Do you know that you can pledge shares in Zerodha Kite to get the margins for trading? In this article, we will discuss in detail how to pledge shares in zerodha, what are the charges to pledge shares, what risks are associated, and how to unpledged shares in zerodha.

Can we pledge shares in Zerodha?

Yes, Zerodha allows you to pledge your holdings as collateral to obtain funds from Zerodha. Zerodha allows the collateral margin on T+1 day for the stocks that are pledged before 5 PM.

Also Check: Can I Gift Shares From Zerodha to Another Demat Account in 2023?

What is the Pledging of shares in Zerodha?

Pledging of shares means when someone needs to borrow money, they use their stocks or bonds as collateral to make sure they’ll pay the money back to the lender.

Now, what happens is many users may have stocks, ETFs, and mutual funds in their holdings but limited cash margins, due to which they miss the trading opportunities.

To avoid this, they can pledge their shares/ETFs as collateral margins to zerodha. These margins can be used for Equity Intraday trading, futures & options writing (equity and currency F&O).

How To pledge Shares in Zerodha Kite?

You need to follow to steps to pledge stock in zerodha:

1. You need to submit the pledge request on the console.

2. The pledge must be authorized on the CDSL portal before 7 p.m.

Note: If you fail to authorize the pledge by 7:00 p.m. then you will not get the margins for the security. However, if the pledge is authorized, margins become available from the next trading day.

Steps for Pledge Shares on Console

Here is the step-by-step process to pledge shares on Console, follow these steps:

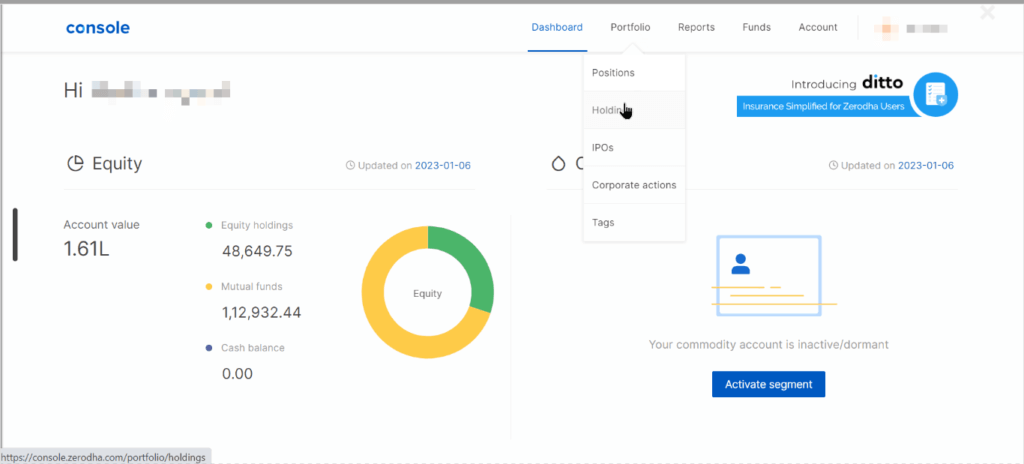

Step #1: Login to Kite Console, click on Portfolio and then on Holdings.

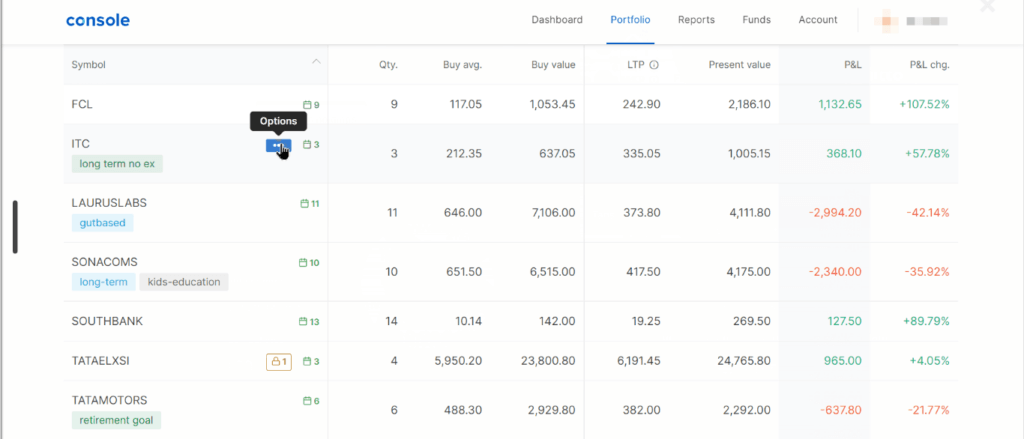

Step #2: Select the shares you want to pledge, and then click on Options.

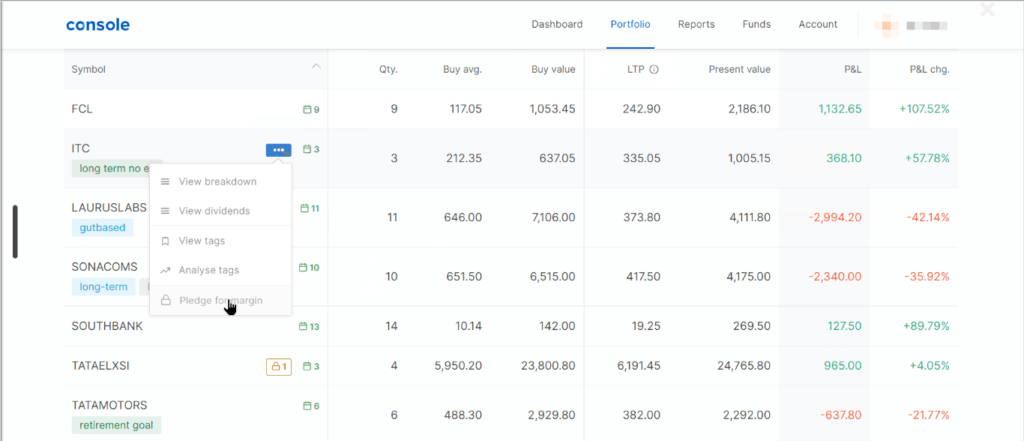

Step #3: Click on Pledge for margin.

Step #4: tick the checkbox to agree to the terms of service for pledging.

Step #5: Enter the Quantity of the shares you want to pledge.

Step #6: Click on Submit.

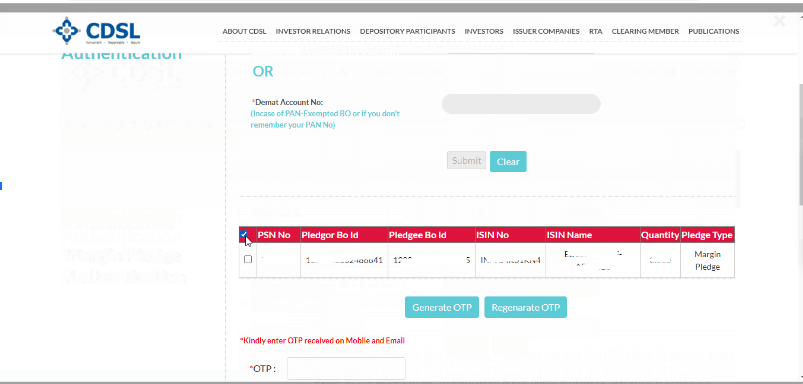

Steps for Authorising the pledge request on CDSL

You will receive the authorizing emails from both Zerodha and CDSL on your registered mobile number and an email. Click on the link received and it will redirect you to the login page of CDSL.

Step 1: Log in to cdslindia.com/Authentication/OTP.aspx using PAN.

Step 2: Click on the checkbox with the pledge details.

Step 3: Click on Generate OTP.

Step 4: Enter the OTP and click on Submit.

What are the risks of pledging shares?

Here are a few risks of pledging shares:

1. Loss of Ownership Control: When you pledge your shares, it may lead to loss of some control over them. And, if you can’t repay the borrowed money, the lender can sell your shares.

2. Market Price Fluctuations: In case of market price fluctuation, if the value of your pledged shares falls significantly, you might have to provide additional collateral that can trouble you a lot.

3. Interest Costs: If the interest rates are high and you cannot generate a good return then it will be difficult to recover and pay the interest cost.

Check here How to Add Nominee In Zerodha Kite Mobile App In Just 5 Min?

Terms and conditions you should know before pledging shares in Zerodha

1. Users can’t use the collateral margins if their account balances are negative.

2. Users can’t trade in commodity futures and options using collateral margins. Here are the segments for which you can take collateral margins:

| Equity Stock delivery | No |

| Equity Intraday | Yes |

| Equity Futures | Yes |

| Equity Options | Yes |

| Currency Futures | Yes |

| Currency Options | Yes |

| Commodity Futures | No |

| Commodity Options | No |

3. The collateral amount varies based on the price of the security.

4. The collateral margin will be available on T+1 day for the stocks that are pledged before 5 PM.

How is the collateral amount calculated?

The collateral amount is calculated from the previous closing price of the securities after a haircut (a % deduction by Zerodha). Such collateral amount is added to the total margin available on Kite. You can see The collateral margin separately in the Funds tab on Kite, under the collateral heading.

You must have 50% of the margin requirement in cash or cash equivalents to use the collateral margin for trading. In case you don’t have a 50% margin, then you have to pay interest at 0.035% per day or 12.775% p.a on the cash margin funded by Zerodha.

Let’s understand how much collateral amount a user gets on pledging shares in Zerodha

For example, if you need a margin of INR 1 lakh, then you must have a minimum of INR 50,000 in cash. Even if you have a collateral margin of INR 2 lakh, still you need INR 50,000 in cash to execute your trade.

If there is a shortfall of cash, then the shortfall amount will be the debit balance for the day, and delayed payment charges will apply to that amount.

Explore Something Interesting : How Much Do Day Traders Make Per Month 2023? | Can Intraday Make You Rich? | Day Trader Salary

Does Zerodha charge for pledging?

The cost of pledging at Zerodha is Rs 30 + GST per pledge request, irrespective of the quantity pledged. There is no cost for un-pledging.

What is the timing of the pledging of shares in Zerodha?

Zerodha processes the pledging requests at 2:00 PM and 5:00 PM on days when the equity market is open.

How to check the status of pledge shares in Zerodha?

Here is the step-by-step process to view the pledged shares and their status on the Zerodha platform:

- Log in to your Zerodha Kite account.

- Click on the ‘Portfolio’ tab showing on the top tab.

- Select ‘Holdings’ from the dropdown menu of the portfolio.

- Click on the ‘Collateral’ tab to view the pledged shares and their status, such as whether they are active or released.

How To Unpledge Shares in Zerodha?

Step 1: Go to the Holdings tab in the Console. Here, you can see the pledged quantity.

Step 2: Click on three dots, and then on Options and choose ‘Unpledge’.

Step 3: Enter the number of shares you want to unpledge and click on ‘Submit‘. Once you click on the submit button, stocks will be credited to your demat account on T+1 day if you submit the unpledged requests before 2:00 PM. And, if you submit a request after 2:00 PM, then it will be processed on the next working day.

More About Zerodha

Change Bank Account in Zerodha

Transfer Shares From Upstox To Zerodha Online

Images credit: Zerodha

Best IPO BO ID Groww BO ID in Groww Candlestick charts CDSL TPIN Generate close demat account in grow Close Groww Account close groww demat account Crypto Tax Calculator Generate TPIN in Groww Groww Account Closing Form Groww app withdrawal time Groww vs Zerodha Groww withdrawal charges Groww withdrawal time How to withdraw money from Groww app Indian market open today INDmoney Reviews Intraday Trading Invest in US market IRFC Share Price NSE R K SWAMY IPO Sarveshwar Foods Limited News Servotech Power Systems Ltd Share Price Stock Market News Swiggy IPO taparia tools share price history Tata Motors Share Price Tata Motors Share Price Target 2025 TBQ and TSQ TBQ and TSQ In Share Market TBQ in Share Market Tpin In Groww App Tpin means TSQ in Share Market TTQ in Share Market Upcoming IPO Upcoming IPO in India Wipro Share Price Target 2025 Wipro Share Price target 2030 Zerodha Zerodha account open Zerodha Holiday Calendar Zerodha Intraday Charges Zerodha Review