Welcome to the Wipro Share Price Target 2025 to 2030 report. In this analysis, we will explore Wipro Share Price Target 2025. We will explore the expected future performance of Wipro’s shares and set a target price for potential investors.

To Predict the Wipro Share Target Price, we will analyze the present business and future business prospects of the company.

We’ll examine Wipro’s financial performance and examine the company’s growth prospects from 2023 to 2030. It includes an analysis of the company’s financials, market trends, and other relevant factors that can affect the Wipro share target price in the coming years. Let’s discuss the Wipro share price target and discover whether you should invest in Wipro or not?

About Wipro

- Wipro Ltd is a global Information technology, consulting and business process services (BPS) company. Wipro has built a strong presence in both domestic and international markets, serving clients across sectors such as finance, healthcare, retail, manufacturing, and telecommunications.

- It is the 4th largest Indian player in the global IT services industry behind TCS, Infosys and HCL Technologies.

- Wipro IT Services Revenue Breakup – Sector-Wise:

| Sector | Revenue percentage |

| BFSI | 31% |

| Consumer | 16% |

| Health | 14% |

| Energy, Natural Resources and Utilities | 13% |

| Technology | 13% |

| Manufacturing | 8% |

| Communications | 5% |

Also Check: Tata Power Share Price Target 2025, 2026, 2027, 2030?

Also Check: Suzlon Share Price Target 2025 (Updated Dec 2023)

Strategic Market Units Wise

| Americas | 60% |

| Europe | 26% |

| APMEA | 14% |

Wipro Ltd forecast for upcoming days

Well, we all have seen that Wipro ended as the worst Nifty performer in 2022. Despite that, as per Trendlyne, a total of 13 brokerages have given ‘Hold’ ratings to Wipro and 5 brokerages have given ‘Strong Buy’ calls. And, the average Wipro share price target is provided at Rs 459.15, which suggests a 16.91 percent potential upside ahead.

| Date | Price | Min Price | Max Price |

| 2023-07-26 | 408.181 | 400.263 | 415.688 |

| 2023-07-27 | 410.398 | 403.045 | 418.100 |

| 2023-07-28 | 410.564 | 403.146 | 418.496 |

| 2023-07-31 | 412.434 | 405.420 | 419.626 |

| 2023-08-01 | 417.197 | 409.779 | 424.379 |

| 2023-08-02 | 416.415 | 408.321 | 423.695 |

| 2023-08-03 | 418.632 | 410.683 | 425.059 |

| 2023-08-04 | 418.798 | 411.290 | 426.805 |

| 2023-08-07 | 420.668 | 412.913 | 428.203 |

Also Check: Zomato Share Price Target 2025

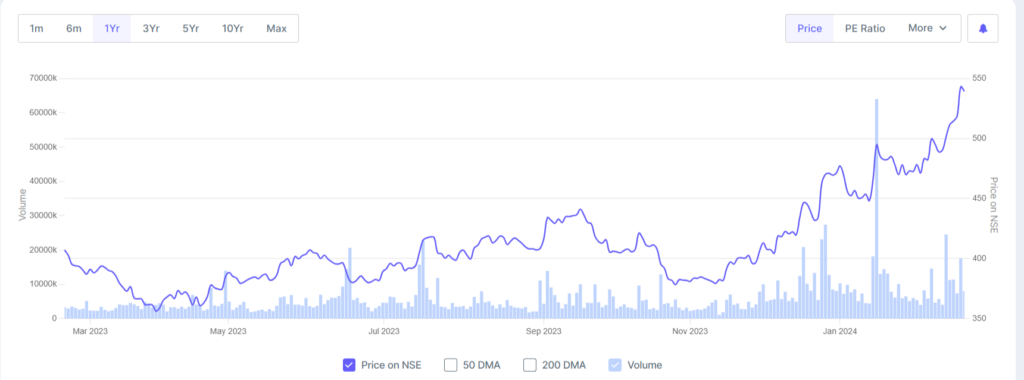

Wipro Share Price Target 2023

Wipro’s Share price is range bound and trading between Rs. 380 – 405. The share has shown a downfall since January 2022 and it has been corrected by almost 45%. The major reason of falling in Wipro’s stock price is investors like FIIs & DIis, and Mutual Funds started selling their holdings due to the recession in US and Europe. Around 86% of Wipro’s revenue comes from the US (60%) and Europe (16%).

Based on Wipro’s strong global presence in the IT sector, we have expected the first Wipro Share Price Target 2023 up to Rs.440, and the second target price can be seen up to Rs.458.

Wipro Ltd. Stock Price Forecast for 2023

| Month | Opening price | Closing Price | Minimum Price | Maximum Price | Change |

| August 2023 | 431.297 | 435.112 | 429.818 | 435.637 | 0.88 % ▲ |

| September 2023 | 434.075 | 443.836 | 434.075 | 445.755 | 2.2 % ▲ |

| October 2023 | 447.635 | 449.982 | 446.522 | 452.713 | 0.52 % ▲ |

| November 2023 | 448.816 | 451.307 | 444.477 | 452.023 | 0.55 % ▲ |

| December 2023 | 450.112 | 459.524 | 450.112 | 460.438 | 2.05 % ▲ |

Also Check: LIC Share Price Target 2025

Also Check: Yes Bank Share Price Target 2025

Also Check: Tata Steel Share Price Target

Also Check: Tata Motors Share Price Target 2025

Wipro Share Price Target 2024

Wipro Ltd. Stock Price Forecast for 2024

| Month | Opening price | Closing Price | Minimum Price | Maximum Price | Change |

| January 2024 | 464.200 | 460.607 | 460.196 | 467.992 | -0.78 %▼ |

| February 2024 | 459.867 | 462.668 | 458.286 | 465.771 | 0.61 % ▲ |

| March 2024 | 460.679 | 457.463 | 454.001 | 461.698 | -0.7 %▼ |

| April 2024 | 461.330 | 453.523 | 452.134 | 462.397 | -1.72 %▼ |

| May 2024 | 452.459 | 455.818 | 449.724 | 457.579 | 0.74 % ▲ |

| June 2024 | 459.525 | 453.978 | 453.978 | 461.030 | -1.22 %▼ |

| July 2024 | 456.349 | 480.674 | 454.241 | 480.823 | 5.06 % ▲ |

| August 2024 | 480.653 | 483.827 | 479.643 | 485.474 | 0.66 % ▲ |

| September 2024 | 487.926 | 497.483 | 487.100 | 497.483 | 1.92 % ▲ |

| October 2024 | 498.008 | 498.644 | 496.329 | 502.859 | 0.13 % ▲ |

| November 2024 | 496.784 | 500.055 | 494.917 | 501.891 | 0.65 % ▲ |

| December 2024 | 503.602 | 514.511 | 501.696 | 514.511 | 2.12 % ▲ |

Wipro Share Price Target 2025

Wipro Ltd. Stock Price Forecast for 2025

| Month | Opening price | Closing Price | Minimum Price | Maximum Price | Change |

| January 2025 | 514.344 | 508.726 | 508.726 | 518.287 | -1.1 %▼ |

| February 2025 | 511.318 | 511.612 | 509.323 | 515.892 | 0.06 % ▲ |

| March 2025 | 512.747 | 511.199 | 504.565 | 512.747 | -0.3 %▼ |

| April 2025 | 511.714 | 503.122 | 503.023 | 512.833 | -1.71 %▼ |

| May 2025 | 502.258 | 505.683 | 499.955 | 507.426 | 0.68 % ▲ |

| June 2025 | 509.447 | 506.737 | 504.586 | 511.304 | -0.53 %▼ |

| July 2025 | 506.823 | 530.255 | 504.220 | 530.255 | 4.42 % ▲ |

| August 2025 | 529.346 | 533.609 | 529.346 | 535.362 | 0.8 % ▲ |

| September 2025 | 537.653 | 547.861 | 536.837 | 547.861 | 1.86 % ▲ |

| October 2025 | 547.438 | 547.563 | 546.143 | 553.329 | 0.02 % ▲ |

| November 2025 | 549.205 | 549.964 | 545.315 | 551.736 | 0.14 % ▲ |

| December 2025 | 553.597 | 563.875 | 551.792 | 564.016 | 1.82 % ▲ |

Wipro Share Price Target 2026

Wipro Ltd. Stock Price Forecast for 2026

| Month | Opening price | Closing Price | Minimum Price | Maximum Price | Change |

| January 2026 | 563.925 | 559.270 | 559.270 | 568.792 | -0.83 %▼ |

| February 2026 | 561.612 | 562.467 | 559.321 | 566.244 | 0.15 % ▲ |

| March 2026 | 563.761 | 561.572 | 554.676 | 563.761 | -0.39 %▼ |

| April 2026 | 561.152 | 552.934 | 552.934 | 563.167 | -1.49 %▼ |

| May 2026 | 551.150 | 555.535 | 550.238 | 557.275 | 0.79 % ▲ |

| June 2026 | 559.340 | 557.234 | 555.258 | 561.508 | -0.38 %▼ |

| July 2026 | 556.358 | 578.923 | 554.338 | 579.731 | 3.9 % ▲ |

| August 2026 | 583.200 | 587.396 | 581.532 | 587.396 | 0.71 % ▲ |

| September 2026 | 588.006 | 597.295 | 586.562 | 597.736 | 1.56 % ▲ |

| October 2026 | 597.079 | 598.349 | 595.968 | 603.752 | 0.21 % ▲ |

| November 2026 | 599.951 | 603.555 | 595.473 | 603.555 | 0.6 % ▲ |

| December 2026 | 603.998 | 613.448 | 601.862 | 613.505 | 1.54 % ▲ |

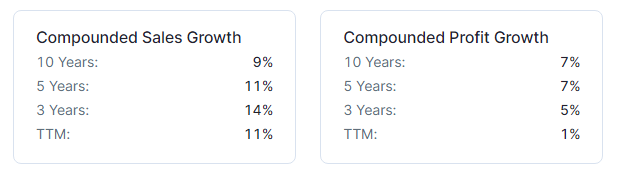

Wipro Share Price Target 2030

Wipro Limited has given a 73% return in the last 5 years which is considered good. Similarly, we can expect a good return in the upcoming five years also, i.e., by 2030. However, we need to keep an eye on Wipro profit growth, as we can see that the sales growth of the company is good for the last 4 years.

Based on the Wipro Fundamental analyses, we found Wipro a good investment long-term stock with a target price up to Rs. 1,000 – Rs. 1,200 by 2030.

Wipro Share Price Target 2023, 2024, 2025, 2030 Table

| Year | Wipro Share Price Target |

| Wipro Share Price in 2023 | Rs. 435 – Rs. 460 |

| Wipro Share Price in 2024 | Rs. 460 – Rs. 515 |

| Wipro Share Price in 2025 | Rs. 512 – Rs. 565 |

| Wipro Share Price in 2026 | Rs. 568 – Rs. 615 |

| Wipro Share Price in 2030 | Rs. 1,000 – Rs. 1,200 |

Major Reason to Increase in Wipro Share Price in the Future

Wipro announced its new business model in February 2023. Wipro’s new model sharpens focus on strategic growth areas, such as:

- Cloud,

- Enterprise technology and

- Business transformation, engineering, and consulting

The new model has been implemented from April 2023 that will deepen alignment with clients’ evolving business needs and capitalize on emerging opportunities in high-growth segments of the market.

Read Wipro New Global Business Model here

Fundamental Analysis of Wipro Share

Wipro Ltd. Pros

- The company has very less debt, its debt-to-equity ratio is 0.27.

- The insurance company has increased its shareholding from 0.04% to 4.63%, which is a positive signal.

- The company is getting a good sales growth rate for last 4 years.

| Year | Sales (Amount in Rs. Crore) |

| March 2020 | 61,138 |

| March 2021 | 61,935 |

| March 2022 | 79,312 |

| March 2023 | 90,488 |

Wipro Ltd. Cons

- The company has delivered poor profit growth of 1.87% over past 3 years.

- Shareholding of Foreign Institutional Investors has come down from 9.34% to 6.58%.

Financial Analysis

Sales Growth: In the Financial year 2022-2023, Wipro’s revenue increased from Rs. 79,312 crore to INR 90,488 crore. It indicates a growth of around 14% in Wipro revenue compared to the previous fiscal year.

Profitability: The Wipro’s net profit decreased by 7.14% from Rs 12,243 crore to Rs 11,366 crore from the previous year.

CAGR of Wipro Ltd.

Wipro Competitors

Disclaimer: Please note that the share price targets provided herein are based on current market conditions and analyst projections, and they do not guarantee future performance. There is no accurate way to predict the share prices for the future. We analyze the past stock performances, current market scenario, and keep tracking the market on a regular basis to set our targets. The actual share price may vary significantly from the target due to various factors, including global economic conditions, company-specific performance, and unforeseen events.

Before making any investment decisions, investors should carefully consider their risk tolerance, financial situation, investment objectives, and conduct thorough research to assess the suitability of the investment.