If you are one of those who are trading or planning to trade in the share market, then you should be aware of what is delivery margin in Zerodha kite. Keep in mind that the delivery margin is different from the intraday margin.

In this article we will understand the meaning of delivery margin, how it works, and how you can check the delivery margin is zerodha kite.

Let’s understand this through a common conversation:

What is delivery margin in Zerodha Kite?

Zerodha delivery margin is the amount blocked by Zerodha (it is usually 20% of the value of stocks sold) when you sell stocks from your Demat account. Such funds are released by Zerodha and you can utilize these from the next trading day.

Can you please explain it with the help of an example?

Yes sure. Here is an example of the delivery margin in Zerodha for you:

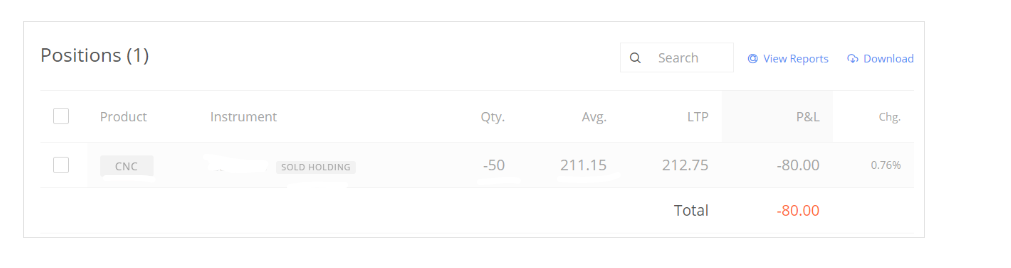

Let’s assume you have bought 50 shares of Tata Power and sold all shares at ₹211.15 each on Monday. The total value of the holdings sold is ₹10,557.50 ( 50 shares * ₹211.15 per share (excluding charges)).

Now, out of the ₹10,557.50, Zerodha will block 20% credit (₹2,111.50) as delivery margin on Monday and 80% credit (₹8,446) is available as a negative balance under the used margin field. You can use the negative used margin for other trades on Monday itself but that 20% will be available for use on Tuesday i.e., the next trading day.

Hope you understand what the delivery margin is in Zerodha kite. But why does Zerodha do that?

Check More About Zerodha

Also Check: How to Earn Rs 1000 Per Day in Share Market in India 2025?

As per SEBI’s new peak margin norms in 2021, when you sell your securities from holding, you will receive only 80% of the total sale on the same day and 20% on the next trading day. And, the main purpose of this new norm is to prevent the new traders from the risk of high losses.

Please note that the delivery margin varies from stock to stock depending on factors such as the stock’s market price, volatility, and overall market conditions. Therefore, it is recommended to check the latest delivery margin requirements directly from Zerodha’s website.

Can you also explain what Available margin, Used margin, and Available cash mean in the above image?

Yes, Sure. Here is the meaning of available margin, used margin, and available cash in Zerodha.

What is the Available Margin in Zerodha?

Available Margin: It is the total amount of funds that are available in your delta account to utilize for trading on a particular day.

What is Available Cash in Zerodha?

Available Cash: It is the closing balance carried forward from the previous day’s to today.

What is the Used Margin in Zerodha?

Used Margin: Used margin is the total funds used for executed equity intraday, F&O positional/intraday trading, and delivery orders. When you square off all the positions, then the used margin is added.

Also Check: Groww vs Zerodha | Is Zerodha Better Than Grow?

Conclusion

As per the SEBI rule, when you sell your shares from holding, then your broker (Here, Zerodha) blocks 20% of the value of stocks sold in your Demat account. It is called the delivery margin in Zerodha. You can utilise that 20% funds in the next trading day.

Do you have any other questions related to delivery margins? Share in the comment box, I would be happy to help you.