The Eight Indian Companies that are being added to the index are:

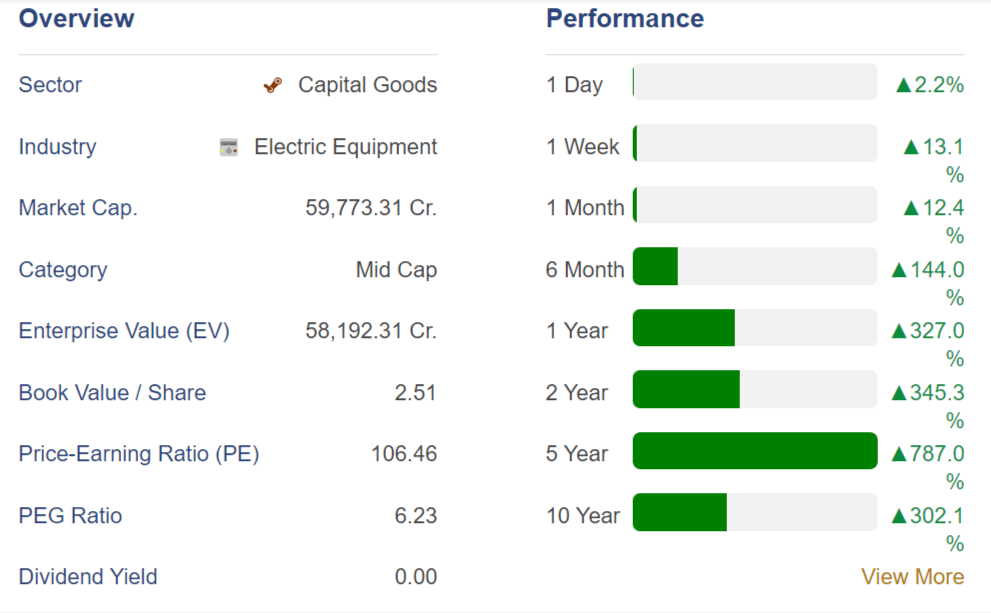

1. Suzlon Energy (Capital Goods – Electrical Equipment)

Also Check: Suzlon Share Price Target 2025 (Updated 2024)

Missed the Railway Run? Catch These 7 Aerospace & Defence Stocks Before They Take Off

2. RVNL (Infrastructure)

Don’t Miss: Top Ayodhya Stocks: 9 Stock Picks Across 3 Key Sectors to Watch

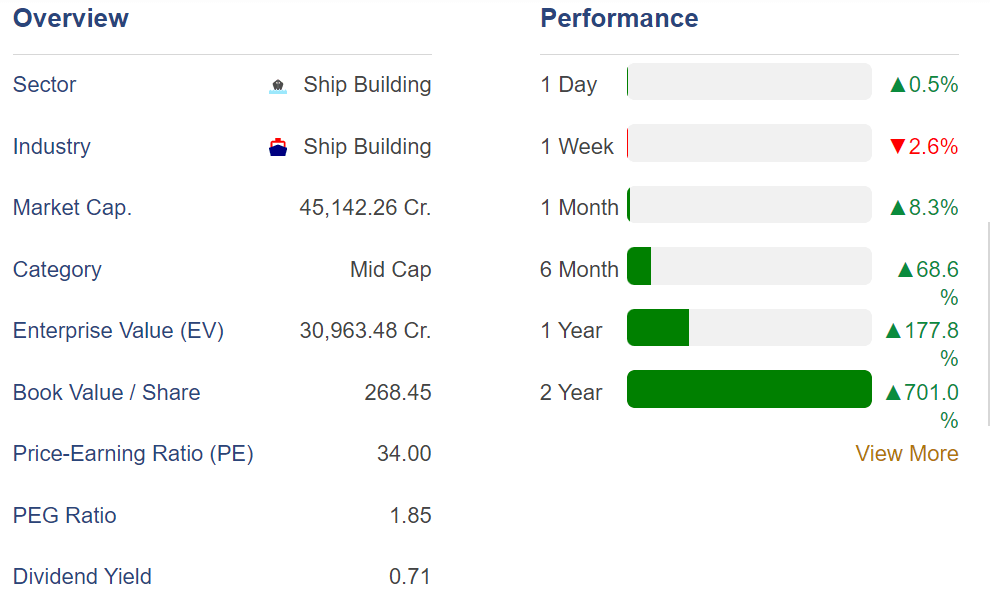

3. Mazagon Dock (Ship Building)

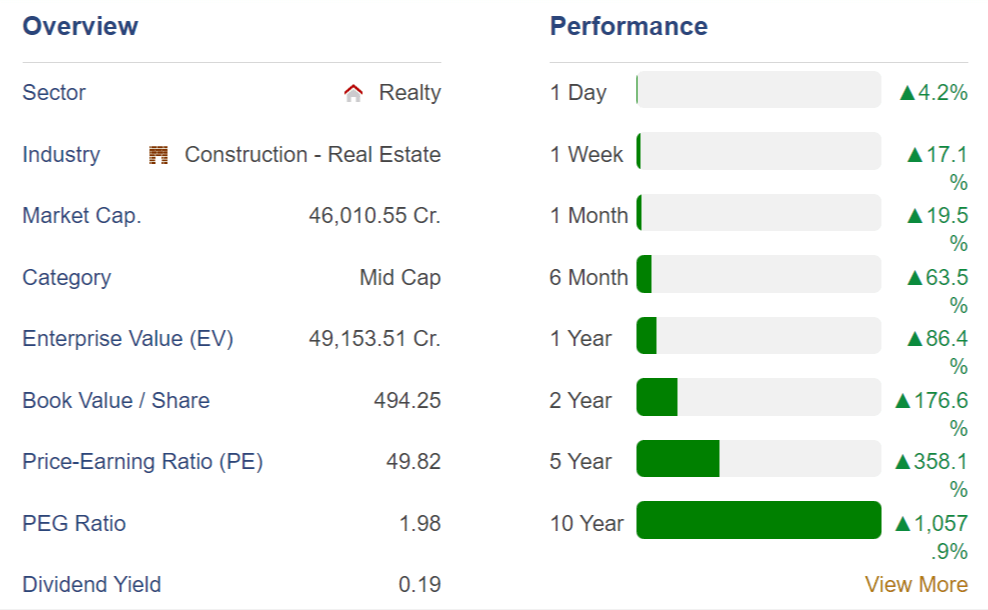

4. The Phoenix Mills (Construction)

5. Thermax (Industrial Equipments)

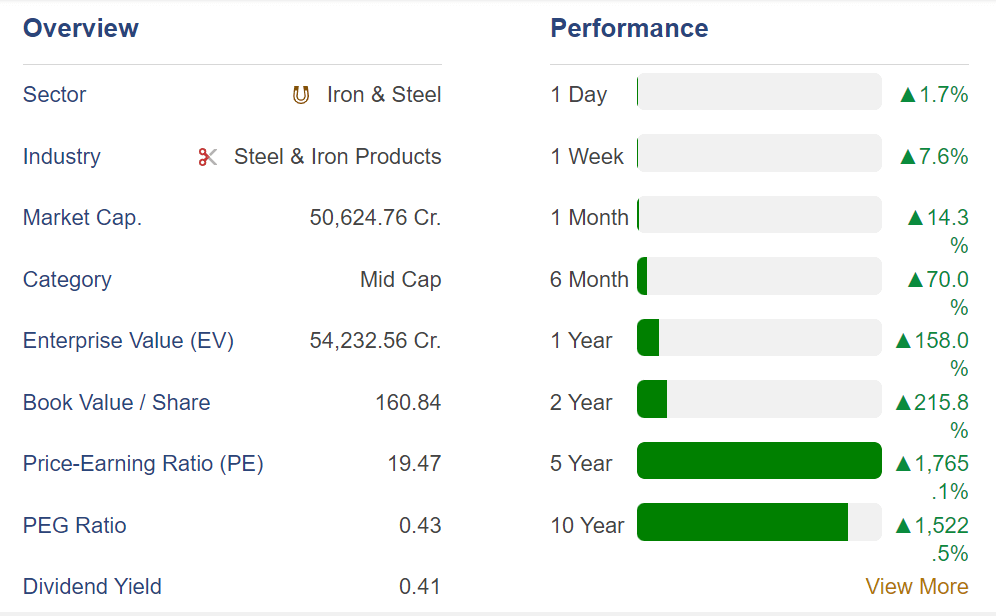

6. Jindal Stainless (Steel & Iron Products)

7. KPIT Tech (IT Software)

8. Prestige Estate (Construction – Real Estate)

These companies are all leaders in their respective industries and have strong growth prospects. Their inclusion in the index is expected to bring Rs 2650 crore into the Indian market.

This is a positive development for the Indian stock market and could lead to higher valuations for the companies that are being added to the index. It is also a sign of the growing importance of the Indian economy in the global market.

The changes in FTSE All-World and FTSE All Cap will be announced on February 16 and the adjustments will take place on March 15,

Also Check: Leading Indian Automaker’s Brand Tops 1 Lakh in FY24, Shares Jump

What is The FTSE All-World Index?

The FTSE All-World Index is a broad, market-capitalization weighted index that tracks the performance of large and mid-cap stocks from developed and emerging markets worldwide. It tracks the performance of the largest companies in the world. Being included in the index is a sign of a company’s success and can lead to increased investment from foreign investors.

Simplified Meaning:

Think of it as a giant basket containing thousands of stocks from all over the world, with each stock’s weight in the basket determined by its market value. So, bigger companies like Apple or Alphabet will have a larger representation than smaller players.

Being added to the FTSE All-World Index is a prestigious accomplishment for a company, indicating its successful performance and potential for attracting further investment, especially from international investors.

When A Stock Is Added To FTSE All-World Index?

There are two main scenarios when a stock is added to the FTSE All-World Index:

1. Semi-annual review: The index is reviewed twice a year (March and September) to ensure it accurately reflects the market capitalization of global stocks. During these reviews, companies can be added, removed, or have their weightings adjusted based on:

- Market capitalization: This is the primary factor, and only companies with sufficient market size are considered for inclusion.

- Liquidity: The stock needs to be easily traded in sufficient volume to allow investors to buy and sell shares efficiently.

- Domicile: The index covers developed and emerging markets, and there are specific limits on the number of companies from each country to maintain diversification.

- Free float: The percentage of shares available for trading by the public should be above a certain threshold.

The changes announced during these reviews take effect about one month later (mid-March and mid-September).

2. Special review: In extraordinary circumstances, the index can be reviewed outside of the regular schedule. This might happen due to:

- Corporate actions: Mergers, acquisitions, or other events that significantly change a company’s market capitalization or structure.

- Market disruptions: Major market events that require adjustments to ensure the index reflects the current market reality.

In the case of the eight Indian companies mentioned above (Suzlon Energy, RVNL, Mazagon Dock, The Phoenix Mills, Thermax, Jindal Stainless, KPIT Tech, and Prestige Estate), they are expected to be added to the FTSE All-World Index during the upcoming March 2024 review, not as a result of a special review.

Disclaimer: The information provided on this website is for general informational purposes only and should not be construed as financial advice, investment recommendations, or guarantees of any kind. This information is not intended as a substitute for professional financial advice. You should always seek the advice of a qualified financial advisor before making any investment or financial decisions.

Images Credit: stockedge