If you are looking at Reliance Share for investment purposes, then you should know about Reliance share price target. We know that Reliance share has grown significantly in recent years. Due to this, it is shares are becoming attractive for the investors. In this article, we will provide a basic analysis of the Reliance share price target for 2024, 2025, 2027, 2030, and 2040.

These targets can help you make right decisions about your investments. In this article, we will discuss about the factors behind the Reliance’s growth, such as diversification, innovation and technology, market demand, and strategic expansion plans.

Overview of Reliance Limited

Reliance Industries Limited (RIL) is one of the biggest companies in India. The company is operating in industries such as petrochemicals, oil refining, oil exploration, energy, textiles, telecommunications, and retail. It was founded by Dhirubhai Ambani and has been a major player in shaping India’s industry and economy.

| Company Name | Reliance Industries Limited |

| Current Market Price | ₹2,926 |

| Market Cap | ₹19,79,675 Cr. |

| Book Value | ₹1,173 |

| Face Value | ₹10 |

| 52 Week High | ₹3,030 |

| 52 Week Low | ₹2,220 |

| Debt | ₹3,46,142 Cr. |

| DIV. YIELD | 0.32% |

Reliance Current Financial Status

| Stock P/E | 28.4 |

| Industry P/E | 8.02 |

| EPS | ₹103 |

| Debt to Equity Ratio | 0.44 |

| Promotor Holding | 75% |

| ROE | 9.23% |

| Sales growth | 2.81% |

| Profit growth | 4.20% |

History of Reliance Share Price Target From 2024 to 2040

Short term analysis: In the past 6 months, Wipro has given a return of 20.15% (+490.55) and in the past 1 year, Wipro has given return of 16.01% (+403.65).

Long term analysis: In the long term, we are considering past 5 years return, which is 124.07% (+1,619.32%) and maximum return the company has provided is 5,416.88% (+2,871.49).

Also Check: HUDCO Share Price Target

Reliance Share Price Target 2024

In the financial year 2023-24, Reliance Industries’ gross revenue reached ₹1,000,122 crore ($119.9 billion), a 2.6% increase from the previous year, driven by growth in consumer and upstream businesses. EBITDA grew by 16.1% to ₹178,677 crore ($21.4 billion), with positive contributions from all major segments. Profit after tax rose by 7.3% to ₹79,020 crore ($9.5 billion).

| Year 2024 | Reliance Share Price Target 2024 |

| 1st Price Target | ₹3,189.34 |

| 2nd Price Target | ₹3,281.60 |

Also Check: WIPRO Share Price Target

Reliance Share Price Target 2025

Ambani said that the company’s main focus is on creating a complete solar PV manufacturing system with a budget of Rs 75,000 crore, aiming to finish by the end of 2025.

Reliance’s strategy also includes Jio expanding its True5G network across India, with over 108 million subscribers now using Jio’s 5G. The Jio True 5G network currently handles about 28% of Jio’s wireless data traffic, with all 5G data running on Jio’s combined 5G and 4G network.

| Year 2025 | Reliance Share Price Target 2025 |

| 1st Price Target | ₹3,576.29 |

| 2nd Price Target | ₹3,609.10 |

Reliance Share Price Target 2026

Reliance Retail had another strong year with significant revenue and profit growth. In FY24, it earned ₹3,06,786 crore, which is 17.8% more than the previous year.

In FY 23-24, Reliance expanded by opening 1,840 new stores, adding 15.6 million sq. ft. of space. Now, it has 18,836 stores with a total area of 79.1 million sq. ft.

Reliance Retail is one of the most visited retailers globally that attracts over a billion customers visiting its stores throughout the year. It also has a growing number of loyal customers, surpassing 300 million registered customers.

| Year 2026 | Reliance Share Price Target 2026 |

| 1st Price Target | ₹3,933.81 |

| 2nd Price Target | ₹3,969.90 |

Reliance Share Price Target 2027

| Year 2027 | Reliance Share Price Target 2027 |

| 1st Price Target | ₹4,326.21 |

| 2nd Price Target | ₹4,365.90 |

Also Check: NMDC Share Price Target

Reliance Share Price Target 2030

Reliance Industries’ Chairman and Managing Director, Mukesh Ambani, shared the future plans for his group companies. These include generating 100GW of renewable energy by 2030, entering the insurance sector through Jio Financial Services (JFS), and launching various 5G and Artificial Intelligence initiatives under Jio Platforms.

Bernstein estimates that by 2030, Reliance could capture 60% of the solar market, 30% of the battery market, and 20% of the hydrogen market. Based on their assumptions, they believe Reliance could earn around $10-15 billion from its new energy business by 2030, which would be about 40% of the total available market.

| Year 2030 | Reliance Share Price Target 2030 |

| 1st Price Target | ₹5,756.29 |

| 2nd Price Target | ₹5,809.10 |

Also Check: Tata Motors Share Price Target

Reliance Share Price Target From 2024 To 2040

Reliance Industries is likely to reach a market capitalization of $1 trillion before 2040. If the company continues to grow at a rate of at least 12% annually for the next 15 years, it could achieve a revenue of about ₹50 lakh crore. Additionally, in the past three years, its market capitalization has been 2-3 times its revenue.

| Year | 1st Target (in ₹) | 2nd Target (in ₹) |

| 2024 | 3,189.34 | 3,281.60 |

| 2025 | 3,576.29 | 3,609.10 |

| 2026 | 3,933.81 | 3,969.90 |

| 2027 | 4,326.21 | 4,365.90 |

| 2028 | 4,757.85 | 4,801.50 |

| 2029 | 5,233.09 | 5,281.10 |

| 2030 | 5,756.29 | 5,809.10 |

| 2040 | 10,050.50 | 10,432.21 |

Also Check: LIC Share Price Target

Reliance Competitive Landscape

Reliance Competitive Landscape in the Indian Share Market:

- Telecommunications: In the telecom sector, Reliance Jio competes with companies like Bharti Airtel and Vodafone Idea. However, Jio is a strong player in the market that is growing fast by offering affordable data and voice plans.

- Retail: Reliance Retail faces competition from other big retail chains like Future Group, DMart, and online giants like Amazon and Flipkart. Reliance Retail is expanding both its physical stores and its online presence to stay ahead.

- Oil and Gas: In the oil and gas sector, Reliance competes with companies like Indian Oil Corporation, Bharat Petroleum, and Hindustan Petroleum.

- Digital Services: Reliance is also competing in the digital services space with other tech and digital companies, aiming to provide a range of services from cloud computing to entertainment through its Jio platforms.

- Renewable Energy: In renewable energy, Reliance is up against companies like Tata Power and Adani Green Energy.

| S.No. | Name | CMP Rs. | Mar Cap Rs.Cr. | Div Yield % | Debt / Equity |

| 1. | Reliance Industr | 2926.05 | 1979674.87 | 0.31 | 0.44 |

| 2. | I O C L | 168.80 | 238366.54 | 7.10 | 0.72 |

| 3. | B P C L | 613.35 | 133051.13 | 3.34 | 0.72 |

| 4. | H P C L | 525.90 | 74601.43 | 2.82 | 1.42 |

| 5. | M R P L | 213.65 | 37444.28 | 0.47 | 0.96 |

| 6. | C P C L | 978.10 | 14565.02 | 2.77 | 0.32 |

| 7. | Gandhar Oil Ref. | 206.13 | 2017.38 | 0.00 | 0.23 |

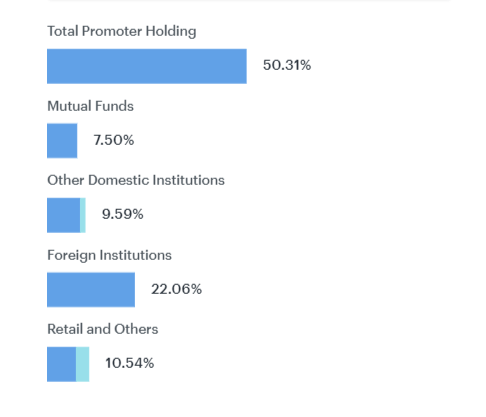

Reliance Shareholding Patterns

- Promoters: The largest share of Reliance Industries is held by the promoters, i.e., 50.31%, which mainly includes the Ambani family. They have a strong control and influence over company’s operations and decisions.

- Institutional Investors: A substantial portion of shares is held by institutional investors like mutual funds, insurance companies, and foreign institutional investors. FIIs (22.06%) and DIIs (16.98%) invest in Reliance because they have strong believe in the company’s growth.

- Retail Investors: Individual investors, including small shareholders, also own a portion of Reliance shares.

- Public and Others: This category includes other entities and the general public who own smaller stakes (10.46%) in the company.

| Dec 2023 | Mar 2024 | |

| Promoters | 50.30% | 50.31% |

| FIIs | 22.13% | 22.06% |

| DIIs | 16.59% | 16.98% |

| Government | 0.18% | 0.19% |

| Public | 10.80% | 10.46% |

Future Prospects and Reliance Share Price Target

Growth Drivers

- Digital Initiatives: Reliance Jio, part of Reliance Industries, is a major growth driver. With its strong presence in telecommunications and focus on expanding digital services, Reliance Jio is expected to keep contributing to overall growth.

- E-commerce Expansion: Reliance Retail is growing quickly and aims to be a leading player in the e-commerce market. Combining digital technologies with physical stores can boost revenue and profits.

- Oil to Chemicals (O2C) Business: Reliance’s focus on refining and petrochemicals looks promising. With rising global demand for chemical products, the O2C segment can generate strong revenue.

- Renewable Energy: Reliance is investing heavily in renewable energy, such as solar, wind, and hydrogen projects. This commitment to clean energy can support long-term growth.

Risks and Challenges:

- Regulatory Challenges: Reliance operates in highly regulated sectors like telecommunications, oil, and retail. Changes in regulations and policies can affect performance and profitability.

- Competition: Reliance faces strong competition in telecommunications and retail. Keeping market share and competitive pricing can be challenging.

- Global Oil Market Fluctuations: Reliance’s profitability in refining and petrochemicals is linked to global oil prices, which can fluctuate.

- Technological Advancements: Rapid technological changes in telecommunications and digital sectors require innovation and adaptation to consumer preferences, posing potential challenges.

Conclusion

In conclusion, Reliance share price targets for 2024 to 2030 are speculative, Reliance Industries is likely to see an upward trend in its share price driven by diversification, innovation, and market expansion, assuming stable global economic conditions.

Reliance’s diverse portfolio, including its strong presence in petrochemicals, retail, and telecom (Jio), suggests continued growth potential. Expansion into green energy and digital services also positions the company well for future growth.

If you found this website helpful, please share it with others. If you have any questions, feel free to ask in the comment box—we’ll do our best to respond and help you out. Thank you for visiting and for being part of FinanceFundaa!

Frequently Asked Questions

Who is the owner of Reliance Company?

Reliance Industries Limited (RIL) is an Indian multinational conglomerate company. The primary owner of Reliance Industries is Mukesh Ambani, who serves as the Chairman and Managing Director.

Is Reliance a good stock to buy?

Reliance Industries has shown strong financial performance over the years, with diversified business interests in petrochemicals, refining, oil, telecommunications (Jio), and retail. The company’s strong market position, diversified business model, and growth prospects, many investors consider Reliance a good stock for long-term investment.

What is the Reliance Share price target for 2024?

The Reliance Share price target for 2024 is ₹3,189.34 to ₹3,281.60.

What is the Reliance Share price target for 2025?

The Reliance Share price target for 2025 is ₹3,576.29 to ₹3,609.10.

What is the Reliance Share price target for 2026?

The Reliance Share price target for 2026 is ₹3,933.81 to ₹3,969.90.

What is the Reliance Share price target for 2027?

The Reliance Share price target for 2027 is ₹4,326.21 to ₹4,365.90.

What is the Reliance Share price target for 2030?

The Reliance Share price target for 2030 is ₹5,756.29 to ₹5,809.10.