Key Highlights

Withdraw Money From Groww Balance:

- Open Groww app, tap “You” then “Groww balance” then “Withdraw”.

- Enter amount and confirm.

- Money received in linked bank within 24 hours for < Rs. 25,000, longer for larger amounts.

Withdraw Money From Groww Mutual Funds:

- This is called redemption.

- Open Groww app, tap “Dashboard” and choose fund to redeem.

- Tap “Redeem”, choose units or amount, and destination (Groww balance or bank).

- Redemption takes 1-2 business days, with some funds having further processing time.

Groww Withdrawal Time:

- Groww balance: < Rs. 25,000 – within 24 hours, > Rs. 25,000 – depends on bank working hours.

- Mutual funds: 1-2 business days, with some variations.

Groww Withdrawal Charges:

- Groww charges no fees for transferring Groww balance to bank.

How To Withdraw Money from Groww App

From Groww Balance

This is the easiest way to withdraw money From Groww, as it’s like withdrawing from any digital wallet.

- Open the Groww app and log in.

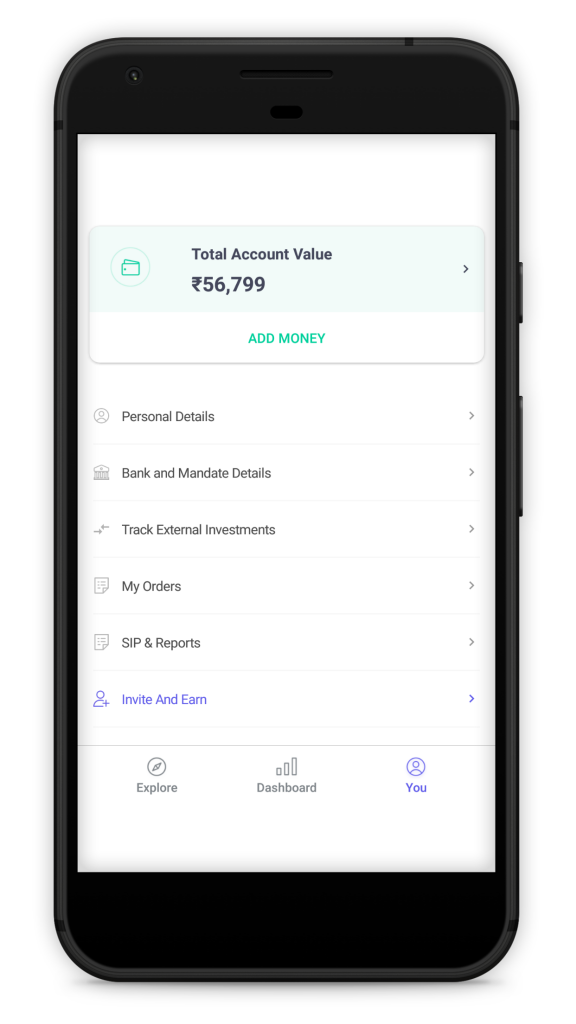

- Tap on “You” at the bottom of the screen.

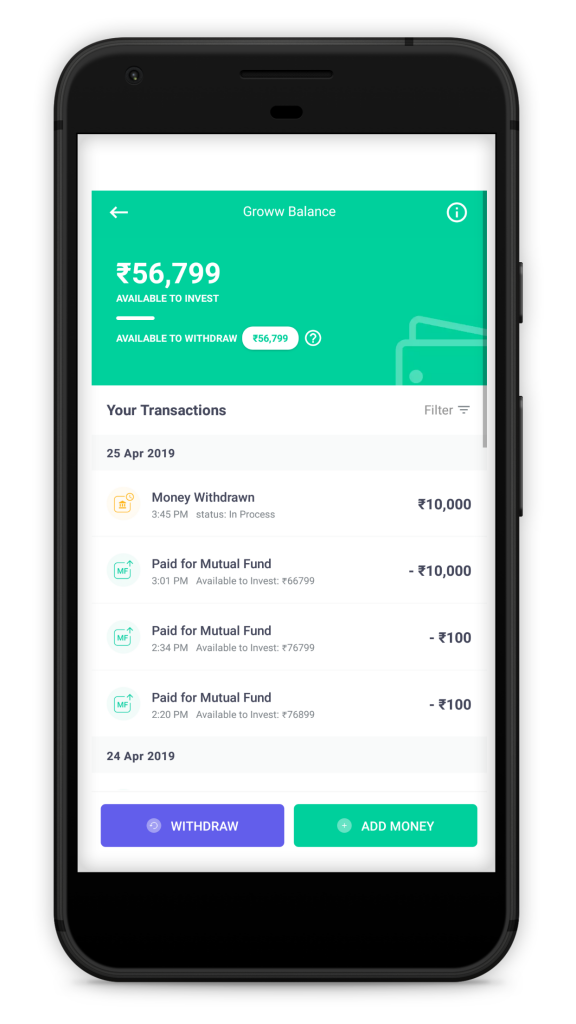

- Tap on your “Groww balance” and then on “Withdraw.”

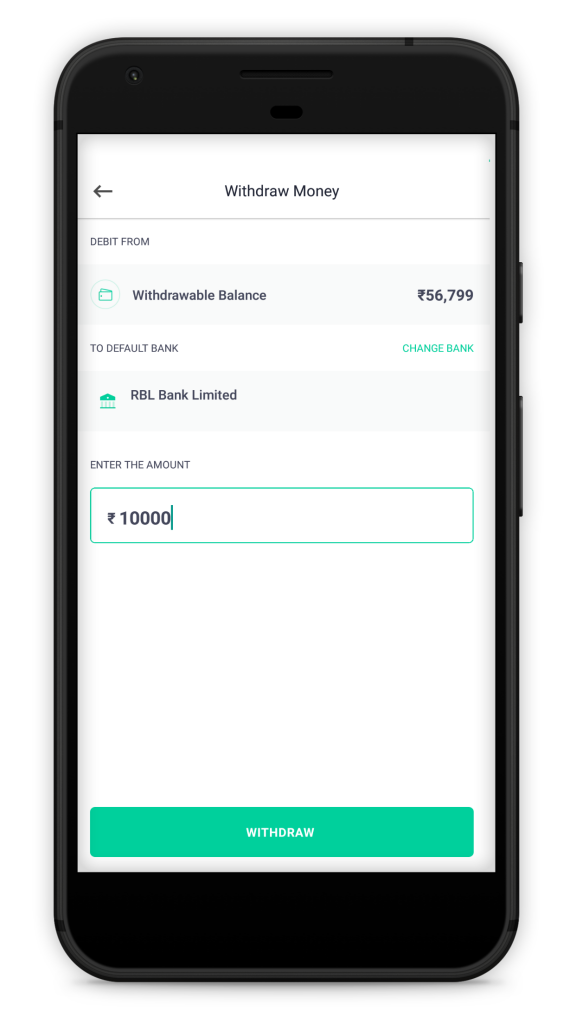

- Enter the amount you want to withdraw and click on “Withdraw” again.

The money will be credited to your linked bank account within 24 hours if the amount is less than Rs. 25,000. Larger amounts might take longer to process.

From Mutual Funds

To withdraw money From Groww mutual funds means redemption of mutual funds. Here is the process of redemption of mutual funds from Groww:

- Open the Groww app and log in.

- Tap on “Dashboard” at the bottom of the screen.

- Choose the mutual fund investment you want to redeem.

- Tap on “Redeem”.

- Choose whether you want to redeem by number of units or by amount.

- Enter the amount or units you want to redeem.

- Choose where you want the money to go: Groww balance or your linked bank account.

- Review the details and tap on “Redeem”.

The redemption usually takes 1-2 business days to complete, and the money will be credited to your chosen destination. Keep in mind that some mutual funds have exit loads, which are charges levied for selling units within a certain period. Check the specific fund details before initiating a redemption.

How To Transfer Money from Groww App To Bank Account?

Transferring or withdraw money from Groww app to your bank account is a straightforward process. You can follow the above methods we have explained to transfer money from your Groww balance or from mutual funds/securities to your linked bank account.

What Is Groww Withdrawal Time?

Groww withdrawal time depends on the source of the funds you’re withdrawing and the amount involved:

From Groww Balance:

- Under ₹25,000: Credited to your linked bank account within 24 hours.

- Above ₹25,000: May take longer. It depends on bank working hours.

From Mutual Funds:

- Redemption process usually takes 1-2 business days. Once the process is completed, the money is credited to your chosen destination (Groww balance or bank account).

- Some funds might have additional processing times.

What Are Groww Withdrawal Charges?

Groww doesn’t charge any fees for withdrawing funds from Groww balance to your linked bank account. Here are some additional things you should know:

- Withdrawing money from your Groww balance: No fees are levied for transferring it to your linked bank account.

- Redeeming mutual funds: Groww doesn’t charge any redemption fees, but specific mutual funds might have exit loads. These are charges deducted from the redemption amount if you sell units within a certain period after investment. Always check the fund details before redeeming.

- Selling securities in your trading/demat account: Groww doesn’t charge any withdrawal fees, but standard brokerage charges and other statutory fees like STT, exchange charges, etc., apply to the sale.

Images Credit: Groww

Other Groww Related Answers

Disclaimer: The information provided on this website is for general informational purposes only and should not be construed as financial advice, investment recommendations, or guarantees of any kind. This information is not intended as a substitute for professional financial advice. You should always seek the advice of a qualified financial advisor before making any investment or financial decisions.