to approve the request further using CDSL TPIN and after that stocks will be reflected in your holdings.

Conclusion – Can I Gift Shares From Zerodha to Another Demat Account?

In conclusion of Can I Gift Shares From Zerodha to Another Demat Account in 2023? The ability to gift shares from a Zerodha Demat account to another Demat account offers a convenient and thoughtful way to transfer ownership of securities.

While gifting shares can be a wonderful gesture for family members or loved ones, it’s crucial to comprehend the tax implications, potential capital gains, and any specific requirements set by Zerodha or the respective depositories.

How to Add Nominee In Zerodha Kite Mobile App In Just 5 Min?

Frequently Asked Questions

Is transfer of shares as a gift taxable?

There is no tax implication on the transfer of shares as a gift up to Rs. 50,000. However, if the gift exceeds Rs. 50,000, then the recipient may have to pay tax.

Can I transfer shares to a family member?

Yes, you can transfer shares to a family member through CDSL under the “Gift stocks” option and enter the recipient details such as name, mobile number, and email ID.

What are the charges for share transfer in Zerodha?

Zerodha charges a standard off-market transfer fee of ₹25 or 0.03% per stock, + 18% GST whichever is higher. The charges are automatically debited from the sender’s trading account.

How do I gift shares through CDSL?

Once the recipient accepts the gift, you will get an email and SMS notification to approve the gift. Just click on “Approve” from your Console’s gift stocks page. It will take you to the CDSL portal, where you need to authorize your share transfer using CDSL TPIN at the CDSL portal.

Can I gift my shares to a friend?

Yes, you can transfer shares to a friend through CDSL under the “Gift stocks” option and enter the recipient details such as name, mobile number, and email ID.