In 1990, MRF, a leading Indian tire manufacturer, embarked on a remarkable journey. Over the decade, investors experienced an astonishing 45255.09% return, reflecting the company’s significant growth and value appreciation. In this blog, I have shared a complete journey of MRF Share Price 1990 and its future potential.

MRF Share Price 1990

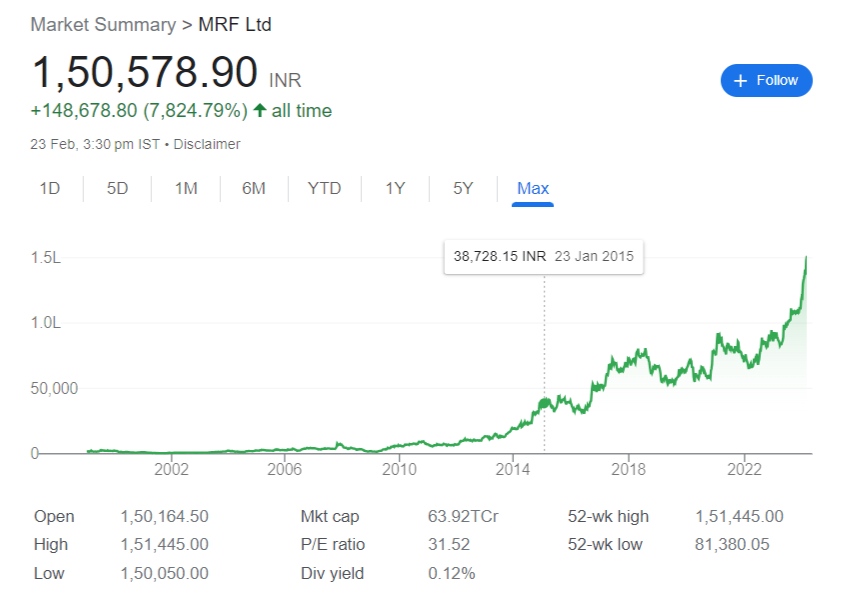

The MRF share price in 1990 was ₹332 and the MRF share price today in 2024 is INR 1,50,578.90. The stock has already generated a massive return on investment (ROI) of 45255.09%

The return on investment for MRF shares is approximately 45255.09%. This means that an investment of ₹100 in 1990 would be worth approximately ₹45255.09 today.

Return on Investment (ROI) = ((Current Price – Initial Price) / Initial Price) * 100%

ROI = ((150578.90 – 332) / 332) * 100%

ROI (MRF share price in 1990 to 2024) ≈ 45255.09%

Also Check: Tata Power Share Price Target 2025, 2026, 2027, 2030 (Updated 2024)

Also Check: Tata Steel Share Price Target 2025 (Updated 2024)

As you can see, MRF’s share price has increased significantly over the past few decades. An investment of ₹1 lakh in MRF in 1990 would be worth over ₹3 crore today!

MRF Journey of 10 Years From 2009 to 2019

The MRF’s shares grew sharply by 2,210 percent between May 11, 2009 to May 9, 2019. The stock growth consolidated to 154.83 percent in the last five years. However, the company’s shares have declined 28.72% during the last one year and 18.65% since the beginning of this year.

Let’s have a quick snippet of MRF Share price from 1990 to 2021.

MRF Share Price In 1990 To 2021

| Year | MRF Share Price |

| 1990 | 332 |

| 1991 | 350 |

| 1992 | 735 |

| 1993 | 925 |

| 1994 | 2000 |

| 1995 | 2500 |

| 1996 | 1820 |

| 1997 | 3175 |

| 1998 | 2150 |

| 1999 | 2070 |

| 2000 | 2820 |

| 2001 | 1255 |

| 2002 | 850 |

| 2003 | 915 |

| 2004 | 2459 |

| 2005 | 2700 |

| 2006 | 2895 |

| 2007 | 4425 |

| 2008 | 7300 |

| 2009 | 2094 |

| 2010 | 6595 |

| 2011 | 7529 |

| 2012 | 7950 |

| 2013 | 13850 |

| 2014 | 20150 |

| 2015 | 40288 |

| 2016 | 41399 |

| 2017 | 53500 |

| 2018 | 73412 |

| 2019 | 67422 |

| 2020 | 70964 |

| 2021 | 96456 |

| 2022 | 77255 |

| 2023 | 1,29,579 |

| 2024 | 1,50,578 |

Also Check: Leading Indian Automaker’s Brand Tops 1 Lakh in FY24, Shares Jump

MRF Share Price History Return Analyses

Beginning of MRF Share Price in 1990

MRF’s story began modestly at INR 332, laying the foundation for a future marked by exceptional growth.

MRF Share Price in 2000

By the year 2000, MRF shares established a landmark of INR 2,820, signifying a significant milestone in the company’s climb. This growth continued, reaching new heights in 2010 with shares commanding a staggering 6,595 rupees, solidifying MRF’s rising prominence.

MRF Share Price in 2015

A pivotal moment arrived in 2015, with MRF’s share price taking a monumental leap to 40,288 rupees. This rise increased the company’s position as a premier investment opportunity, attracting the attention of investors nationwide.

MRF Share Price in 2023

MRF’s journey culminated in its crowning achievement: becoming India’s most expensive stock. This title is a testament to the company’s enduring legacy, unwavering commitment to excellence, and the trust it inspires in investors. As of January 1, 2023, MRF shares reached a staggering 1,29,579 rupees, continuing to enthrall investors with their stellar performance.

The wealth-generating potential of MRF shares is truly remarkable. Imagine an investor who had the foresight to allocate just 1 lakh rupees (approximately $1,200) in 1990, when prices were 332 rupees. Today, their investment would be worth an astounding 2.8 crore rupees (approximately $340,000).

Why MRF Share Price Is So High?

MRF’s share price is indeed quite high, and there are several factors contributing to it:

Strong Brand Recognition and Market Leadership: MRF is India’s leading tyre manufacturer, enjoying a strong reputation for quality and reliability. This brand loyalty translates to consistent demand and pricing power.

Dominant Market Share: MRF holds a dominant market share in India’s two-wheeler tyre segment (over 70%) and a significant share in the four-wheeler segment. This market leadership allows them to control pricing to a certain extent. MRF share price in 1990

Profitability and Consistent Dividends: MRF has a consistent track record of profitability and has maintained a healthy dividend payout ratio of over 10% in recent years. This attracts investors seeking stable returns.

Limited Competition: The Indian tyre industry is relatively concentrated, with MRF facing limited competition from domestic and international players. This reduces price pressure and allows MRF to maintain premium pricing.

Growth Potential: The Indian automobile industry is expected to see continued growth in the coming years, which bodes well for MRF’s future sales and profitability. This growth potential further attracts investors to the stock.

Limited Public Float: MRF has a relatively low public float (less than 30%), meaning a smaller number of shares are available for trading. This limited supply can contribute to higher demand and push up the price.

Fundamental Analysis of MRF Share

About MRF Shares

- MRF has a long and successful history in the tyre industry.

- The company enjoys a strong brand reputation and financial performance.

- MRF shares have consistently delivered good returns to investors.

- The recent ₹1 lakh milestone signifies the company’s premium status in the Indian stock market.

- Official Website: https://www.mrftyres.com/

Positive Aspects:

Strong Revenue Growth: MRF has shown consistent revenue growth over the past few years, with an average CAGR of around 19% in the last 3 years and 23% in the last 10 years. This indicates strong demand for its products and a healthy market position. MRF share price in 1990.

Improving Profitability: the margins of MRF are still relatively low, but we can a good improvement in both operating and net profit margins in recent years. This suggests efficient cost management and pricing power.

Debt-free Company: MRF has a strong financial position with a debt-to-equity ratio of 0.20. This financial stability provides a buffer against economic downturns and allows for future investments.

Consistent Dividend Payout: MRF has a good track record of paying dividends, indicating its commitment to shareholder returns. The company has a dividend yield of 0.12%.

Negative Aspects:

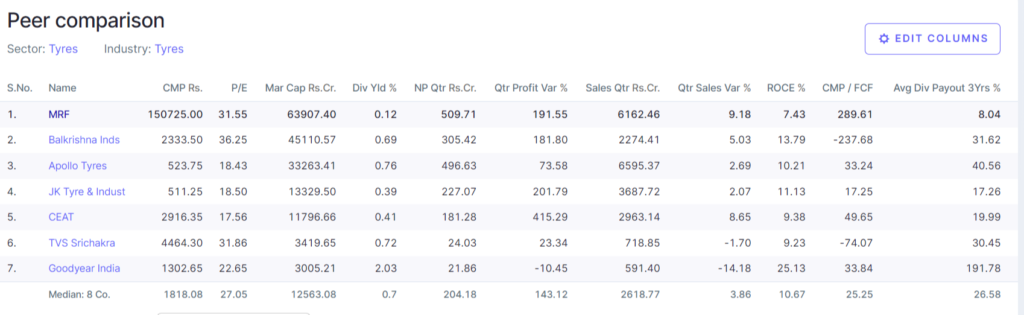

Lower Margins: Compared to its competitors, MRF operates with lower profit margins.

High Valuation: Currently, MRF trades at a P/E ratio of 31, which is significantly higher than the industry average. This could indicate the stock price is already overvalued and has already priced for its future growth potential.

Limited Free Cash Flow Generation: Despite its profitability, MRF struggles to convert earnings into free cash flow, potentially hindering its ability to invest in growth initiatives.

Overall MRF share price in 1990:

MRF’s strong revenue growth and improving profitability are positive indicators for its future. However, its lower margins, high valuation, and limited free cash flow generation raise some concerns. Investors should carefully consider these factors before making an investment decision.

Additional Points to Consider:

Industry trends: Analyze the overall growth potential of the tire industry in India and globally.

Competition: Assess the competitive landscape and MRF’s position within it.

Future growth plans: Understand the company’s plans for expanding its product portfolio, entering new markets, etc.

Valuation: Compare MRF’s valuation i.e., MRF share price in 1990 to its peers and industry benchmarks.

Conclusion on MRF share price in 1990

MRF is a strong company with a solid track record and a dominant market position. However, the high valuation and limited public float are concerns.

Frequently Asked Questions

What was the MRF share price in 1990?

The MRF share price in 1990 was ₹332.

How much has the MRF share price grown since 1990?

The MRF share price in 1990 was ₹332 and the MRF share price today in 2024 is INR 1,50,578.90. The stock has already generated a massive return on investment (ROI) of 45255.09%

Has the MRF share price ever split?

No, MRF has never had a stock split. This means the share price has grown organically, contributing to its high current value.

Are there any risks associated with investing in MRF now?

There could be a few risks associated with MRF Shares now including:

Economic slowdown: A decline in overall economic activity could impact tire demand.

Increased competition: New entrants or aggressive marketing by existing competitors could impact market share.

Raw material price fluctuations: Rising costs of rubber and other materials could affect profitability.

What are some alternative investments to MRF shares?

Investors looking for MRF alternatives in the Indian tire industry could consider:

Other tire manufacturers: Ceat, Apollo Tyres, etc.

Automotive component companies: Motherson Sumi Systems, Bharat Forge, etc.