Key Highlights Tata Steel Bonus History

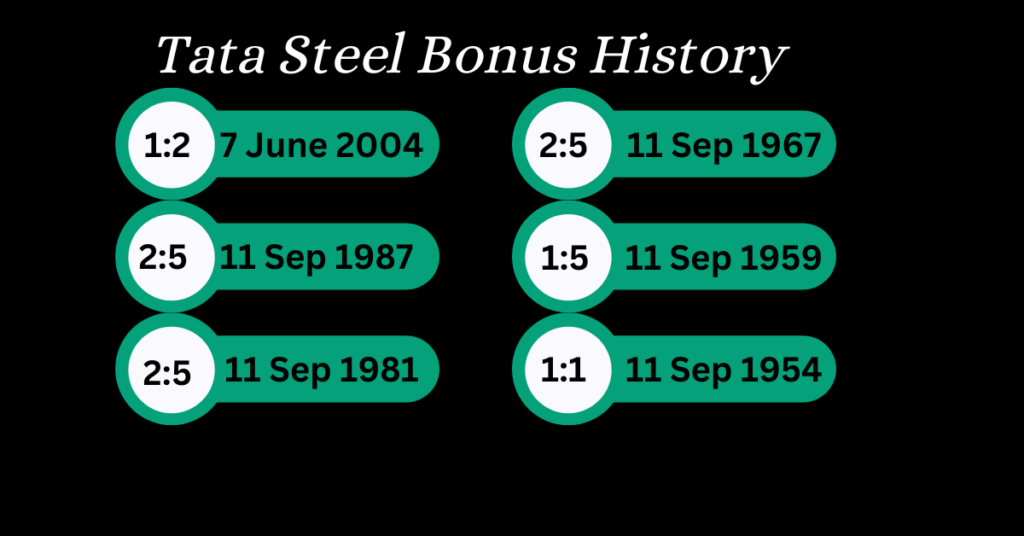

Tata Steel Bonus History: Tata Steel has issued only 6 bonus shares in its history. The last bonus issue was issued in 2004. The company is potentially prioritizing cash dividends instead of issuing bonus shares.

Bonus ratios: The bonus ratios have ranged from 1:1 in 1954 to 1:2 in 2004. The company is flexible in issuing bonus shares based on financial performance and future growth plans.

Tata Steel Share Bonus History

| Announcement Date | Bonus Ratio | Record Date |

| 7 June 2004 | 1:2 | 12 August 2004 |

| 11 September 1987 | 2:5 | – |

| 11 September 1981 | 2:5 | – |

| 11 September 1967 | 2:5 | – |

| 11 September 1959 | 1:5 | – |

| 11 September 1954 | 1:1 | – |

Also Check: Tata Steel Share Price Target 2025

Also Check: Tata Power Share Price Target 2025, 2026, 2027, 2030 (Updated 2024)

Also Check: TCS Bonus History Since 2006

What is the Bonus Ratio?

A bonus ratio is a ratio used by companies to announce a bonus issue of shares to their existing shareholders. It shows the number of new shares that will be issued for every existing share held by shareholders.

For example, if Tata Steel issues a bonus ratio of 1:1. It means that for every share a shareholder currently holds, they will receive one additional bonus share. Tata Steel Bonus History.

Bonus issues are the rewards for existing shareholders without having to pay out cash dividends. They can also be used to increase the company’s equity base without raising new capital from outside investors.

What is the Record Date?

The record date is a specific date set by a company to determine which shareholders are eligible to receive a bonus, dividend, or other distribution. If you want to be eligible for a dividend, then you must own the stock at least two business days before the record date.

Example of Record Date and Bonus Ratio

Here is an example of how the bonus ratio (Tata Steel Bonus History) and record date work together:

A company announces a bonus issue of shares in the ratio of 1:1.

The record date for the bonus issue is set as June 30th.

This means that any investor who owns shares of the company on June 30th will be eligible to receive one additional bonus share for every share they currently hold.

If you buy shares of the company after June 30th, you will not be eligible for the bonus shares.

Also Check: MRF Share Price 1990: A Massive 45255.09% Return Journey

Impact of Bonus Issue on Investors

Increases market capitalization: Each bonus share issued dilutes the existing shares, leading to a lower per-share price but increasing the total number of shares outstanding and thus the overall market capitalization. This can improve stock liquidity and make the company more attractive to a wider range of investors.

Boosts shareholder confidence: Issuance of Bonus shares can be a signal of the company’s strong financial health and future prospects. It increases investor confidence which may lead to a positive impact on the share price. Tata Steel Bonus History.

Tata Steel Share Recent Trend

No bonus shares since 2004: As Tata Steel has not issued any bonus shares since 2004, it seems that the company has shifted its focus towards other forms of shareholder rewards, such as cash dividends or stock buybacks. This could be due to various factors, including prioritizing capital expenditure for growth, managing debt levels, or maintaining a healthy dividend payout ratio.

Stock splits instead of bonuses: Tata Steel has implemented three stock splits since 2004. Stock split helps a company to achieve a similar effect of increasing affordability and liquidity without issuing bonus shares. Tata Steel Bonus History.

Frequently Asked Questions

How many bonus shares has Tata Steel issued in its history?

Tata Steel has issued 6 bonus shares in total.

When was the last bonus share issued?

The last bonus share was issued in 2004.

What were the ratios of the bonus shares issued?

The ratios varied from 1:1 to 1:2.

Are there plans for any future bonus shares?

It is difficult to predict future bonus issuance, but considering recent trends and focus on other shareholder rewards, they seem less likely in the near term.

What is the tax on receiving bonus shares?

Bonus shares attract capital gains tax when sold.

How do bonus shares affect other financial ratios like EPS and debt-to-equity?

Bonus shares can decrease EPS and increase the debt-to-equity ratio.

What are the advantages and disadvantages of bonus shares for investors?

Advantages of bonus shares include increased market capitalization, boosted confidence, and improved liquidity. And, the disadvantages include dilution of existing shares and potential tax implications.

What are the alternatives to bonus shares that Tata Steel has used?

Tata Steel has used stock splits and cash dividends as alternatives to bonus shares.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.