Welcome to the Tata Motors Share Price Target 2025 report. In this analysis, we will explore Tata Motors’ share Price Target 2025. We will explore the expected future performance of Tata Motor’s shares and set a target price for potential investors.

To Predict the Tata Motors Share Target Price, we will analyze the present business and future business prospects of the company.

We’ll examine Tata Motor’s financial performance and examine the company’s growth prospects from 2023 to 2030. It includes an analysis of the company’s financials, market trends, and other relevant factors that can affect Tata Motors’ share target price in the coming years. Let’s discuss the Tata Motors share price target and discover whether you should invest in Tata Motors or not.

About Tata Motors

Tata Motors Limited is an Indian multinational automotive manufacturing company. Tata Motors manufactures a wide range of vehicles, including passenger cars, commercial vehicles, buses, trucks, defense vehicles, and electric vehicles.

The company has been investing heavily in new technologies, such as electric vehicles and autonomous driving, in recent years. This investment is expected to pay off in the long term and could lead to significant growth in Tata Motors’ share price.

The company’s commitment to innovation, quality, and sustainability has earned it a strong reputation both domestically and internationally.

Revenue Mix of TATA Motors

| Jaguar Land Rover | 67% |

| Tata Commercial Vehicles | 19% |

| Tata Passenger Vehicles | 11% |

| Vehicles financing | 2% |

| Others | 1% |

Also Check : Tata Power Share Price Target 2025, 2026, 2027, 2030?

Also Check: Suzlon Share Price Target 2025 (Updated Dec 2023)

Also Check: LIC Share Price Target 2025, 2026, 2027, 2030

Tata Motors Share Price Target 2023, 2024, 2025, 2026, 2030 Table

| Year | Tata Motors Share Price Target |

| Tata Motors Share Price in 2023 | Rs. 640 – Rs. 700 |

| Tata Motors Share Price in 2024 | Rs. 700 – Rs. 830 |

| Tata Motors Share Price in 2025 | Rs. 830 – Rs. 950 |

| Tata Motors Share Price in 2026 | Rs. 1,020 – Rs. 1,200 |

| Tata Motors Share Price in 2027 | Rs . 1,230 – Rs. 1,450 |

| Tata Motors Share Price in 2028 | Rs. 1,480 – Rs. 1,630 |

| Tata Motors Share Price in 2029 | Rs. 1,660 – Rs. 1,830 |

| Tata Motors Share Price in 2030 | Rs. 1,880 – Rs. 2,050 |

Also Check: Yes Bank Share Price Target 2025

Also Check: LIC Share Price Target 2025

Also Check: Wipro Share Price Target 2025

Also Check: Tata Steel Share Price Target 2025

Note: Above Tata Motors Share Price Target 2023, 2024, 2025, 2026, 2030 are based on a number of factors, such as company’s financial performance, its investment in new technologies, and the overall growth of the Indian automobile market. Of course, these are just estimates, and the actual share price could vary depending on a number of factors.

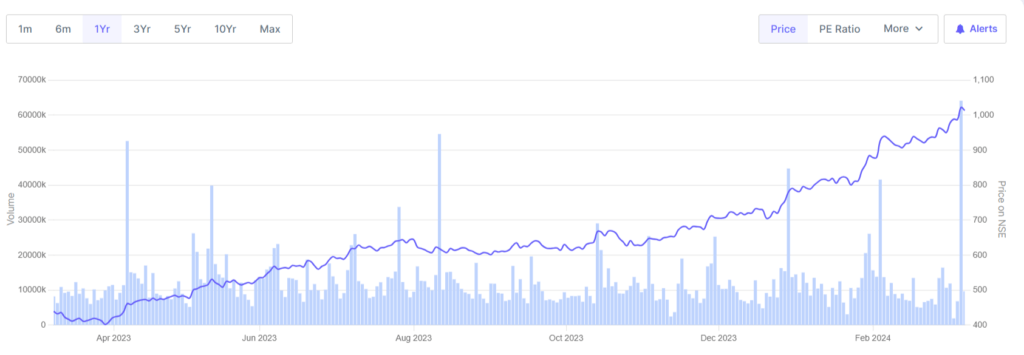

Tata Motors Share Price Target 2023

Tata Motor’s stock is trading at around Rs. 1,011 per share, which has recently touched its lifetime high of Rs. 1,066 per share. According to multiple analysts, the Tata Motors share price target for 2025 is around Rs. 1,500-1,600.

| Month | Minimum Price | Maximum Price |

| September 2023 | 647.129 | 660.077 |

| October 2023 | 660.560 | 692.728 |

| November 2023 | 693.083 | 700.184 |

| December 2023 | 697.674 | 703.077 |

Reasons to Increase Tata motor’s Share Price

Here are a few of the reasons that can contribute towards the growth of Tata Motors share price:

Indian Automotive Market Growth: The Indian automotive market is expected to grow at a compound annual growth rate (CAGR) of 10% to 12% over the next five years. It will give a superior advantage to Tata Motors due to its brand name and loyalty.

Strong Brand Equity: Tata Motors is one of the most trusted brands in India. The company has a proven track record of manufacturing high-quality vehicles. Moreover, the prices of Tata motor cars are affordable for Indian Families, which gives the company an edge over the competition. This brand equity will help Tata Motors to attract new customers and grow its market share.

Focus on Innovation: Tata Motors is investing heavily in research and development. The company is developing new technologies, such as electric vehicles and self-driving cars. Such innovations will help Tata Motors to stay ahead of the competition and grow its market share.

Electric Vehicle (EV) Initiative: With a focus on sustainable mobility, Tata Motors has been investing significantly in electric vehicle technology. The increasing demand for eco-friendly transportation solutions could positively impact the company’s valuation.

Tata Motors Share Price Target 2024

| Month | Minimum Price | Maximum Price |

| January 2024 | 706.335 | 728.528 |

| February 2024 | 725.213 | 728.109 |

| March 2024 | 725.197 | 730.183 |

| April 2024 | 732.982 | 749.593 |

| May 2024 | 743.872 | 753.773 |

| June 2024 | 753.114 | 755.667 |

| July 2024 | 756.482 | 763.265 |

| August 2024 | 759.016 | 769.846 |

| September 2024 | 773.139 | 783.655 |

| October 2024 | 784.494 | 816.992 |

| November 2024 | 816.137 | 823.592 |

| December 2024 | 821.424 | 830.102 |

Also Check: Zomato Share Price Target 2025

Tata Motors Share Price Target 2025

| Month | Minimum Price | Maximum Price |

| January 2025 | 954.585 | 975.670 |

| February 2025 | 972.293 | 975.063 |

| March 2025 | 972.403 | 979.199 |

| April 2025 | 980.265 | 997.019 |

| May 2025 | 991.288 | 999.836 |

| June 2025 | 1000.228 | 1003.505 |

| July 2025 | 1003.655 | 1010.604 |

| August 2025 | 1006.278 | 1017.831 |

| September 2025 | 1019.283 | 1031.262 |

| October 2025 | 1030.786 | 1062.575 |

| November 2025 | 1064.224 | 1070.305 |

| December 2025 | 1068.338 | 1076.986 |

Tata Motors Share Price Target 2026

| Month | Minimum Price | Maximum Price |

| January 2026 | 1076.726 | 1099.376 |

| February 2026 | 1095.896 | 1098.522 |

| March 2026 | 1095.891 | 1102.699 |

| April 2026 | 1103.340 | 1120.581 |

| May 2026 | 1115.001 | 1123.959 |

| June 2026 | 1123.864 | 1127.133 |

| July 2026 | 1126.699 | 1134.230 |

| August 2026 | 1129.750 | 1141.626 |

| September 2026 | 1142.758 | 1154.891 |

| October 2026 | 1153.854 | 1185.176 |

| November 2026 | 1187.216 | 1194.318 |

| December 2026 | 1191.916 | 1199.287 |

Tata Motors Share Price Target 2030

In 2030, as per our research and technical analysis, the minimum share price target of Tata Motors is Rs 1,880, And at the end of the year, the maximum price target for Tata Motors shares is Rs.2,050.

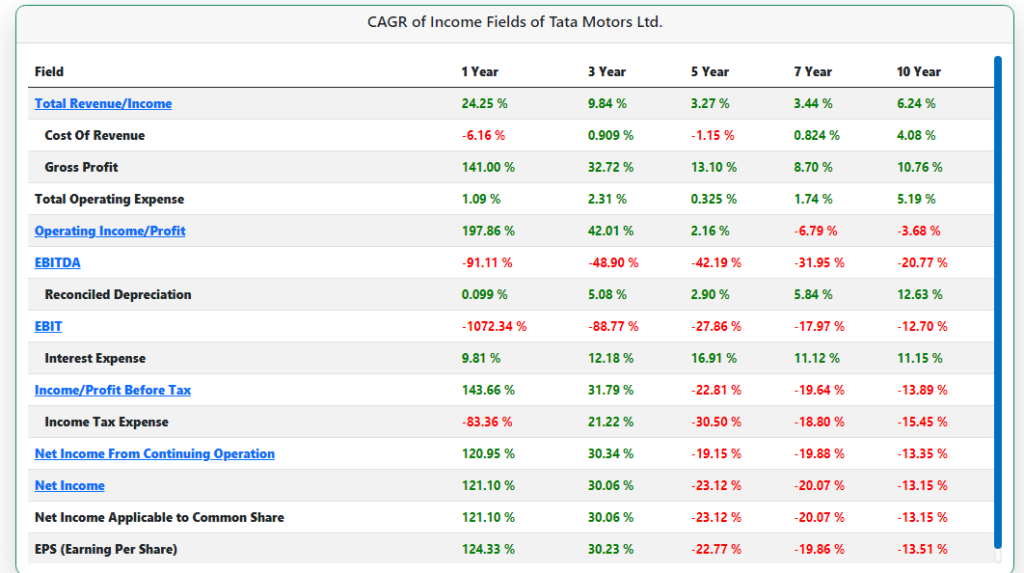

Fundamental Analysis of Tata Motors Stocks

Sales Growth: In March 2019, Tata Motors recorded sales of Rs. 69,203 crores and after 3 years of struggle, Tata Motors has started maintaining good sales growth. In March 2023, the company recorded sales of Rs. 65,757 crores. It is a sign that we can also expect good growth in the company’s sales in 2025. The company’s revenue is expected to grow at a CAGR of 12% to 15% over the next five years. This growth will be driven by the company’s focus on new product development and its expansion into new markets.

Profitability: Comparing Tata motor’s profits, we have observed that the company has started generating profits, and in March 2023, it recorded a profit of Rs. 1,416 crores compared to Rs. 1,292 crores loss in the previous year. The company has slowly and steadily started its journey from loss-making to profit-making company.

Debt Management: the Company’s current net debt-to-equity ratio of 0.2. Additionally, Tata Motors also has a healthy cash flow generation. The company’s free cash flow has been growing at a CAGR of 15% over the past five years.

Overall, the fundamental analysis of Tata Motors stocks is positive.

CAGR of TATA motors Ltd.

The CAGR of TATA Motors Ltd. is expected to be around 10% to 12% over the next five years.

Tata motors Competitors

Conclusion

The overall outlook for Tata Motors is positive, and the company is well-positioned for growth in the coming years. As a result, investors who are looking for exposure to the Indian automobile market may want to consider adding Tata Motors to their portfolios.