Can I Invest In US Stock Market From India Using Zerodha?

When it comes to answering can I invest in US Stock Market from India using Zerodha, then the clear answer is as of now No. Currently, this is not allowed to invest in the US Stock Market from India using Zerodha. However, Zerodha is also in the process of getting its membership of the NSE IFSC.

Zerodha and NSE IFSC

We are in the process of getting our membership and hopefully should be live in a few months once we receive the necessary approvals from the Indian exchanges and SEBI. In any case, the regulatory sandbox restrictions apply today in terms of maximum users, and we should hopefully have our platform ready by the time this user restriction is removed from NSE IFSC and the product and process are tested out well.

“Do you know NSE IFSC is a SEBI-approved subsidiary of the National Stock Exchange that allows Indian investors to invest money in US-based stocks?”

Meanwhile, in this article Can I Invest In US Stock Market From India Using Zerodha 2023, you can explore other ways to invest in the US Stock Market from India.

You can also explore How to Buy Shares in Zerodha Kite Long Term 2023?

Can Indians invest in the US stock market?

Yes, Indians can invest in the US Stock Market through various options, such as global trading accounts, overseas trading accounts, Mutual funds, ETFs, and the NSE IFSC Exchange.

“Do you know that you can trade/ invest in fractional quantities/values of a share in the US market?” For example, if a company’s stock is trading at $100 per share, you would need to have $100 to buy one share. However, in such a case, you are allowed to purchase less than a full share. For instance, you could buy $50 worth of a $100 stock and own 0.5 shares. Can I Invest In US Stock Market From India?

How to buy stock in the US market from India?

There are different ways that allow you to buy stock in the US market from India. Let’s explore:

1. Direct stock purchase with a Global trading account

The first option you have available is opening a global trading account with a brokerage firm that offers access to US stock exchanges. Many Indian brokers work as intermediaries that allow you to execute trades by collaborating with US stockbrokers.

Invest in US Stock Market through INDmoney App, check our reviews here: Is It Safe to Use INDmoney? INDmoney Review Sep 2023

2. Opening an Overseas trading account with a foreign broker

Another choice for setting up a trading account for international markets is an international broker having a presence in India. Here are some of the brokers that offer overseas trading accounts: Charles Schwab, Ameritrade, Interactive Brokers, etc.

3. Mutual funds

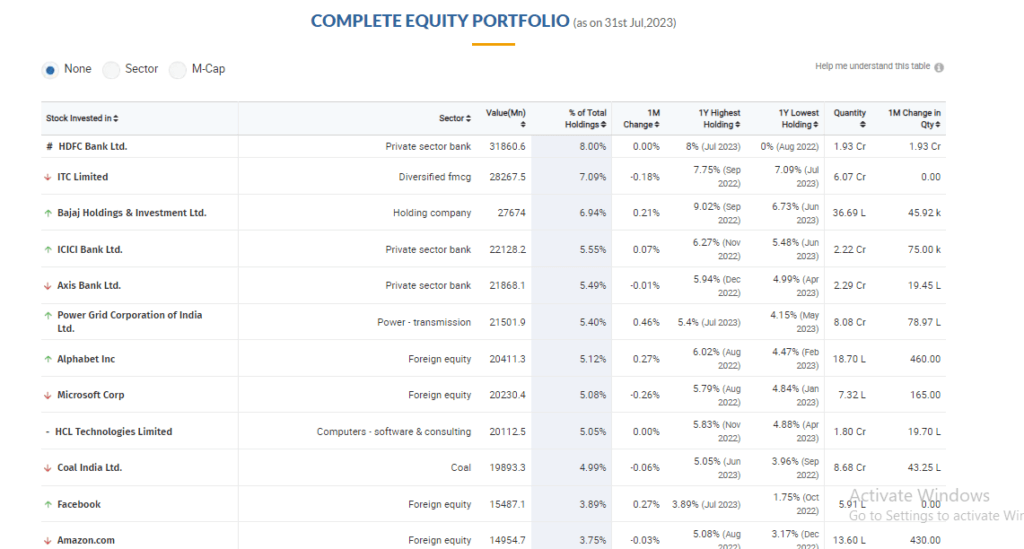

Another option is to invest in US stock through mutual funds. This is an indirect method as you don’t directly invest in the US Stock Market, however, your mutual fund manager invests a portion of your money in international stocks. One the examples of such mutual funds is Parag Parikh Flexi Cap Fund – Direct Plan – Growth.

Explore something Interesting: How Much Do Day Traders Make Per Month 2023? | Can Intraday Make You Rich? | Day Trader Salary

4. Exchange-traded funds (ETF)

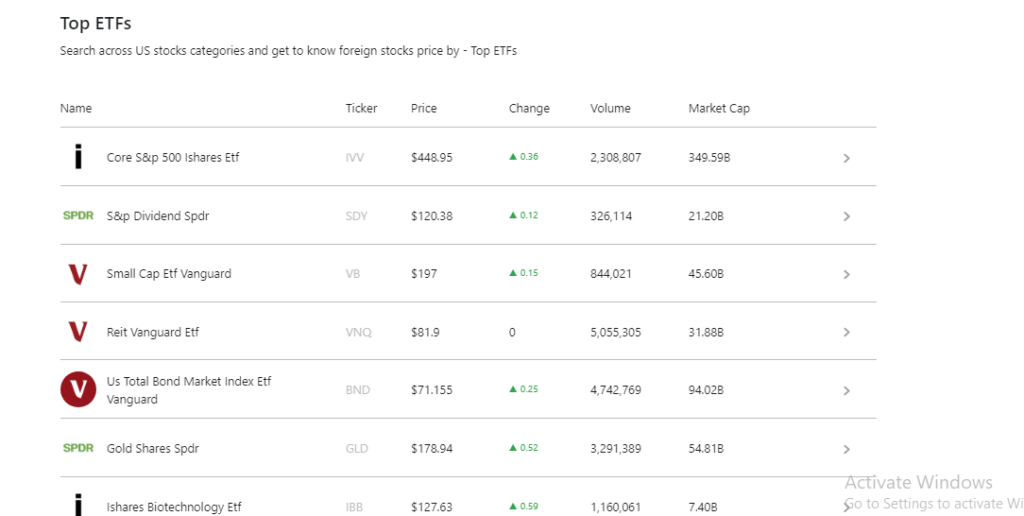

Unlike mutual funds, Exchange-Traded Fund (ETF) units are traded on the stock market. So you can buy and sell ETF units in the exchanges to invest in the US market. Here are a few ETF examples that invest your money in US stocks:

Can I Invest In US Stock Market From India?

5. NSE IFSC (International Financial Service Centre) Exchange

From March 3, 2022, Indian retail investors can trade/invest in US stocks on the NSE IFSC (International Financial Service Centre) Exchange. The NSE IFSC exchange is located in Gujarat’s GIFT City (Gujarat International Finance Tech City.

Currently, NSE IFSC Exchange allows you to buy or sell 50 US stocks, including Microsoft, Netflix, Apple, Amazon, Walmart, Alphabet (Google), Meta Platforms (Facebook) and Tesla (check the list here: https://www.nseix.com/markets/global-stocks).

Also Read: How to Earn Rs 1000 Per Day in Share Market in India 2023?

How can I buy US stocks in NSE IFSC India?

Before investing in US Stock from India you should be aware that the domestic Demat account does not allow trading in US stocks. You need to open a new Demat account from the NSE IFSC Registered Brokers.

Step 1: Open a trading and Demat account with an NSE IFSC Registered Brokers. Some names include Anand Rathi International Ventures, Edelweiss Securities, Emkay Financial Services, HDFC Securities, Motilal Oswal, and SMC Global. Can I Invest In US Stock Market From India? You can check all the NSE IFSC Registered Brokers list here:

Step 2: You need to transfer funds from your Indian bank account to the broker’s IFSC-registered account. Here, you should focus on currency conversion because deals on the exchange are made in dollars instead of Indian rupees.

Here, we are ending our article on Can In Invest in US Stock Market From India?

If you want to invest in Indian Market, then you must have a domestic Trading and Demat account, you can read our reviews on different trading brokers:

Is Zerodha Good For Beginners In India 2023? Honest Review

Is Angel Broking Better Than Zerodha? Zerodha Vs Angel Broking 2023

Zerodha, Upstox, and Groww Comparison 2023

Conclusion on Can I Invest In US Stock Market From India

Now that you have gathered knowledge on Can I Invest In US Stock Market From India and how to invest in US stocks from India, you can start trading. But you should do your proper research on types of risks and regulations associated with the same before investing.