In today’s digital age, the facilitation of financial transactions and services are increasing rapidly through mobile applications. One such app that has gained attention is the Navi loan app. Based on that, we have made a detailed article on Navi Loan App Review 2024 and Is Navi Loan App Safe.

In this Navi Loan App review, we will assess the Navi loan app’s security features and overall user experience to determine – Is Navi loan app Safe for users seeking financial assistance.

What is Navi App – Navi Loan App Review

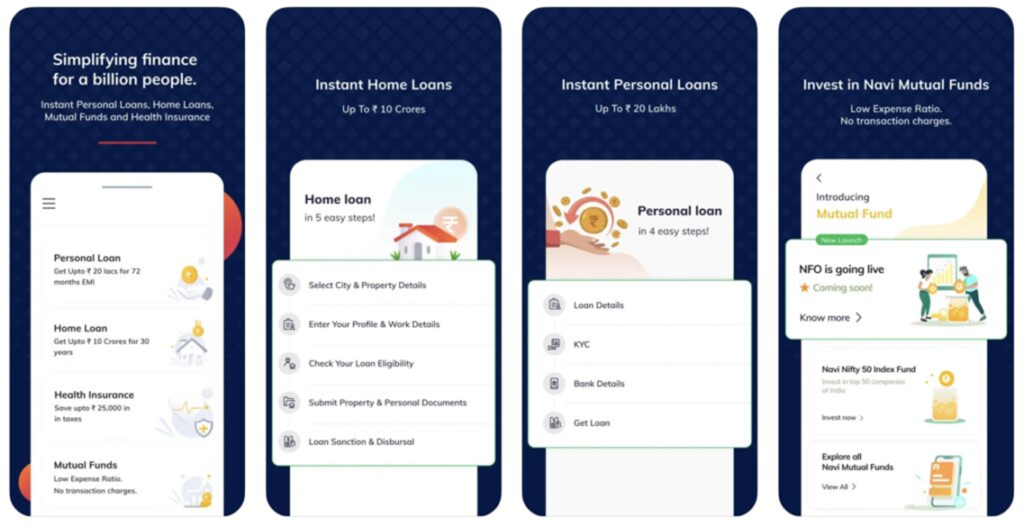

Navi App is a loan application launched by Sachin Bansal, ex-CEO of Flipkart, in 2020. Navi app is one of the first instant loan approval apps that allow users to get a fast loan of up to Rs 20 lakh.

Users can easily use the app and get an instant loan. The Navi app is available for Android and iOS devices, so whether you use an Android or Apple smartphone, you can download the App from Google Play Store or App Store to sign up and access a host of products, including personal loans, home loans, and health insurance with zero paperwork.

Also Check: Is Dhan Trading App Safe? Dhan App Review 2024

Also Check: Is Cred App Safe and Reliable | Honest Cred App Review 2024

Who Can Use Navi Loan App?

If you are an Indian citizen and 18 years or above, you can create your account on the Navi loan app and avail loan and health insurance facilities.

Advantages of Navi Loan App

- India’s first app to offer users instant loans.

- A simple and hassle-free KYC requirement.

- You can get instant personal loans up to Rs. 20 lahks.

- Competitive rates start at 9.9% p.a.

- Quickly check whether you are eligible to get a loan or not.

- No need for any collateral or security deposit to get the loan.

- Select the EMI amount based on your salary or income sources.

Disadvantages of Navi Loan App

- The loan’s interest rate can vary from 9% to 36% per annum. You have to be careful here.

How to Transfer Shares From Upstox To Zerodha Online (2024)?

Documents Required to Get Loan from Navi App

Here is the List of Documents Required to get a loan from Navi App:

1. Income Proof

Bank account statements for the last 6 months, Salary certificate or salary slips for the last 6 months.

2. Address and Identity Proof

PAN Card, Driving Licence, Utility Bills, Aadhar Card, Voter’s ID, Bank Statement or Ration Card.

3. Employment Proof

Appointment Letter, job contract, HR’s or official email ID, Identity card, and Job Continuity Proof.

4. Passport-size photograph

Latest Passport size photograph.

5. Residence Proof

Property documents, maintenance bill, and electricity bill.

6. Investment Proof (optional)

Fixed deposit, mutual fund investment receipts.

How Much Do Day Traders Make Per Month 2024? | Can Intraday Make You Rich? | Day Trader Salary

How to Avail Loan from Navi App?

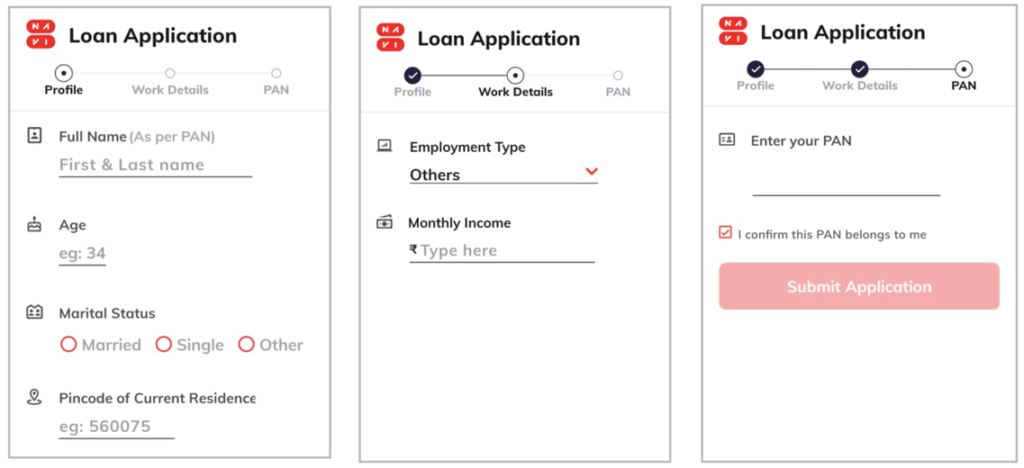

Getting a loan from the Navi app is a simple and quick 10 minutes process. However, you must check out the eligibility before applying for a loan.

Step 1: Download and install the Navi app from Play Store or App Store.

Step 2: Open the application and click on the “Apply” tab.

Step 3: Fill in basic details to process your loan application like:

- Full Name

- Age

- Marital Status

- Pin code of residence

Step 4: Fill in employment and income details.

Step 5: Now, enter your PAN number.

Step 6: Once you complete all the above details, your loan will be instantly processed within 10 minutes.

Note: The loan processing fee is 2.5%. The minimum processing fee is Rs 500, and the maximum is Rs 5000 Plus 18% GST extra.

Is Navi App Safe? – Navi Loan App Review

Navi app is 100% safe and genuine that offers instant loans. It is a legit app operated by Navi Technologies Limited. The loan process is simple and quick. However, the loan’s interest rate can vary from 9% to 36% per annum. It is advisable to be clear about the terms and conditions of the company.

Also Check: Is It Safe to Use INDmoney? INDmoney Review 2024

Navi Loan App Customer Care Details

Navi application offers loan services to those cities where it has centers. If you need any help related to the Navi app loan, you can directly contact their customer service team. Here are the Navi Loan App Customer Support Details:

Customer Care Number: Company has not shared any direct contact number.

Official Customer Support Email: help@navi.com, grievance@navi.com

Official Office Address: 9th Floor, Vaishnavi Tech Square, Iballur Village, Begur Hobli, Bengaluru 560102

How to Add Nominee In Zerodha Kite Mobile App In Just 5 Min?

Conclusion Is Navi Loan App Safe

So, hope you got your answer with our article “Navi Loan App Review” The Navi App is straightforward and easy to use. Users can easily install and download the app from the App Store or Play Store. Once installed, register yourself quickly with basic details and select the amount of loan and EMIs to get an instant loan through Navi App.

Frequently Asked Questions

Is the Navi app safe for loan?

Yes, the Navi app is safe and genuine for loans. However, it is advisable to read all the terms and conditions carefully as the Navi loan interest rates vary from 9% to 36% per annum.

Is Navi loan app real or fake?

Navi loan app is real that offers loan and health insurance services instantly. It was launched by Sachin Bansal, ex-CEO of Flipkart, in 2020.

Is the Navi app RBI approved?

RBI does not approve digital lending apps. The Navi App is operated by Navi Technologies Limited. Navi Finserv Limited is an RBI-registered Systemically Important Non-Deposit Taking NBFC (ND-SI) that lends through the Navi App. Navi Technologies is the digital lending partner of Navi Finserv.

What is the Navi loan interest rate?

Navi loan interest rates vary from 9% to 36% per annum.

What is the minimum loan from Navi?

The minimum loan from Navi is INR 10,000.

Disclaimer: The information provided on this website is for general informational purposes only and should not be construed as financial advice, investment recommendations, or guarantees of any kind. This information is not intended as a substitute for professional financial advice. You should always seek the advice of a qualified financial advisor before making any investment or financial decisions.