Choose the topic of your interest

ToggleKey Highlights of Zerodha vs Indmoney

Services:

Indmoney: Offers wider range with Indian/US stocks, ETFs, mutual funds, FDs, insurance, loans, and financial planning.

Zerodha: Focused on equities (Indian & ETFs), F&O, commodities, mutual funds, and IPOs.

Fees:

Indmoney: 0.05% or Rs 20 per order (Indian), $0.75 per trade (US). Other charges: DP, transaction, SEBI, stamp duty.

Zerodha: Free for equity delivery, 0.03% or Rs 20 per order for intraday/F&O. Charges for currency/commodity, AMC, DP, transaction, SEBI, and stamp duty.

Platform:

Indmoney: Simple, mobile-friendly app.

Zerodha: Advanced trading platforms (Kite, Sensibull) with charting tools and algorithmic trading.

Target Audience:

Indmoney: Beginners, mobile-first investors, US stock interest.

Zerodha: Frequent traders, advanced feature users, and diverse investment options.

Other Points:

- Both are SEBI-registered, but Zerodha has a longer track record.

- Indmoney offers educational resources, and Zerodha excels in technical analysis tools.

- Indmoney’s financials show a loss, but Zerodha is profitable.

Should I Use INDmoney or Zerodha?

- Choose Indmoney for ease of use, US stocks, and basic investing.

- Choose Zerodha for low brokerage, advanced features, and diverse options.

Let’s check in detail Zerodha vs Indmoney.

Top Pradhanmantri Suryodaya Yojana Stocks: 11 Stocks Picks Across 3 Key Sectors to Watch

Atal Setu Bridge: The Hidden GEM Stock You Need in Your Portfolio

Zerodha vs Indmoney

Indmoney is known for its user-friendly interface that provides demat and trading services to invest in the Indian market. Indmoney allows equity delivery, intraday trading, investment in US stocks, mutual funds, and fixed deposits. However, it does not offer currency and commodity trading.

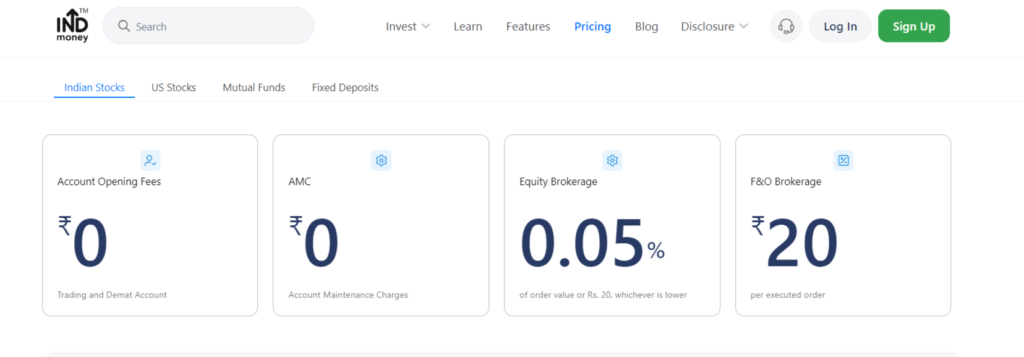

Indmoney does not charge any account opening or AMC fees. Like other brokers, you have to pay a lower of 0.05% or Rs 20 per executed order for equity delivery or Intraday trading.

On the other hand, Zerodha is a popular discount brokerage platform known for its powerful trading tools and charts. Zerodha allows you to trade or invest in equity, currency, commodity, F&O, mutual funds, and ETFs.

Looking for another App that allows US Stock Investment from India? Check our detailed comparison and winner of this post: Vested vs Indmoney: Which Platform Wins on US Stock Investment Fees 2024?

Also Check :Is It Safe to Use INDmoney? INDmoney Review 2024

Zerodha vs Indmoney Which is Better – A Quick Comparison

| A Brief Overview | INDmoney | Zerodha |

| Founders | Ashish Kashyap | Nithin Kamath & Nikhil Kamath |

| Founded | 2019 | 2010 |

| Head Office & Branches | Gurugram, Haryana; Zero branches | Bengaluru, Karnataka; 120+ branches |

| Stock exchanges | NSE, BSE, CDSL, US Stock Exchange Commission | NSE, BSE, MCX & MCX-SX |

| Trading platforms | INDmoney app | Zerodha Kite |

| Trading segments allowed | Equity, Futures and Options, Mutual Funds, FDs, IPOs, US Stocks & ETFs | Equity, Commodity, Currency, Futures and Options, Mutual Funds, IPOs & ETFs |

| Account opening charges | Rs. 0 (Free) | Rs 200+ Rs 100 for Commodity (optional) |

| AMC Fees | Rs. 0 (Free) | Rs. 300 (Rs. 75 per quarter) |

| Brokerage Charges | INDmoney Brokerage | Zerodha Brokerage |

| Equity Delivery | 0.05% or Rs 20 per executed order, whichever is lower | 0 (Free) |

| Equity Intraday | 0.05% or Rs 20 per executed order, whichever is lower | 0.03% or Rs. 20 per executed order, whichever is lower |

| Equity Futures | Rs. 20 per executed order | 0.03% or Rs. 20 per executed order, whichever is lower |

| Equity Options | Rs. 20 per executed order | Rs. 20 per executed order |

| Currency Futures | Not Available | 0.03% or Rs. 20 per executed order, whichever is lower |

| Currency Options | Not Available | Rs. 20 per executed order |

| Commodity Futures | Not Available | 0.03% or Rs. 20 per executed order, whichever is lower |

| Commodity Options | Not Available | Rs. 20 per executed order |

| Call & Trade Charges | Rs. 500 per order | Rs. 50 per order |

Zerodha vs INDmoney Charges Comparison

1. Zerodha vs Indmoney Demat Account Charges

Indmoney Account opening charges and AMC: INDmoney does not charge any account opening fee or AMC, which makes it a very good option for beginners to start investment and stock market trading.

Zerodha Account opening charges: Zerodha online account opening fees for equity, F&O, and currency are Rs. 200 and Rs. 300 for commodity trades. The offline charges are RS 400 and Rs 600, respectively. Zerodha account maintenance charges or AMC are Rs. 300 + 18% GST per annum, which is charged quarterly, i.e., Rs. 75 + GST. Zerodha deducts AMC charges automatically from your demat account every 90 days.

| Particulars | INDmoney | Zerodha |

| Account opening charges | Rs. 0 (Free) | Rs 200 (for equity only) + Rs 100 for Commodity |

| AMC Fees | Rs. 0 (Free) | Rs. 300 (Rs. 75 per quarter) |

Who is the winner?

Definitely, Indmoney is a good choice for beginners to start with zero account opening and AMC fees.

2. Zerodha vs Indmoney Brokerage Charges

Indmoney Brokerage charges: INDmoney charges a simple brokerage of 0.05% on the total transaction value or RS 20, whichever is lower on all types of trades.

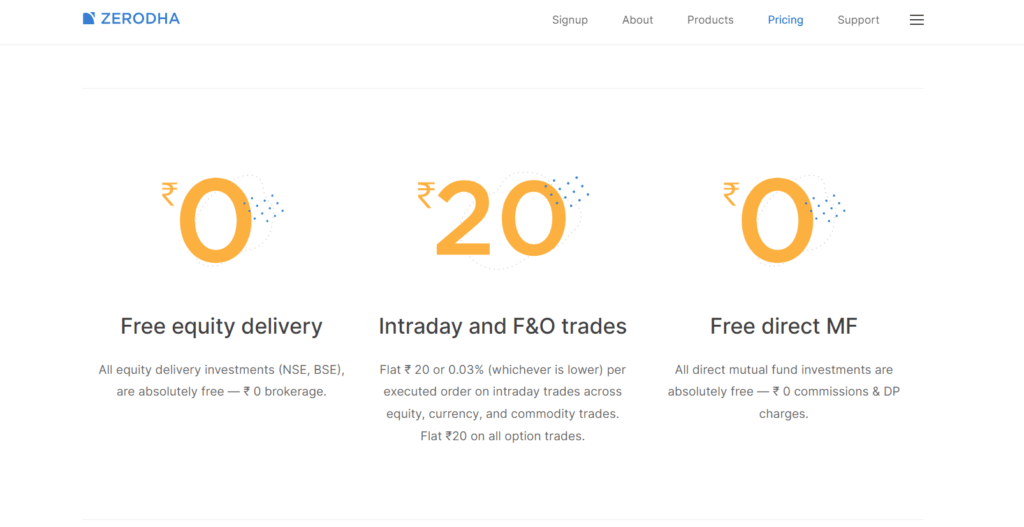

Zerodha Brokerage charges: The brokerage doesn’t charge any fees for equity delivery trades, and for intraday and future trades, it charges 0.03% or RS 20 per order, whichever is lower. A flat fee of RS 20 is charged per trade for options.

| Segment | INDmoney | Zerodha |

| Equity Delivery | 0.05% or Rs 20 per executed order, whichever is lower | 0 (Free) |

| Equity Intraday | 0.05% or Rs 20 per executed order, whichever is lower | 0.03% or Rs. 20 per executed order, whichever is lower |

| Equity Futures | Rs. 20 per executed order | 0.03% or Rs. 20 per executed order, whichever is lower |

| Equity Options | Rs. 20 per executed order | Rs. 20 per executed order |

| Currency Futures | Not Available | 0.03% or Rs. 20 per executed order, whichever is lower |

| Currency Options | Not Available | Rs. 20 per executed order |

| Commodity Futures | Not Available | 0.03% or Rs. 20 per executed order, whichever is lower |

| Commodity Options | Not Available | Rs. 20 per executed order |

Who is the winner?

INDMoney charges 0.05% or Rs.20 for delivery, while Zerodha has no charge for this. For intraday trading, both brokers have the same rate of 0.03% or Rs.20. Futures and Options trading costs are identical for both. Zerodha is leading in terms of brokerage charges.

Do you Know about INDmoney’s Revenue & Expenses in FY23?

3. Zerodha vs Indmoney STT charges

Securities Transaction Tax (STT) is applicable on both the buy and sell sides of equity transactions, including equity delivery, equity intraday, and equity futures and options (F&O) trades. It is levied by the government on securities and commodities.

| Particulars | INDmoney | Zerodha |

| Equity Delivery | 0.1% on both buy & sell | 0.1% on both buy & sell |

| Equity Intraday | 0.025% only on sell | 0.025% only on sell |

| Equity Futures | 0.0125% only on sell | 0.0125% only on sell |

| Equity Options | 0.0625% on sell side (on premium) | 0.0625% on sell side (on premium) |

| Currency F&O | Not Available | No STT |

| Commodity Futures | Not Available | 0.01% on sell (Non-Agri) |

| Commodity Options | Not Available | 0.05% on sell |

4. Zerodha vs Indmoney Stamp Duty Charges

Stamp Duty Charges are fees imposed by state governments in India on the transfer of securities, including the purchase and sale of stocks, mutual funds, and other financial instruments.

| Particulars | INDmoney | Zerodha |

| Equity Delivery | 0.1% on buy & sell | 0.1% on buy & sell |

| Equity Intraday | 0.025% only on the sell side | 0.025% only on the sell side |

| F&O – Futures | Rs 0 on Buy and 0.0125% on Sell | Rs 0 on Buy and 0.0125% on sell |

| F&O – Options | Rs 0 on Buy and 0.0625% (on premium) Sell | 0.125% of the intrinsic value on options that are bought and exercised and 0.0625% on sell side (on premium) |

5. Zerodha vs Indmoney Other charges

Indmoney:

1. Additionally, Indmoney charges transaction charges by the NSE and the BSE, STT charges, stamp duty charges, and SEBI turnover charges of 0.0001% on both equity and intraday trades.

2. A DP charges of Rs. 13.5 per scrip are charged on the delivery trades, irrespective of the quantity of shares sold.

3. Indmoney charges Rs. 500 per order for call and trade charges.

Zerodha:

1. The company levies STT or CTT charges, transaction charges, GST charges of 18% (charged only on brokerage, SEBI, and transaction), SEBI turnover charges of 0.0001% on both equity and intraday trades, and stamp charges.

2. DP charges of Rs.13.5 per scrip are charged on delivery trades irrespective of the quantity of shares sold.

3. Zerodha charges Rs 50 per order for call and trade charges.

| Particulars | INDmoney | Zerodha |

| SEBI Turnover Tax | 00.0001% on turnover (Rs 10 per crore) | 00.0001% on turnover (Rs 10 per crore) |

| GST | 18% of brokerage & transaction value | 18% of brokerage & transaction value |

| DP charges | Rs. 13.5 | Rs. 13.5 |

| Call and Trade Charges | Rs 500 | Rs 50 |

6. Mutual Fund and IPO Charges

Indmoney and Zerodha do not charge any fees for mutual funds and IPO investments through their platforms.

| Particulars | INDmoney | Zerodha |

| Mutual Fund Investment Charges | 0 (Free) | 0 (Free) |

| IPO charges | 0 (Free) | 0 (Free) |

7. Demat Charges

Dematerialization is the process of converting physical securities into an electronic format, allowing them to be held in a demat account.

| Particulars | INDmoney | Zerodha |

| Demat Charges | Rs. 250 per certificate | Rs. 150 per certificate + Rs. 100 courier charges |

8. Remit Charges

Remat charges, short for “Rematerialization charges,” are fees levied by depository participants (DPs) when an investor requests the conversion of electronic securities (held in dematerialized or demat form) back into physical certificates. Zerodha vs Indmoney

| Particulars | INDmoney | Zerodha |

| Remit Charges | Rs. 250 per certificate | Rs. 150 per certificate + Rs. 100 courier charges |

9. Fund Transfer Charges

If you transfer funds through UPI or IMPS to a demat account, there is no charge levy by either platform, i.e., Indmoney and Zerodha.

However, if you transfer funds through net banking, INDmoney charges Rs. 10, and Zerodha charges Rs. 9.

| Particulars – Zerodha vs Indmoney | INDmoney | Zerodha |

| Fund transfer through UPI or IMPS | 0 (Free) | 0 (Free) |

| Fund transfer through net banking | Rs. 10 | Rs. 9 |

Zerodha vs Indmoney Investment Options

Indmoney

INDstocks and ETFs: The Indmoney app allows users to invest in Indian stocks in ETFs through different categories. You can see various options to invest based on theme, technical strength, dividends, and industry-specific stocks.

Mutual Funds: Mutual Funds offer a great Investment opportunity that caters to different kinds of Investment Objectives without the daily hassle and frequent management. Explore various types of mutual funds such as equity, debt, index, large-cap, small-cap funds, and much more. Zerodha vs Indmoney

Fixed Deposits: Indmoney has a dedicated fixed deposit dashboard where you can track all FDS and their average returns in a single place. Plus you can also check the detailed information about the best-fixed deposit schemes offered by different banks, including tenures, interest rates, and minimum investment amounts.

US Stocks: INDmoney makes it easy for anyone wanting to start investing in US stocks from India. You can buy US stocks and ETFs from India directly through INDmoney. The platform allows you to start trading without any account opening fees or withdrawal fees. It takes less than 3 minutes to open a US stocks account with INDmoney.

Also Read: INDmoney Insta Cash 2024: Get Instant Funds When You Need Them Most

Zerodha

Indian Stocks and ETFs: Zerodha KITE provides an intuitive platform for trading and investing in equity stocks on both the NSE and the BSE.

Mutual Funds: Zerodha COIN app offers a great platform for investing directly in more than 2000 direct mutual funds without charging any commission fee. It helps users to save up to 1.5% annually in fees.

F & O and Commodities: Zerodha provides Kite, Sensibull, and Streak trading platforms to provide seamless trading of various commodities such as metals, oil, and agro commodities on MCX and futures and options of the index on the NSE.

IPOs: Zerodha allows you to invest in IPOs through its Kite app. Investing in IPOs through Zerodha Kite is a quick and simple process, just placing the bid during market hours.

Fixed Income Instruments: If you are looking for a higher rate of return than a standard fixed deposit, then investing in fixed income instruments is a good alternative. It includes government bonds, T-bills, Sovereign Gold Bonds, and State development loans. Zerodha vs Indmoney

Zerodha Comparison with Other Brokers

Zerodha vs Indmoney Coin

Indmoney

Indmoney is a financial management platform that offers a range of services, including mutual fund investments, insurance, loans, and financial planning. It aims to provide users with a holistic view of their financial portfolio and offers features for both beginners and experienced investors.

It provides a consolidated view of all financial assets and liabilities, making it easier for users to manage their finances.

Indmoney follows a fee-based model for financial planning services. Users should review the fee structure for the specific services they opt for.

Zerodha Coin

Zerodha Coin is a platform specifically designed for mutual fund investments. It allows users to invest in direct mutual funds with no commission charges and without going through a regular mutual fund distributor.

Zerodha Coin has a simple and intuitive interface specifically designed for mutual fund investments.

Zerodha Coin does not charge any commission for mutual fund investments. However, investors need to be aware of the expense ratio associated with the mutual funds they choose.

Conclusion Zerodha vs Indmoney: Who is the Winner?

In conclusion of Zerodha vs Indmoney, the choice between Indmoney and Zerodha is based on your priorities. Indmoney is preferred for its all-in-one approach, with a wider range of services and a user-friendly interface. However, make sure to consider its fee-based model for some services and recent financial loss. Zerodha is a great choice for commission-free mutual funds, advanced features, and diverse investment options.

Indmoney generally has higher fees for Indian stocks and US trades compared to Zerodha. Consider your investment goals, preferred platform complexity, and acceptable fees to choose the best fit. If you want to invest in US stocks, Indmoney is your only option or choose Zerodha for Commission-free Mutual Funds and Advanced Features.

Frequently Asked Questions

Zerodha is better if you're a frequent trader who values low brokerage and advanced features and Choose INDmoney if you're a new investor looking for a simple and mobile-friendly experience. Both are SEBI-registered, but choose Zerodha for reliability and INDmoney for ease of use. Investing in US stocks through INDmoney is generally considered safe. They partner with DriveWealth, a reputable and established online brokerage platform known for its strong security measures. However, while security is a priority for both INDmoney and DriveWealth, it's important to remember that no online platform is completely risk-free. INDmoney charges 0.05% of order value or ₹20, whichever is lower for the Indian stocks and Trading Fees $0.75 per trade for US stocks. Indmoney is a better choice for beginners as the platform doesn’t charge any account opening fee and AMC. Indmoney offers free demat and trading accounts for Indian stocks with no annual maintenance charges (AMC), whereas Zerodha charges Rs. 200 for opening equity and F&O account and additional Rs, 100 for commodity trading. You can invest in US stocks with Indmoney only. Zerodha doesn’t allow investing in US Stocks.Which is better, Zerodha or INDmoney for Indian stocks?

Is it safe to use INDmoney?

How much money does INDmoney charge?

Which is better for beginners, Indmoney or Zerodha?

How much does it cost to open an account with Indmoney or Zerodha?

Can I invest in US stocks with Indmoney or Zerodha?

Can i try switching from one brokerage partnet to another later stage.

Yes. You can change broker anytime depend upon your requirements. They will help you transferring your broker account.