Wipro Limited, a prominent global information technology, consulting, and outsourcing company, has a rich history. The company has a consistent record of rewarding its shareholders through bonus issues. In this blog, we will explore Wipro bonus history from 1971 to 2024, highlighting key milestones, patterns, and factors influencing its bonus issuance decisions over the years.

Key Highlights of Wipro Bonus History

Wipro has issued bonus shares 8 times in its history. The last bonus was issued by Wipro in March 2019.

Wipro Bonus Share History Years: 1971, 1981-1996 (6 times), 1997, 2004, 2005, 2010, 2017, 2019.

Also Check: Tata Steel Bonus History Since 2004

Also Check: TCS Bonus History Since 2006

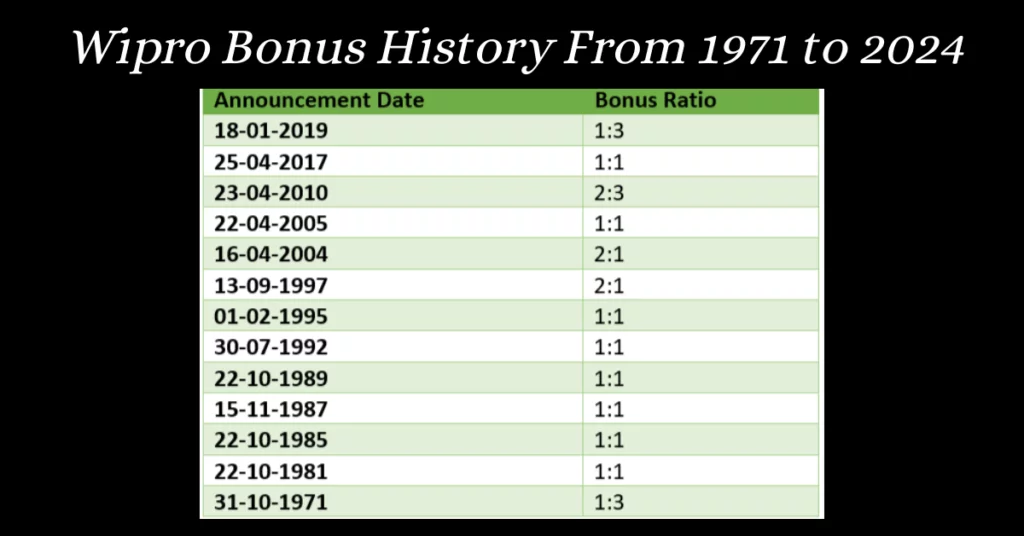

Wipro Bonus Share History From 1971 to 2024

| Announcement Date | Bonus Ratio | Record Date |

| 18 Jan 2019 | 1:3 | 07 Mar 2019 |

| 25 Apr 2017 | 1:1 | 14 Jun 2017 |

| 23 Apr 2010 | 2:3 | 16 Jun 2010 |

| 22 Apr 2005 | 1:1 | 23 Aug 2005 |

| 16 Apr 2004 | 2:1 | 28 Jun 2004 |

| 13 Sep 1997 | 2:1 | 17 Nov 1997 |

| 01 Feb 1995 | 1:1 | – |

| 30 July 1992 | 1:1 | 10 Sep 1992 |

| 22 Oct 1989 | 1:1 | – |

| 15 Nov 1987 | 1:1 | – |

| 22 Oct 1985 | 1:1 | – |

| 22 Oct 1981 | 1:1 | – |

| 31 Oct 1971 | 1:3 | – |

Also Check: Wipro Q3 Results: Profit Down, but ADRs Fly – What to Expect on Monday?

Meaning of Bonus Ratio

The “bonus ratio” is the ratio at which bonus shares are issued to existing shareholders by a company. Bonus shares are additional shares distributed by a company to its existing shareholders. These are issued free of charge, in proportion to the number of shares shareholders already own.

For example, if a company announces a bonus ratio of 1:2, it means that for every 2 shares held by an investor, they will receive an additional bonus share. Similarly, if the ratio is 1:1, shareholders will receive one bonus share for each share they hold.

About Wipro Limited

Wipro Limited is a leading Indian multinational information technology services and consulting company. The company was established in 1945 by Mohamed Premji. Wipro is one of the biggest IT companies in India and a global player in the IT industry.

Over the years, Wipro has grown into one of the largest IT service providers in India and is listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange of India (NSE).

Wipro offers a wide range of services, including:

IT consulting: Wipro helps businesses with digital transformation, cloud computing, cybersecurity, and other IT needs.

Business process services: Wipro provides outsourcing services for tasks such as customer service, finance, and human resources.

Technology services: Wipro offers services such as application development, infrastructure management, and testing.

The company has several clients across various industries such as technology, healthcare, finance, manufacturing, telecommunications, and more, with a global presence spanning multiple countries.

Frequently Asked Questions

How many bonus shares has Wipro issued in its history?

Wipro has issued bonus shares 13 times in its history, but only 8 times in the past 25 years.

What is the most recent bonus share issue from Wipro?

The last bonus share issue was in March 2019 with a ratio of 1:3.

Can you provide a table with all the bonus share issues and their ratios?

Yes, you can find a table with all the bonus share issues and their ratios in the resources I shared previously.

When can we expect the next bonus share issue from Wipro?

The company does not announce bonus share issues in advance, so it’s impossible to say for sure when the next one might be. It depends on various factors like company performance, financial reserves, and future expansion plans.

Does a bonus share issue affect the company’s stock price?

In the short term, the stock price might dip slightly due to increased supply. However, in the long run, it shouldn’t affect the underlying value of the company and could potentially increase investor confidence.

Who is eligible to receive bonus shares?

Existing shareholders who hold shares on the record date are eligible to receive bonus shares.

What happens to my existing shares when a bonus share issue is announced?

For every existing share you hold, you will receive additional shares based on the announced ratio. For example, in a 1:3 bonus, you will receive 3 new shares for every 1 existing share you own.

Are there any tax implications for receiving bonus shares?

Yes, there might be tax implications depending on your individual circumstances. It’s advisable to consult a tax advisor for specific guidance.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.