Choose the topic of your interest

ToggleWelcome to the Tata Steel Share Price Target report. In this analysis, we will explore Tata Steel share price target 2025, Tata Steel target price from 2023 to 2025. we will explore the expected future performance of Tata Steel’s shares and set a target price for potential investors.

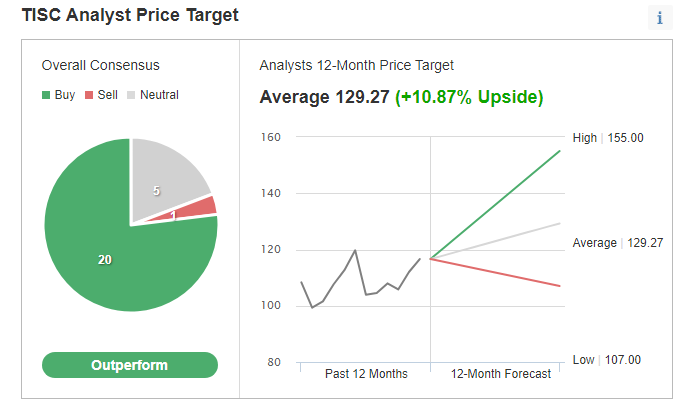

To get Tata Steel Share Price Target, we have examined the company’s financials, market trends, and other relevant factors that can affect the Tata Steel share price target in the coming years. Let’s delve into the details and discover the potential growth prospects of this renowned company.

About Tata Steel

- Tata Steel Ltd is the first private steel company in Asia, established in 1907.

- The company manages everything related to making steel, starting from mining and processing iron ore and coal to producing and delivering the final products.

- Tata Steel has planned to increase their steel production capacity in the country to 30 million tonnes per year by 2025.

What is the Tata Steel Share Price Target from 2023 to 2025?

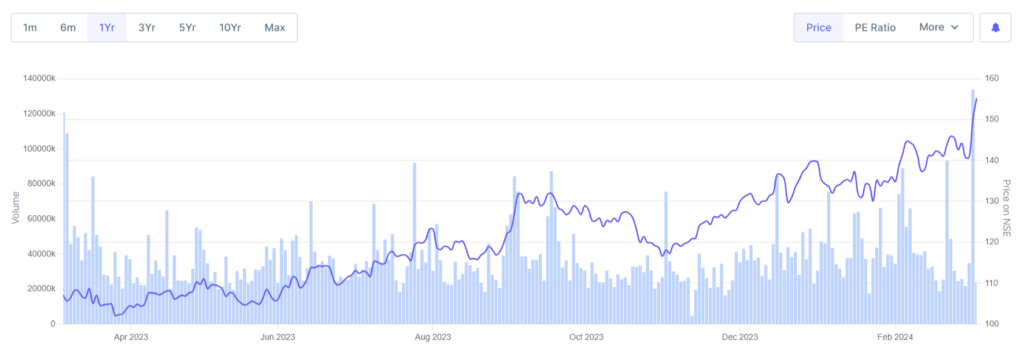

Tata Steel’s stock is trading at around Rs. 155 per share. Though the stock has provided the stagnant return in the last 1 year and currently trading nearby last year’s price only. The stock touched its high of around Rs. 155.65 in March 2024 and its lifetime high price is around Rs. 155.

Tata Steel Share Price Target 2023

As per the current market analysis, the Tata Steel share price target by the end of 2023 is expected to be around Rs. 140 – 160 per share.

Also Check: Zomato Share Price Target 2025

Also Check: Adani Power Share Price Target 2025, 2026, 2027, 2030

Tata Steel Share Price Target 2025

As per the current market analysis, the Tata Steel share price target by 2025 is expected to be around Rs. 220 – 250 per share.

Also Check: Tata Power Share Price Target 2025, 2026, 2027, 2030?

Also Check: Tata Motors Share Price Target 2025

Also Check: Yes Bank Share Price Target 2025

Reasons to Increase Tata Steel Share Price

The major reason to increase Tata steel share price is due to:

Robust Demand: The demand for steel products is expected to remain strong in the coming years, driven by infrastructure development, urbanization, and industrialization. Additionally, the post-pandemic economic recovery is likely to further boost steel demand across sectors.

Diversified Portfolio: Tata Steel’s diverse product portfolio allows it to cater to various industries, including automotive, construction, engineering, and infrastructure. This diversification reduces its dependence on specific sectors and mitigates risks associated with market fluctuations.

Sustainable Initiatives: Environmental concerns and sustainable practices have gained prominence in recent years. Tata Steel’s commitment to sustainable operations and reducing its carbon footprint aligns well with changing market dynamics and regulatory requirements.

To estimate the potential share price target for Tata Steel in 2025, we must evaluate its historical financial performance and growth trends. Though past performance is not indicative of future results, it provides a valuable basis for projection.

Let’s do the Fundamental analyses of TATA Steel Share to know the Tata Steel Share Price Target.

Also Check: Wipro Share Price Target 2025

Fundamental Analysis of Tata Steel Stocks

A quick Overview for Tata Steel Share Price Target 2025

The company has shown a good profit growth of 31.96% for the past 3 years.

The company has shown a good revenue growth of 28.76% for the past 3 years.

The company has been maintaining healthy ROE of 20.80% over the past 3 years.

The company has been maintaining a healthy ROCE of 22.30% over the past 3 years.

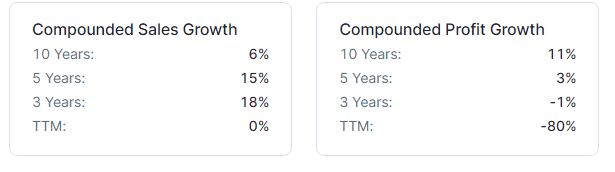

Sales Growth: Tata Steel is constantly maintaining good revenue growth over the past few years. The company’s revenue increased from INR 156,476 crores in FY2020-21 to INR 243,959 in FY2021-22, which is around 55%. On the basis of Tata Steel’s steady revenue growth, the company is showcasing the potential to generate substantial sales in the future.

Profitability: The company’s profits increased from INR 8,190 crores in FY2020-21 to INR 41,749 in FY2021-22. Improvements in operational efficiency and cost-cutting measures have enhanced Tata Steel’s profitability. It is expected that the company will keep continuing such cost-cutting measures, hence, the profitability is likely to remain favorable.

Debt Management: Reducing debt and maintaining a healthy debt-to-equity ratio has been a priority for Tata Steel. Tata Steel has reduced INR 24,340 crore net debts in the financial year 2021-22 (FY22) and in 2020-21 (FY21), the debt was cut by INR 29,390 crore. Its current Debt to equity ratio is around 0.28, which means that the company has a low proportion of debt in its capital.

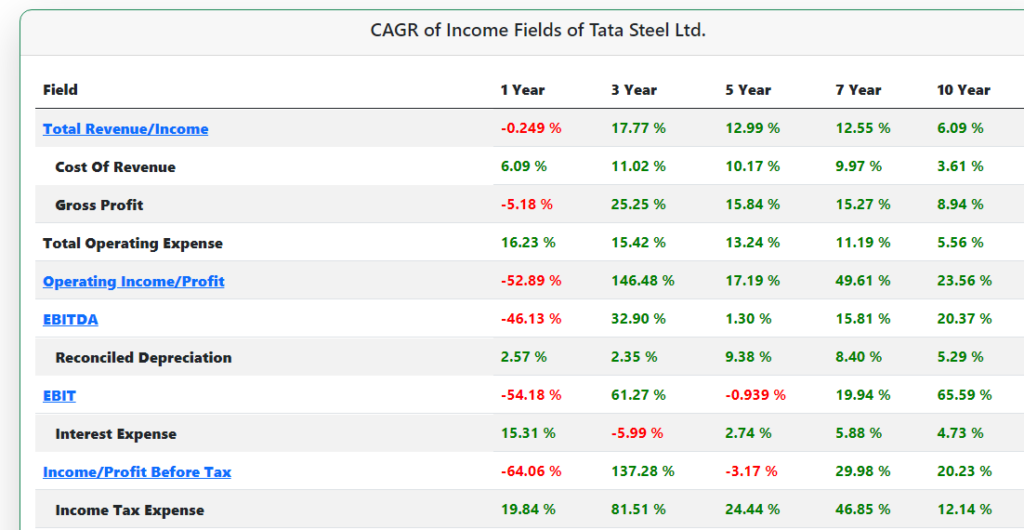

Despite a performance fundamental performance of Tata Steel in FY 20-21 and 21-22, it is to be observed here that in FY 22-23, there is a drop in Tata Steel revenues and net profits, which seems to be a concerning point.

Also Check: LIC Share Price Target 2025

Also Check: Suzlon Share Price Target 2025

CAGR of TATA Steel Ltd.

In the past five years, Tata Steel’s revenue has grown at a CAGR of 15% with 3% annual profit growth.

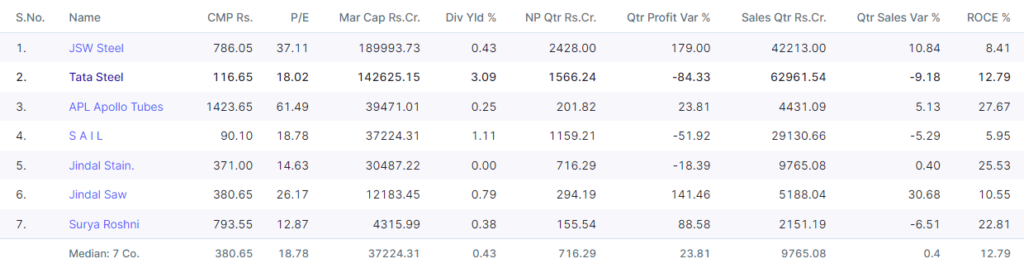

Tata Steel Competitors

Conclusion

As per market analysis, Tata Steel Share Price Target is around Rs. 140 – 142. Definitely, we need to track the market on regular intervals as market remains highly volatile due to external factors as well.

Disclaimer: Please note that the share price targets provided herein are based on current market conditions and analyst projections, and they do not guarantee future performance. There is no accurate way to predict the share prices for the future. We analyze the past stock performances, current market scenario, and keep tracking the market on a regular basis to set our targets. The actual share price may vary significantly from the target due to various factors, including global economic conditions, company-specific performance, and unforeseen events.

Before making any investment decisions, investors should carefully consider their risk tolerance, financial situation, investment objectives, and conduct thorough research to assess the suitability of the investment.