Intraday trading is a type of trading in which you buy and sell stocks Same day. This means that you do not hold the stocks overnight. Intraday trading can make you rich, but it also carries a high risk. Therefore, it is important to understand the risks before you start intraday trading. If you are looking to learn how to do intraday trading in Zerodha, you have come to the right place.

In this article, we have discussed the steps on how to do intraday trading in Zerodha. We will cover everything from opening a Zerodha trading account, and Zerodha intraday charges, to placing buy and sell orders. We will also discuss some of the risks associated with intraday trading and how You can reduce such risks.

By the end of this guide, you will have a good understanding of how to do intraday trading in Zerodha. You will also have the experience and knowledge to make informed decisions about your trades.

How To Do Intraday Trading in Zerodha?

To do intraday trading in Zerodha, you must have a Zerodha trading account. You can open a Zerodha trading account quickly. Once you have a Zerodha trading account, you can use the Zerodha Kite trading platform to do intraday trading.

Make sure to know about the Zerodha Brokerage Charges, Fees, AMC, Transaction Charges before starting intraday trading in Zerodha

In case you want to buy shares in Zerodha for Long term also, check the process How to Buy Shares in Zerodha Kite Long Term 2024?

Are you looking to open zero brokerage trading account, then must check my reviews on:

Is Finvasia Trusted or Not? | Shoonya Finvasia Charges 2024

Is Dhan Trading App Safe? Dhan App Review 2024

How to use the Zerodha Kite trading platform?

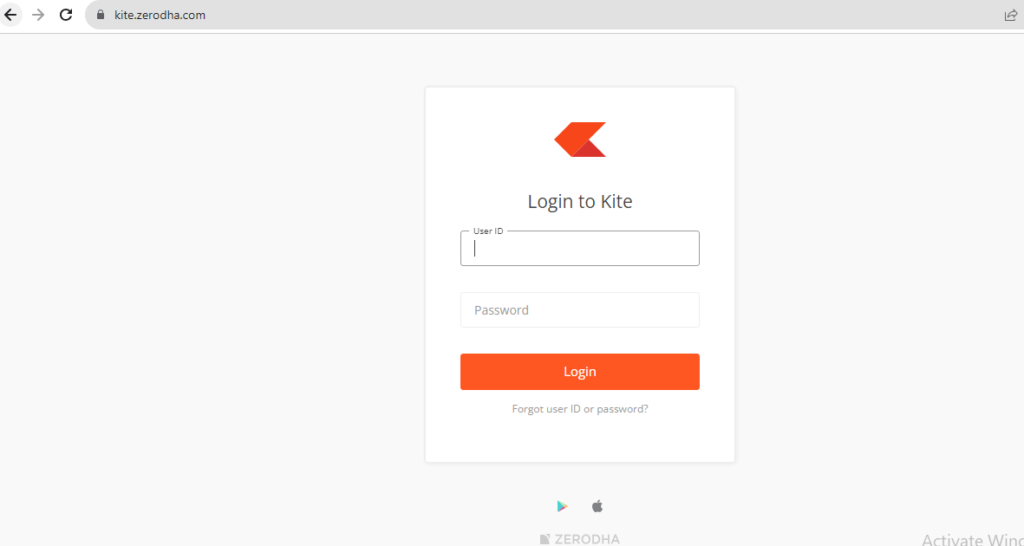

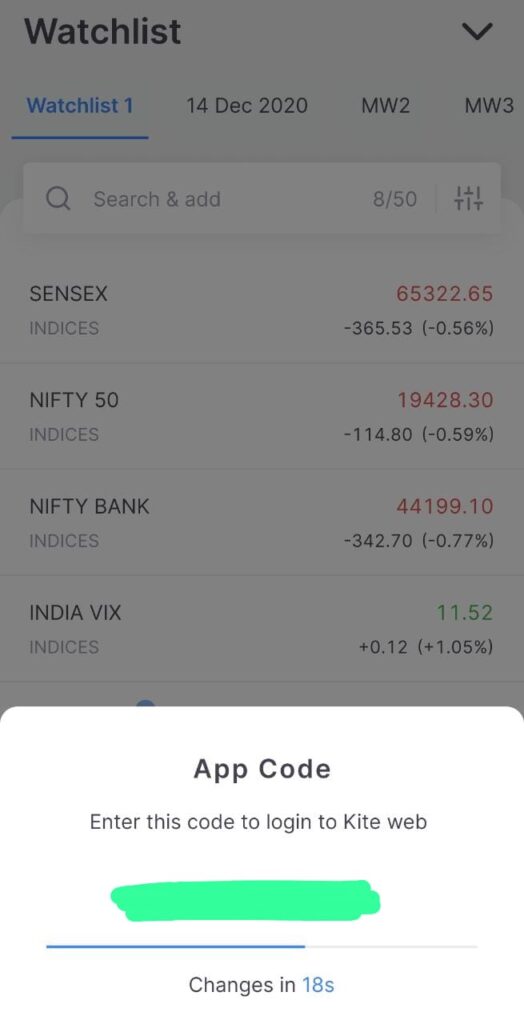

Step 1: Log in to the Zerodha Kite trading platform

The first step is to open the Zerodha Kite trading platform https://kite.zerodha.com/ and log in with your user ID and password. It will ask you to enter an “App code” for authentication. You will receive this app code on your mobile phone zerodha kite app.

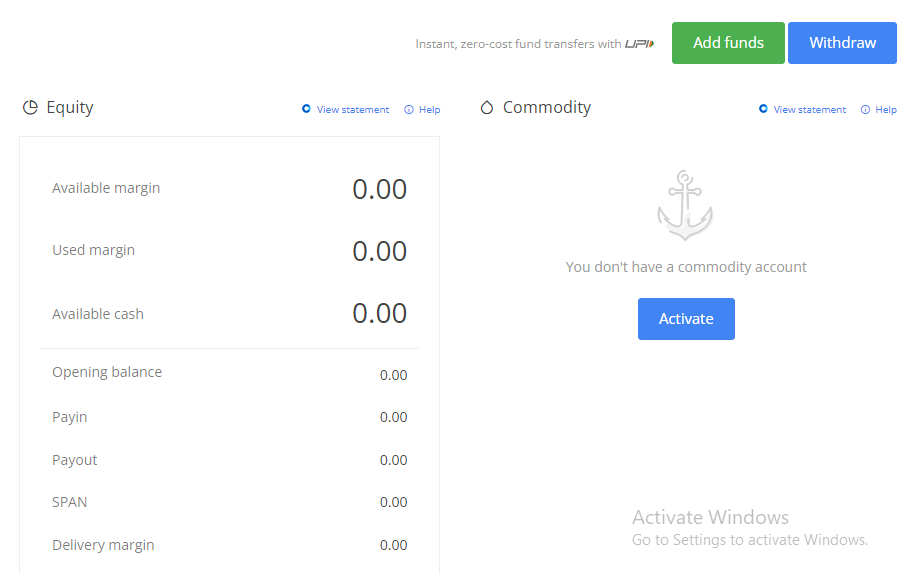

Step 2: Add funds to Zerodha’s account

The next step is to add funds by clicking on add funds option and entering the amount. Now select The option from UPI or Netbanking. How to do intraday trading in Zerodha.

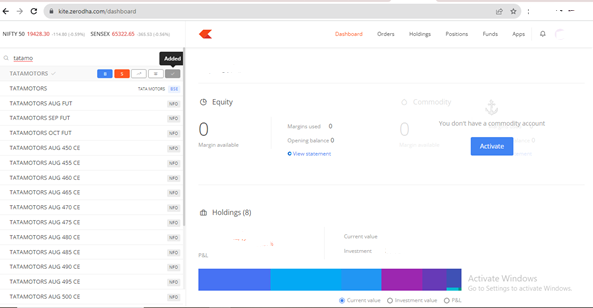

Step 3: Select the stock you want to trade

The next step is to select the stock you want to trade. You can write the name of the stock in the search option and at the stock in the watchlist. You can add up to 50 stocks in one watchlist and also create multiple watchlists as per your requirements.

You can also check my guidance, I have explained practically How Do I Choose Which Stocks To Buy For Intraday? (Practical Ways)

Try these 5 Best Indicators for Intraday Trading to select stocks

How to place buy and sell orders

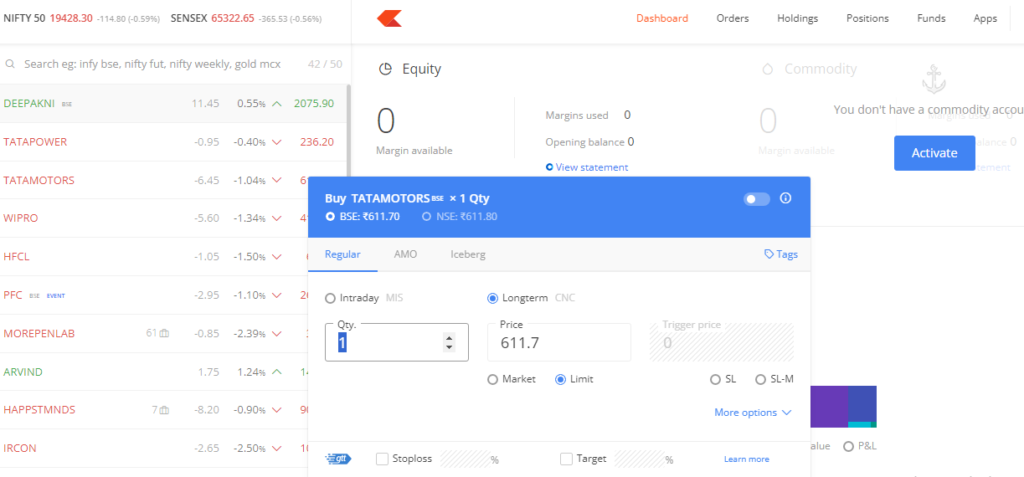

Step 4: Place a Buy Order

If you want to buy the stock, you will need to place a buy order. To do this, click on the “Buy” button. You will then need to enter the number of shares you want to buy and the price At which you want to buy the stock. Once you have entered the details, click on the “Place Order” button.

Let’s understand the necessary options in front of you while placing a buy order:

Quantity (Qty): The number of shares you want to buy

Price: the price at which you want to buy the share. If you Want to choose the market order, Then keep this option blank.

Product Type: MIS is for the intraday and CNC is for the long term

- MIS stands for Marginal Intraday Square Off. These types of orders are placed by the traders for Intraday trading using leverage. If one does not square off its positions, then the Zerodha square off the positions automatically at 3:20 PM.

- CNC states for Cash and Carry. This order can be placed for more than 1 day and it is not for intraday trading.

Order Types: You can choose between a market order, a limit order, or a stop loss order.

Market Order (Market): A Market order is like telling the seller, “I want to buy or sell this stock right away at whatever the current price is.” your order will be executed at the current market price.

Limit Order (Limit) : A limit order means, “I want to buy or sell this stock, but only at a specific price or better (my choice, my rules).” So, if you want to buy that stock, you’ll only buy it if the price is within your set budget. Your order will be executed when the stock price will be within your set budget or price better than your limit price.

Stop Loss Limit Order (SL): A stop loss limit order is like “If the price of this stock drops to a certain level, I want to automatically sell. It’s like saying, “If my stock’s price falls to this point, I’ll only sell it if I can get a good price around there.” It helps to prevent big losses.

Stop Loss Market Order (SL-M): “If the price of this stock drops to a certain level, I want to sell it immediately at whatever price is available.” It’s like saying, “If my stock’s price reaches this point, just sell it as fast as possible, even if the price isn’t great.” This helps you quickly get out of the stock to prevent bigger losses.

Want to start Trading? Get your Free PDF on How To Make Money Trading With Candlestick Charts?

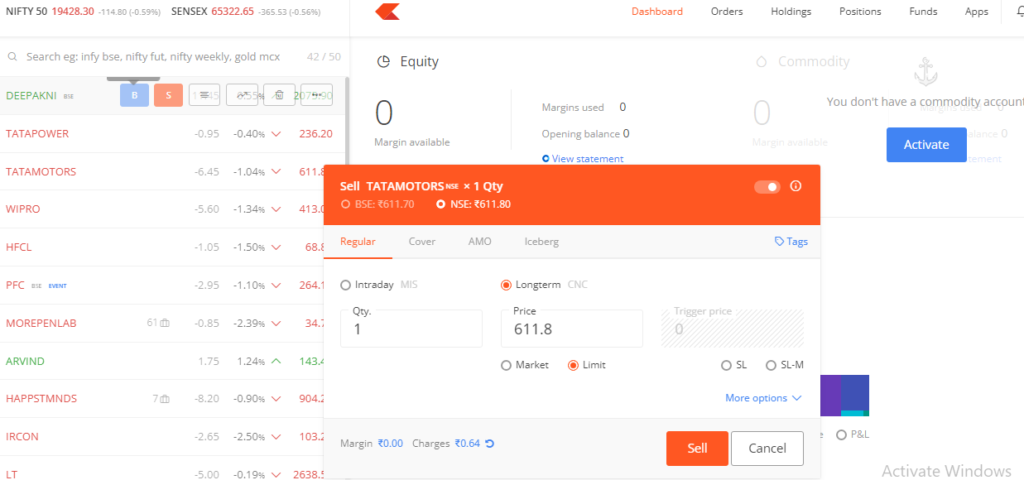

Step 5: Place a sell order (Exit your trade)

If you want to sell the stock, you will need to place a sell order. To do this, click on the “Sell” button. You will then need to enter the number of shares you want to sell and the price at which you want to send. you want to sell at. Once you have entered the details, click on the “Place Order” button.

Also Check: Can I Open Two Demat Accounts With One PAN Card in Zerodha 2024?

Intraday Order Types in Zerodha

Cover Order in Zerodha

Cover order works as a risk mitigation option. It means “I want to buy or sell this stock, but I also want to set a safety net.”

When you place a cover order, you actually place two orders at once: a main order to buy or sell the stock and a “cover” order to set a stop loss. If the stock’s price moves against your expectations, the cover order helps you limit potential losses by automatically selling or buying at a certain point.

After Market Order (AMO) in Zerodha

After Market Order is placed if you have missed trading within market hours. It allows you to place an order after market hours for the next day as soon as the market opens.

So, if you know you’ll be busy when the market opens, you can still place your orders in advance.

Here are the timings of AMO in Zerodha:

- NSE – 3:45 PM to 8:57 AM

- BSE – 3:45 PM to 8:59 AM

Best Time Frame for Intraday Trading? Intraday Trading Time Analysis

IceBerg in Zerodha

An iceberg order in Zerodha is like placing a big order for stocks in smaller pieces. You’re not showing the entire order to everyone in the market at once, instead, you send each small order for execution once the previous order has been executed.

Each small order is called a leg in Iceberg. You can decide no. of legs you want to divide a big order into.

Iceberg can be useful when you’re buying or selling a large amount of stock and you don’t want to immediately affect the stock’s price by executing the whole order in one go.

Zerodha Intraday Trading Timing

- Regular Trading Days (Monday to Friday)

- Market Opening Time: 9:15 AM (Indian Standard Time, IST)

- Intraday Closing Timings: 3:20 PM (IST)

Note: If you have open Intraday positions and do not square off till 3:30 pm, it will automatically square off all the intraday positions at 3:20 PM.

Zerodha Intraday Trading Charges

Below are the charges levied in the Zerodha intraday trading –

| Particulars | Charges |

| Brokerage | 0.03% or ₹20/executed order whichever is lower |

| STT/CTT | 0.025% on the sell-side |

| Transaction Charges | NSE: 0.00325% BSE: 0.003% |

| GST | 18% on (brokerage + transaction charges) |

| SEBI Charge | ₹5/Crore |

| Stamp Charges | 0.003% or ₹300/crore on buy-side |

Zerodha Intraday Charges Calculator

If you want to calculate estimated Zerodha Brokerage charges in advance, you can use: Zerodha Intraday Charges Calculator and if you want to understand what type of charges Zerodha charges, you can check here: Zerodha Brokerage Calculator Free Intraday, Delivery, & F&O 2024

Frequently asked questions

What is the Zerodha Intraday Square off-timings?

Zerodha’s intraday square-off timings are 3:20 PM (IST). If you miss squaring off the MIS position, then Zerodha will automatically square off the open positions.

How much Zerodha charge for intraday?

Zerodha charges a flat brokerage fee of ₹20 per executed order for intraday trading, regardless of the trade size.

What is Intraday MIS in Zerodha?

Intraday MIS (Margin Intraday Square-off) is a product type offered by Zerodha. It allows you to trade with higher leverage for intraday positions. However, at the end of the day (intraday square off timings 3:30 pm) all positions under MIS are automatically squared off by Zerodha.

How do I start intraday for beginners?

As a beginner to start intraday trading, it’s advisable to first understand the basics of stock markets, technical and fundamental analysis, and risk management. Open a Zerodha trading account, learn about different order types, and start with small quantities.

How much money is required for intraday trading in Zerodha?

The amount of money required for intraday trading in Zerodha depends on the stocks you want to trade and the leverage you use.

How to do intraday trading step by step?

Step 1: Log in to Zerodha Kite trading platform

Step 2: Add funds to Zerodha account

Step 3: Select the stock you want to trade

Step 4: Place a buy order

Step 5: Place a sell order (Exit your trade)