Wipro Quarterly Results Highlights Q3

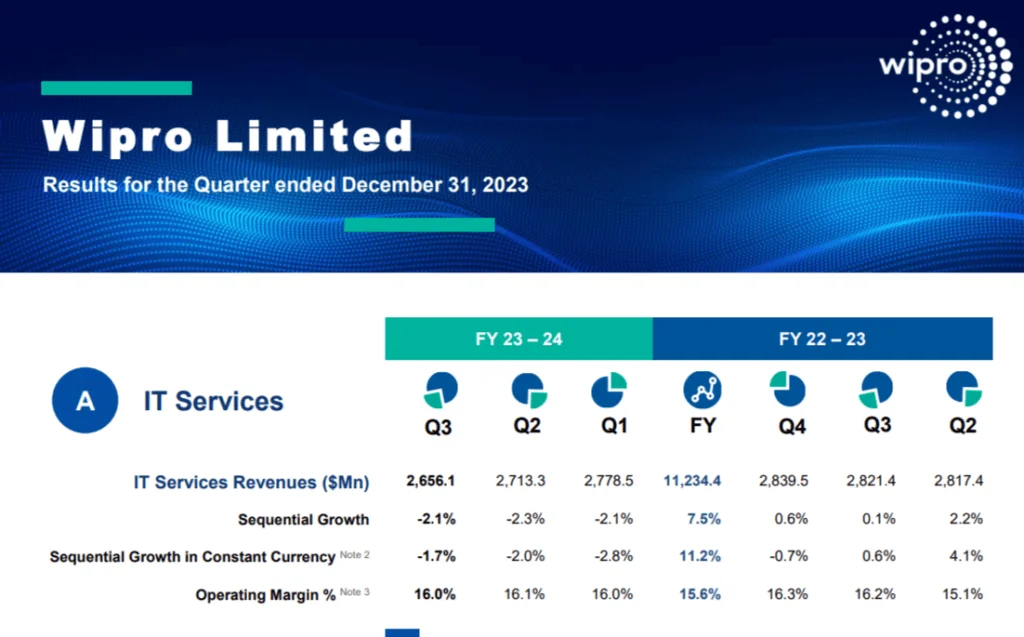

- Wipro’s net profit fell 12% YoY to Rs 2,694 crore in Q3, its fourth consecutive quarter of decline.

- Revenue fell 4.4% YoY to Rs 22,205 crore, missing analyst estimates of Rs 22,343 crore.

- The company’s bottomline rose 1.8% sequentially and its topline fell 1.4% sequentially.

- Wipro adjusted its revenue growth guidance for Q4 to -1.5% to 0.5%, down from -3.5% to -1.5% in Q3.

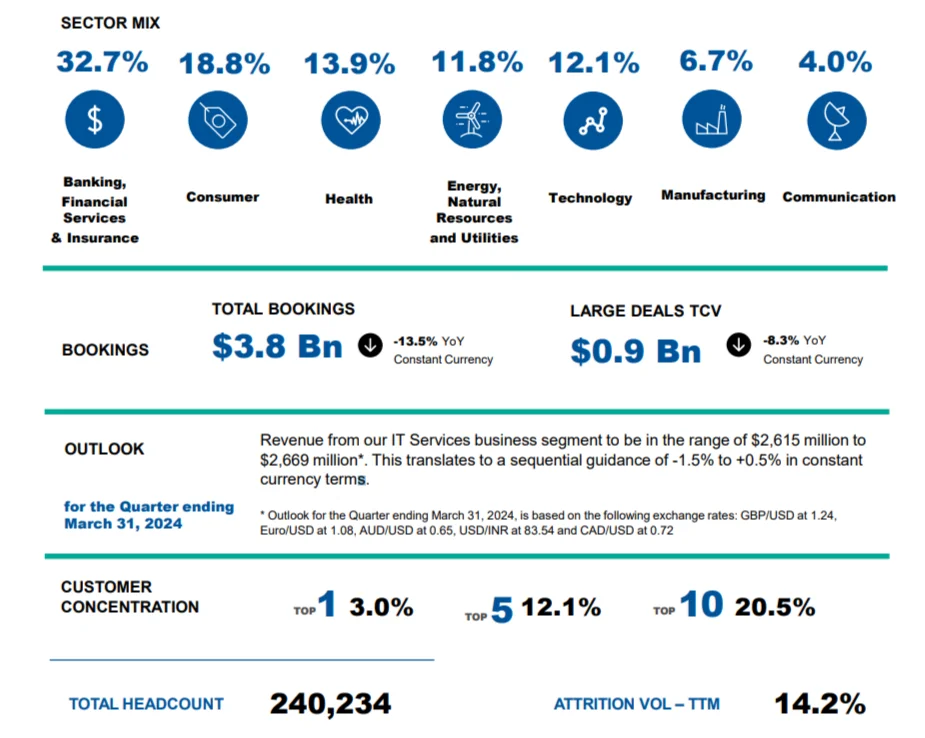

- The decline in revenue was due to weakness in the BFSI vertical and high exposure to consulting.

- Q3 is typically a weak quarter for IT companies due to furloughs and fewer working days.

- Wipro’s top rival Infosys reported a 7.3% YoY fall in net profit in Q3.

- Wipro’s EBIT margin fell 10 bps to 16% due to a wage hike and furloughs.

- The company won large deals worth $0.9 billion in Q3, down from $1.28 billion in Q2.

- Wipro declared an interim dividend of Rs 1 per share.

- The company’s shares closed 3.88% higher at Rs 465.45 apiece on BSE.

Also Check: Quick Highlights of HCL Tech Q3 Results; Dividend Declared

Also Check: Top Ayodhya Stocks: 9 Stock Picks Across 3 Key Sectors to Watch

Read More: Is India’s Market About To Boom? 8 Key Players Join A Prestigious Global Club

Management Commentary – Wipro Q4 Guidance

Expected revenue: Wipro thinks their IT services revenue for the next quarter will be somewhere between $2,615 million and $2,669 million. That means it might stay about the same or go down a tiny bit compared to the previous quarter.

CEO’s thoughts: The CEO, Thierry Delaporte, is hopeful about the future even though things might be a bit slow right now. He pointed out some good signs:

- They’re still signing lots of deals, even during a time when things usually slow down.

- Their consulting business, which is a good indicator of future growth, is starting to pick up again.

- They’re investing in AI to make their company more efficient and ready for new opportunities.

CFO’s thoughts: The CFO, Aparna C Iyer, is happy with how they’re managing their finances, even with some challenges. She mentioned:

- They’re keeping their profit margins steady at 16%, even though they’re spending more on growth and taking care of their employees.

- They’re working on making their company more adaptable and efficient, which is helping them stay strong.

Overall: It seems like Wipro might face some challenges in the near future, but they’re hopeful about growth in the long run. They’re signing good deals, their consulting business is showing signs of life, and they’re investing in AI to get ready for new opportunities down the road.

Wipro ADR Jump

Wipro ADR jumped almost 17 per cent after the company declared quarterly results for the quarter ending December 2023. Wipro ADR traded at $6.28, up 16.95 per cent on Friday.

Also Check: Weekly Stock Market Recap: 6 Key News Stories and Their Impact on Stock Prices

What’s an ADR and How Does it Work in the Market?

ADR stands for American Depositary Receipt. It’s a certificate issued by a U.S. bank representing a certain number of shares of a foreign company’s stock. These certificates trade on U.S. stock exchanges just like any other domestic stock.

Here’s How ADRs Work:

- A foreign company can partner with a U.S. bank to issue ADRs. The bank will purchase shares of the foreign company’s stock and hold them in custody.

- The bank then issues ADRs representing these shares. Each ADR typically represents one or more shares of the foreign company’s stock.

- Investors can buy and sell ADRs on U.S. stock exchanges like the New York Stock Exchange (NYSE) or the Nasdaq.

- When an investor buys or sells an ADR, they are actually buying or selling shares of the foreign company’s stock, but they are doing so without having to directly deal with the foreign stock exchange or currency conversion.

Disclaimer: The information provided on this website is for general informational purposes only and should not be construed as financial advice, investment recommendations, or guarantees of any kind. This information is not intended as a substitute for professional financial advice. You should always seek the advice of a qualified financial advisor before making any investment or financial decisions.